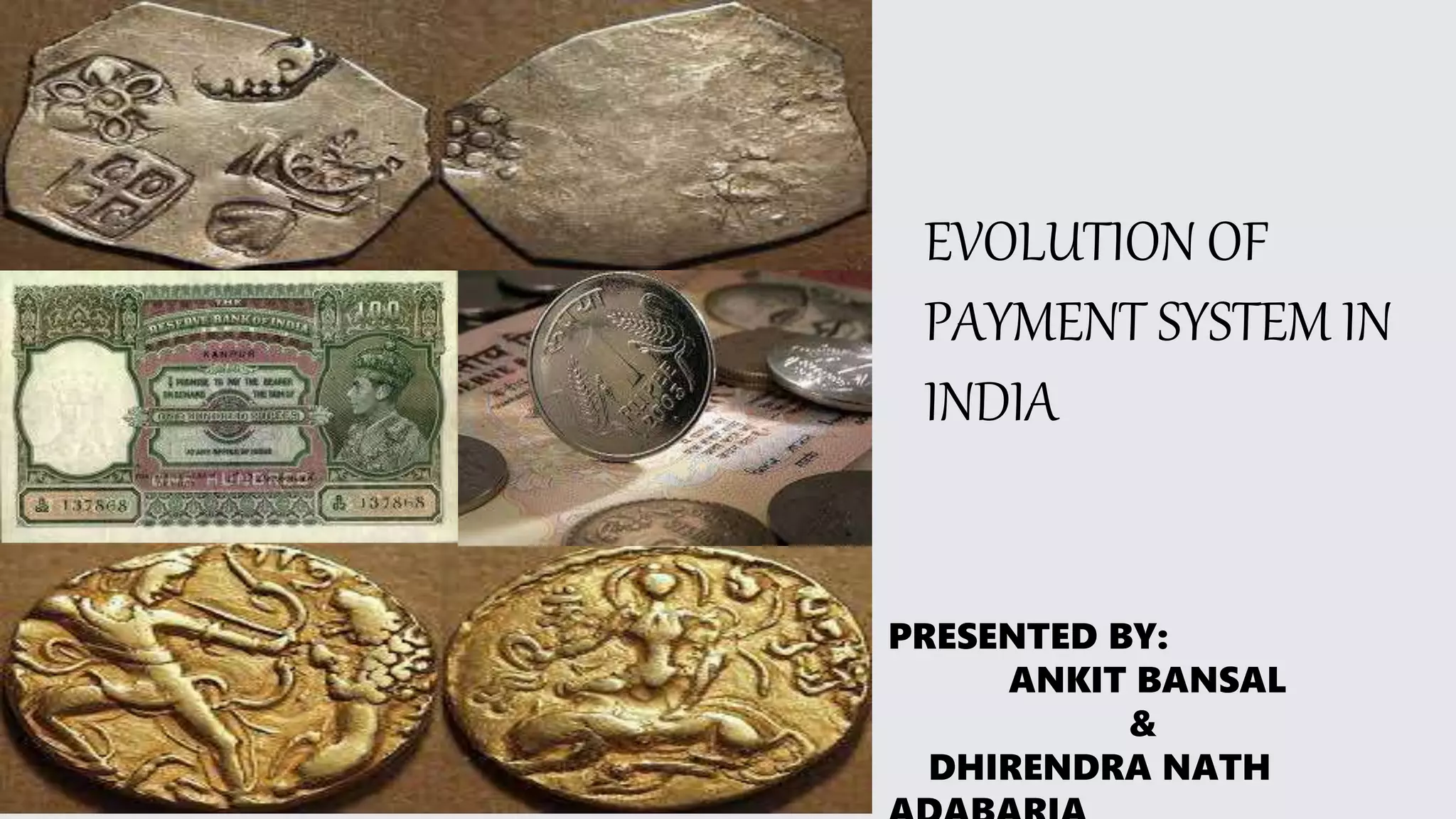

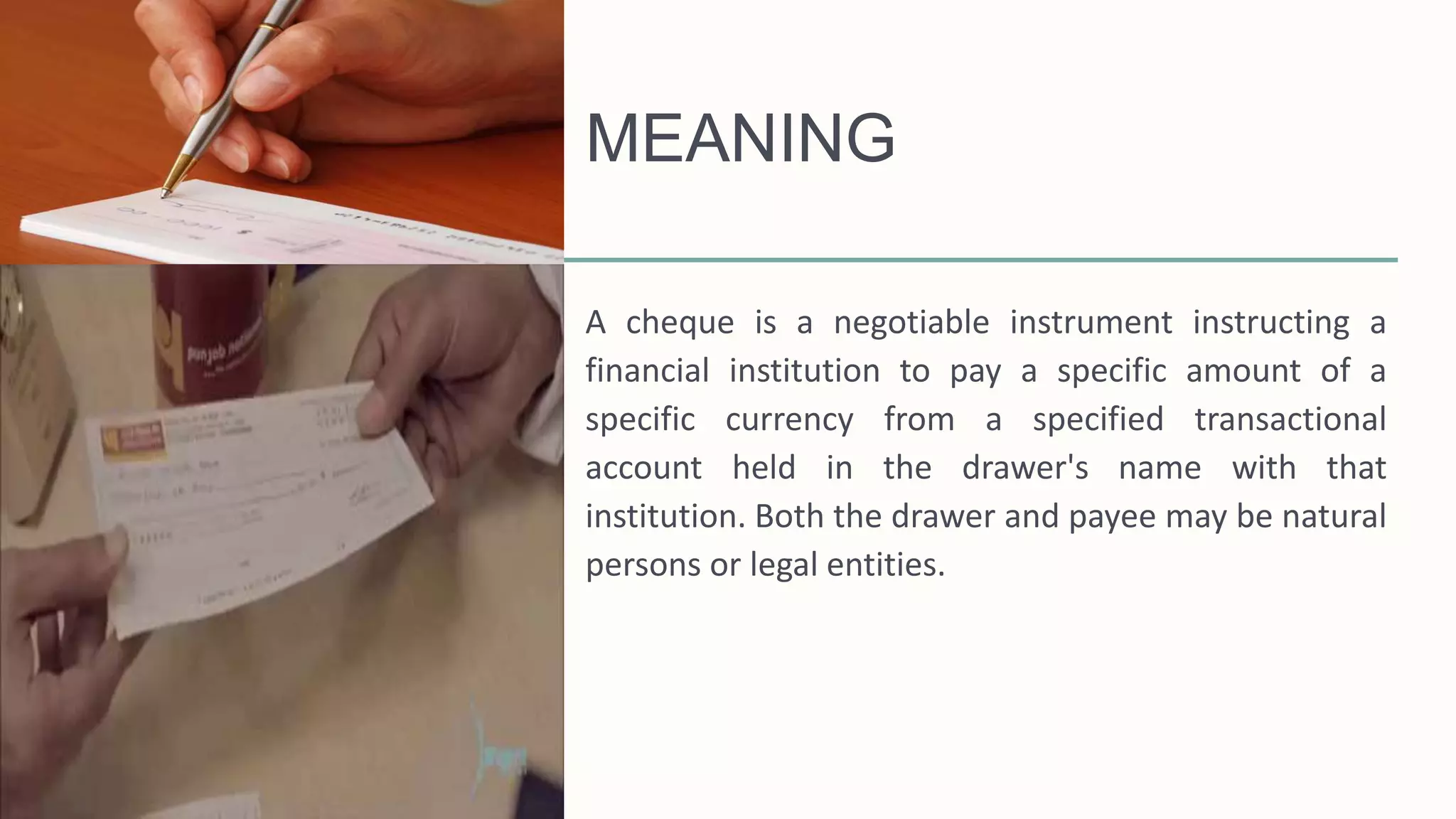

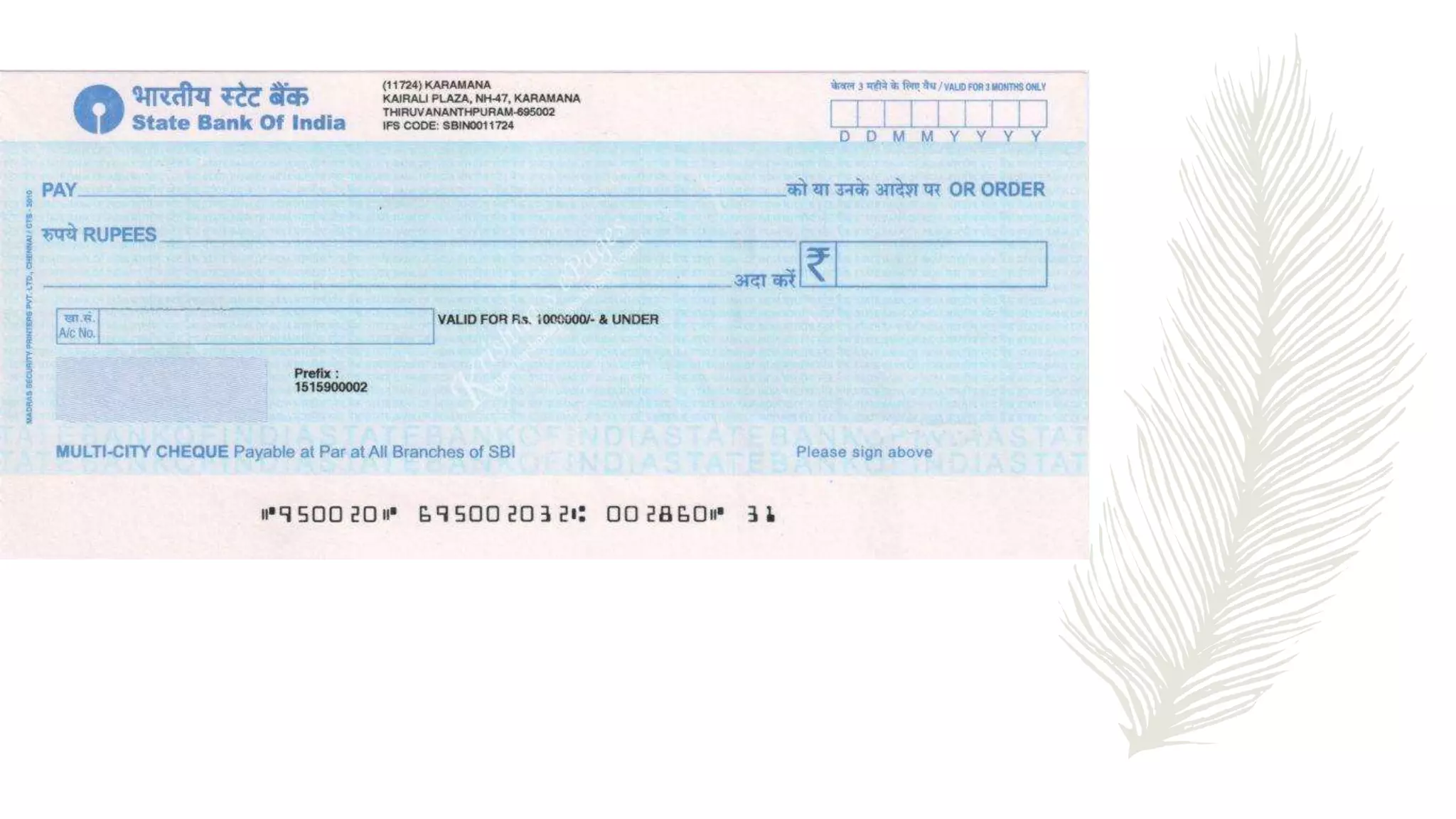

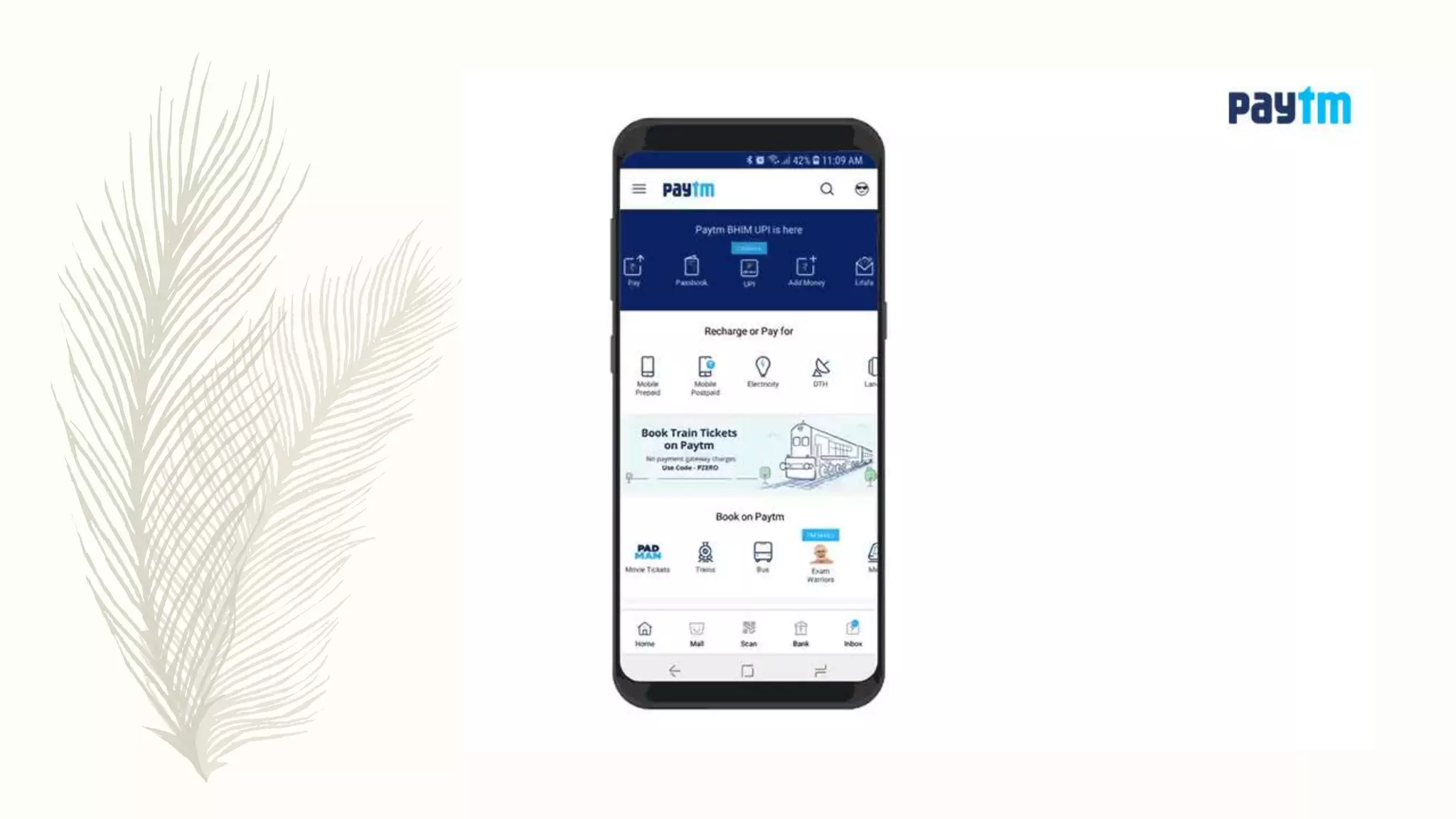

The document summarizes the evolution of payment systems in India from barter systems to modern digital payments. It traces the progression from barter exchange, to cash payments, cheque payments, online payments, and mobile payment applications. Each system is defined and the key advantages and disadvantages are outlined. The core information provided is the historical evolution of payment methods in India and an overview of the main systems with their benefits and drawbacks.