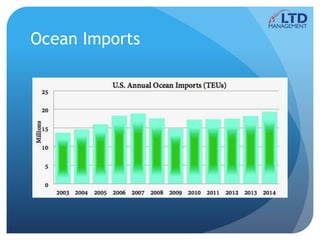

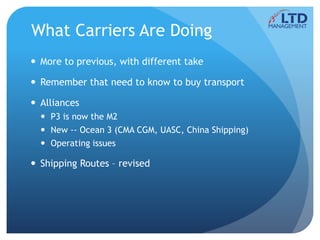

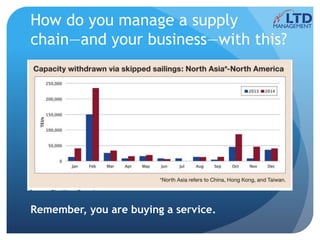

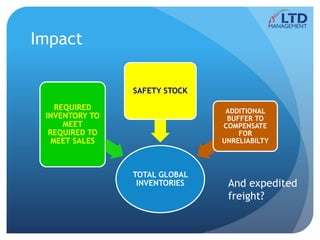

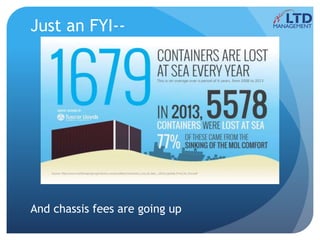

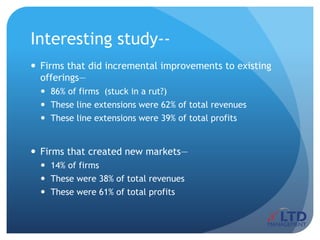

Global logistics and supply chain management are experiencing significant changes and challenges. Mega ships are now the norm, creating issues around port congestion and infrastructure. Ocean carrier consolidation is ongoing, with questions around future rates, service levels, and carrier viability. Unreliable carrier performance is driving up inventories and costs. To differentiate, companies should consider a blue ocean strategy of creating new market spaces rather than competing head-to-head. Opportunities include leveraging e-commerce, multichannel distribution, and global expansion through innovative supply chain practices focused on customer service. The future belongs to companies that embrace change through supply chain innovation.