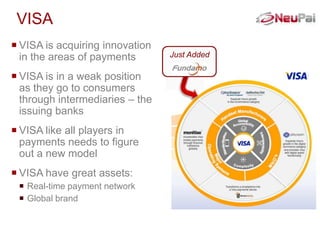

1. Payments is a large and growing business that is being disrupted by new mobile and non-bank competitors like PayPal, Square, and Google.

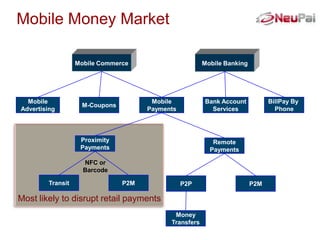

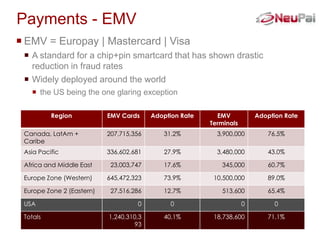

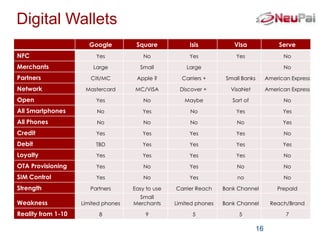

2. Mobile payments in particular are growing rapidly and will likely surpass online payments. Mobile platforms like NFC will be important to winning in this new environment.

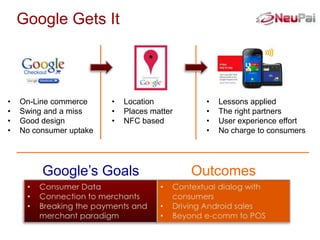

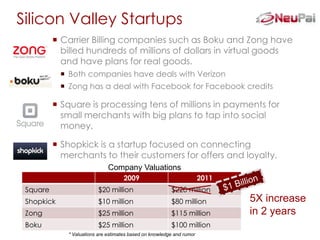

3. Silicon Valley has become the center of innovation in mobile payments, with startups as well as tech giants developing new payment solutions and technologies.