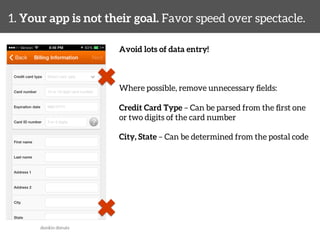

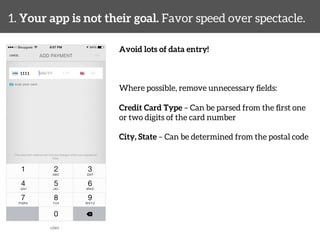

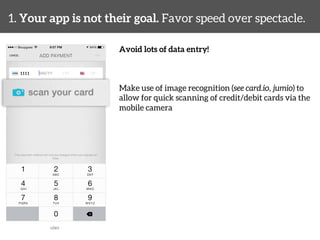

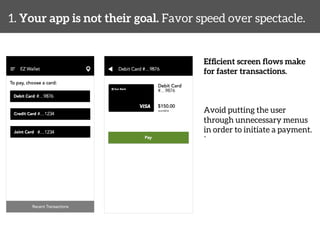

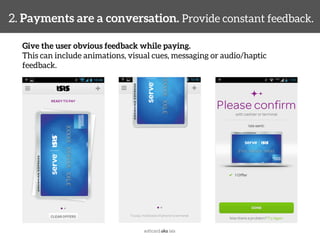

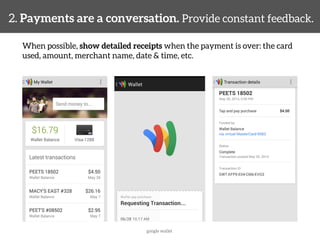

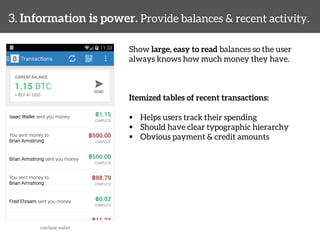

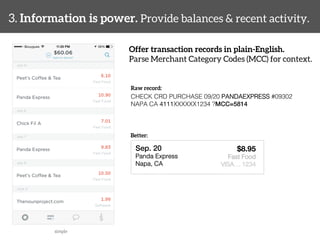

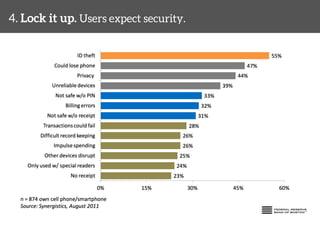

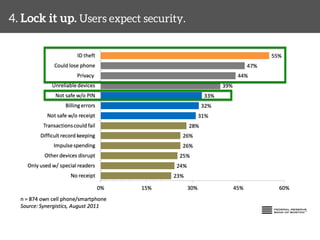

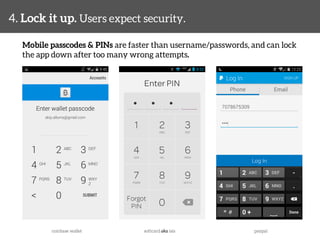

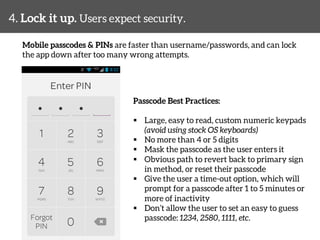

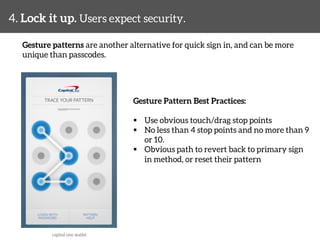

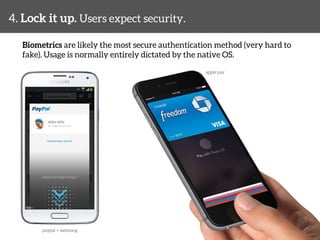

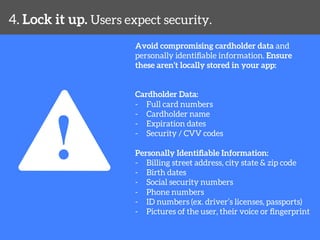

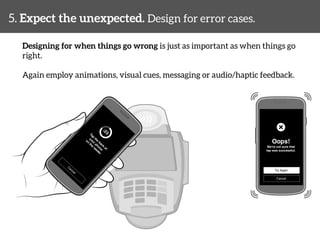

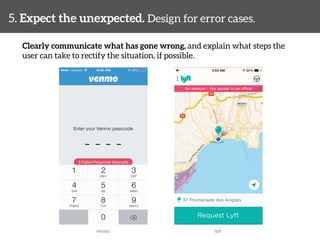

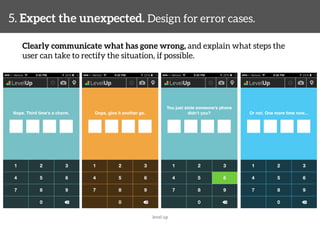

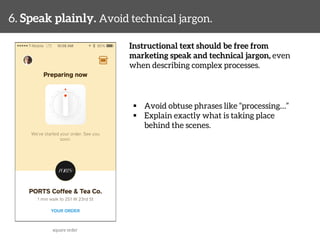

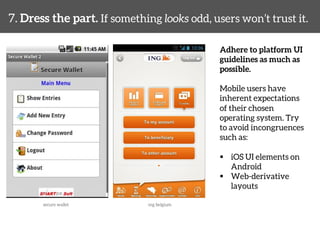

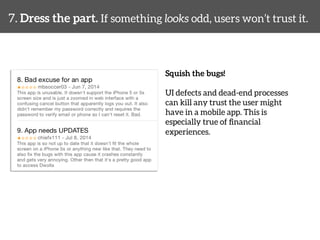

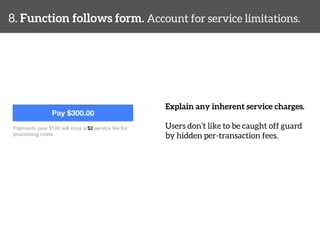

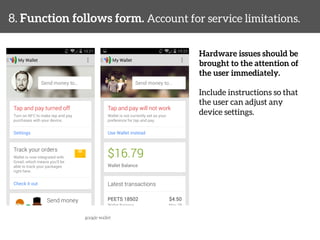

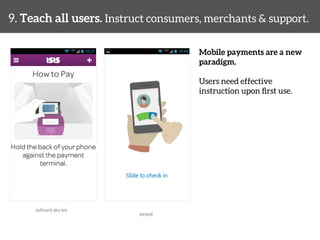

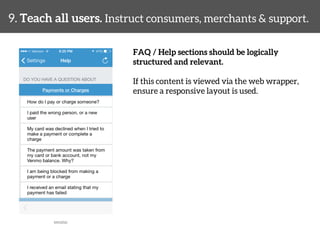

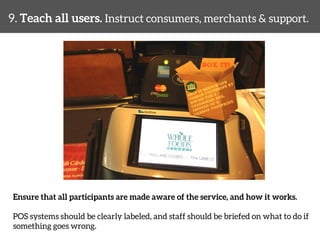

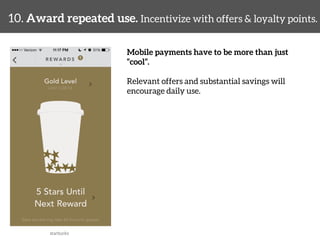

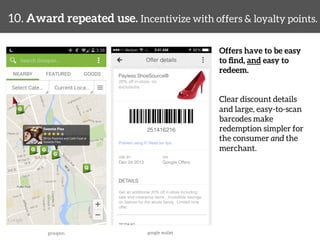

The document provides ten essential tips for designing effective mobile payment experiences, emphasizing the importance of speed, security, and clear communication. Key recommendations include minimizing data entry, providing constant feedback during transactions, and ensuring user trust through consistent design and functionality. The guide suggests that rewarding users with loyalty incentives can enhance repeated use and engagement with mobile payment systems.