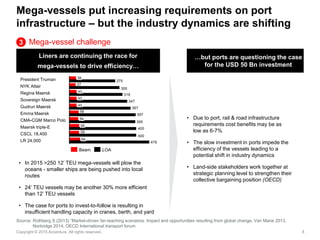

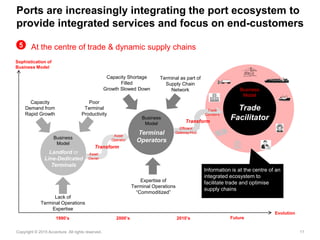

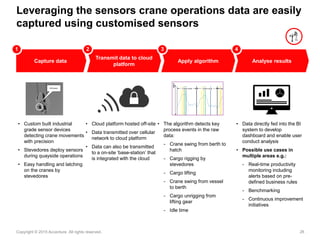

The document discusses the evolving challenges and opportunities facing port operators, emphasizing the role of technology in enhancing productivity and redefining value propositions. Key drivers include global economic volatility, consolidation among shipping alliances, the rise of mega-vessels, and advancements in automation and analytics. It highlights the importance of agility, customer-centric operations, and integrated service models to navigate the shifting dynamics of the maritime logistics ecosystem.