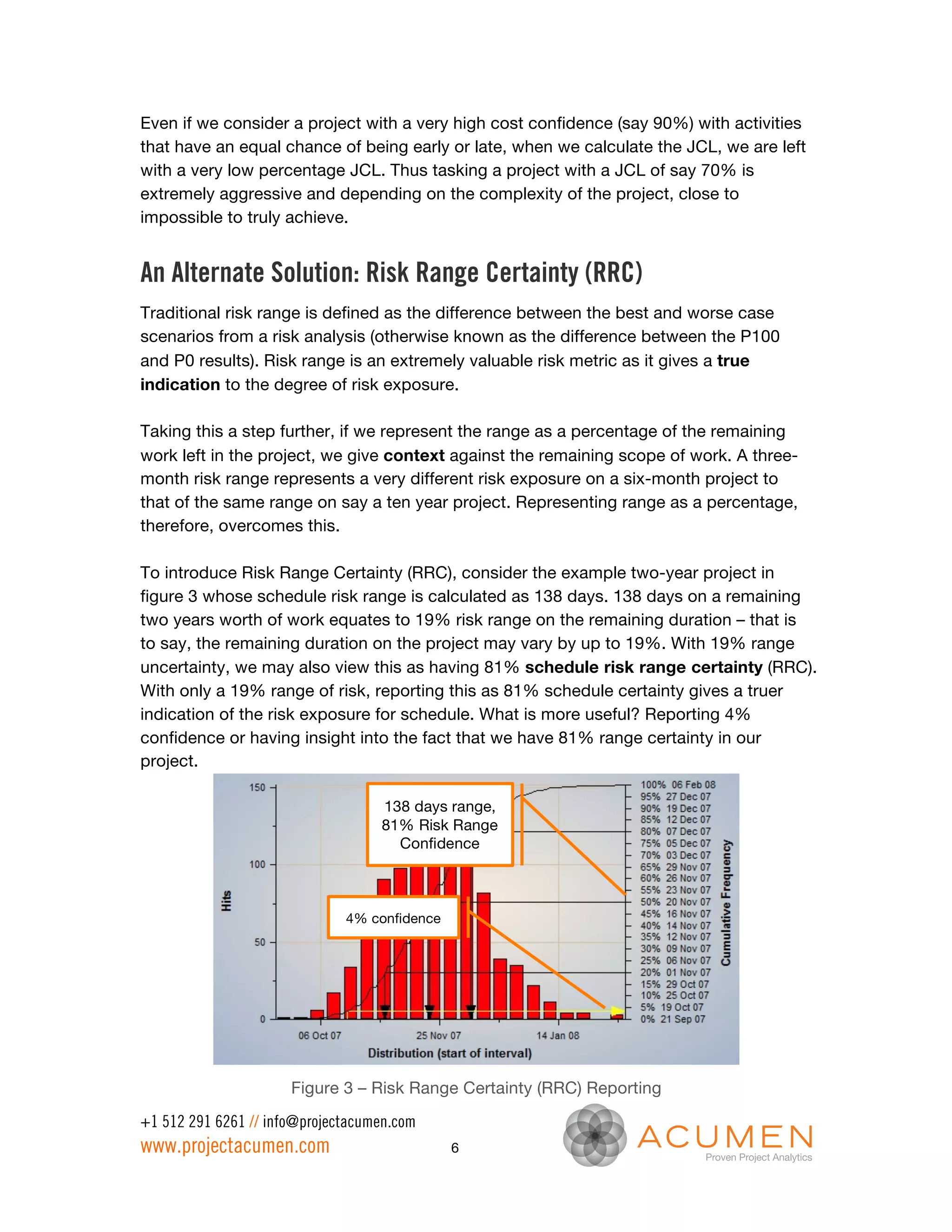

The document discusses a new risk exposure metric called risk range certainty (RRC) designed to address the shortcomings of traditional metrics like schedule confidence level and joint confidence level (JCL), which often lead to skewed risk assessments due to a phenomenon known as merge bias. RRC provides a more realistic representation of a project's risk by indicating the percentage of certainty regarding the remaining schedule risk range, making it more comprehensible for project managers and stakeholders. The conclusion emphasizes the importance of meaningful risk reporting and highlights the positive reception of RRC among project teams and executives.