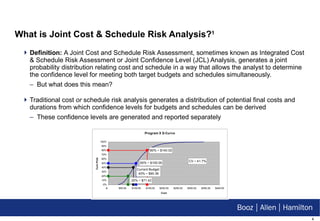

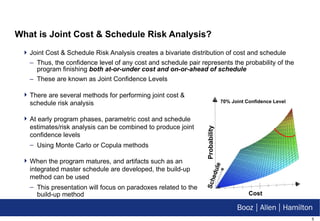

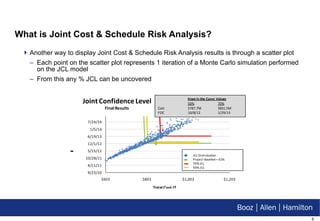

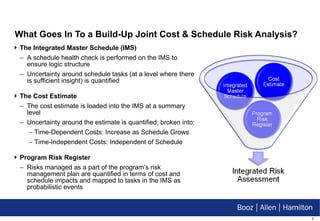

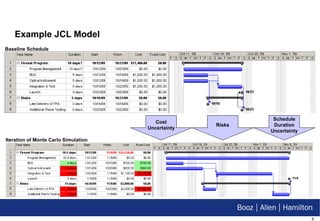

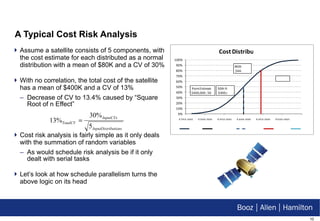

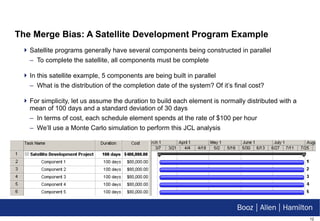

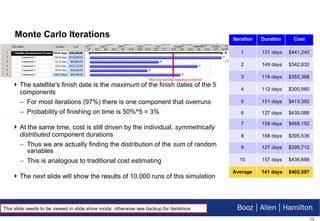

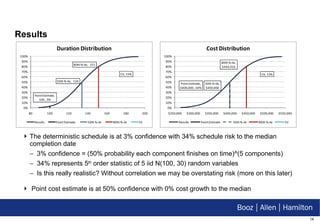

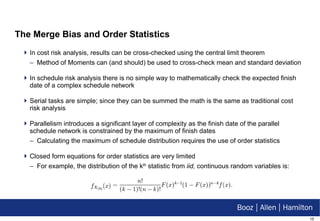

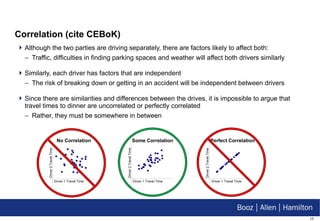

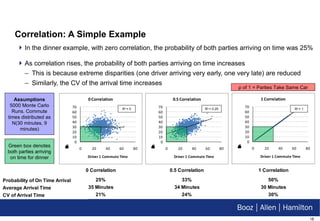

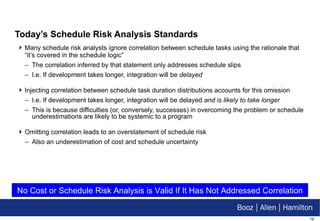

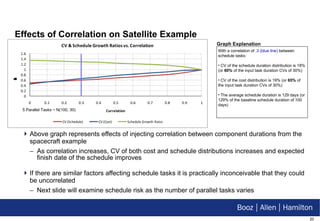

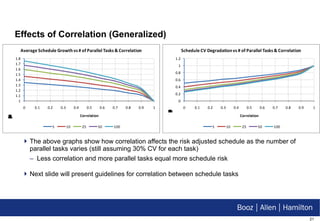

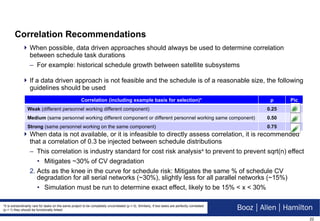

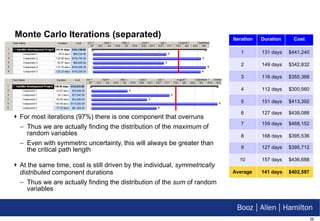

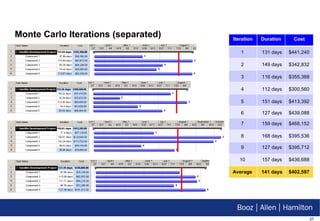

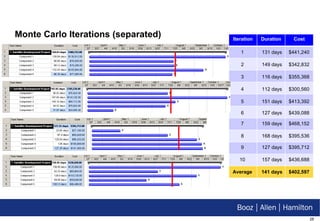

This document discusses joint cost and schedule risk analysis (JCL), which generates a joint probability distribution relating cost and schedule to determine the confidence level for meeting both targets simultaneously. It examines two paradoxes of the build-up JCL methodology: 1) schedule parallelism causes the deterministic schedule to have a low confidence level, and 2) correlation between schedule tasks affects the mean and variance of completion date. The document provides recommendations for accounting for these effects, including using a 0.3 correlation when data is unavailable.