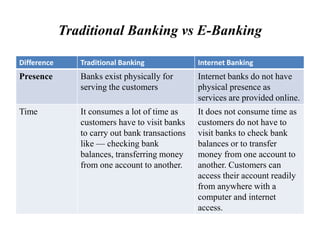

The document compares traditional banking with e-banking, highlighting key differences such as physical presence, time consumption, accessibility, security, cost, and customer service. Traditional banks require physical visits during working hours and involve more time and costs, while e-banking offers 24/7 access, convenience, and lower operational costs but faces security challenges. Overall, e-banking provides a more efficient and cost-effective alternative for managing finances remotely.