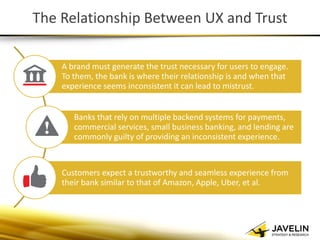

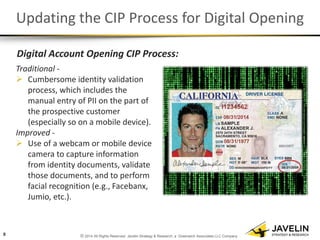

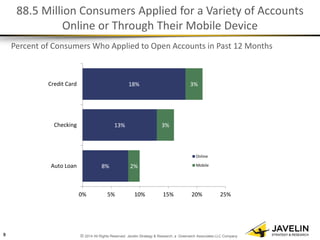

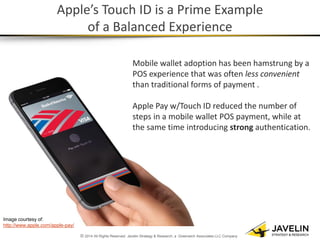

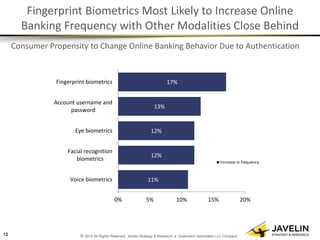

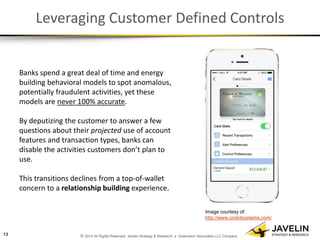

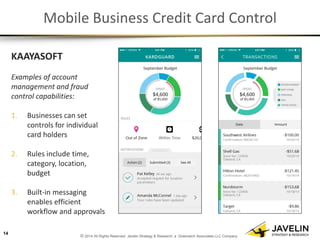

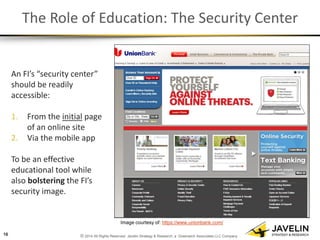

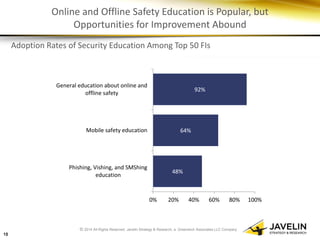

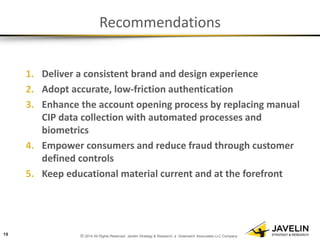

The document discusses strategies for balancing fraud prevention and customer experience in the mobile banking sector. It emphasizes the importance of consistent branding, low-friction authentication, and customer-defined controls to enhance trust and security. Key recommendations include improving account opening processes and keeping educational materials current to address security concerns.