Rational Unified Process

Uwierzytelnianie mobile

in Action

Accumulate Mobile Everywhere

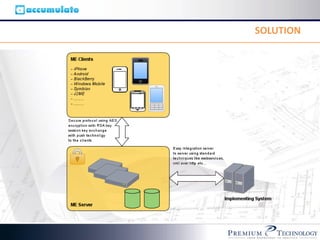

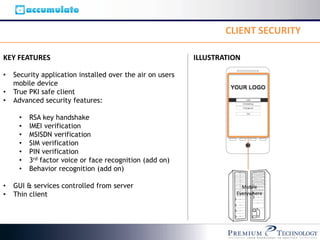

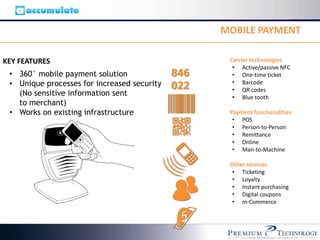

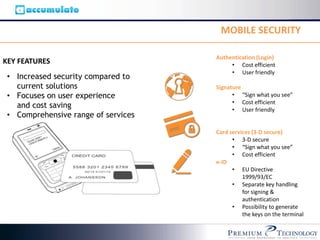

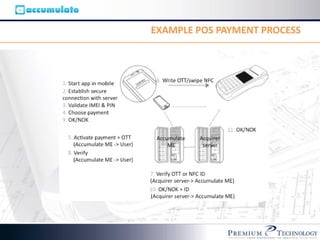

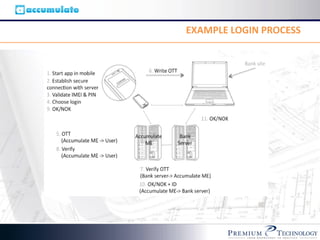

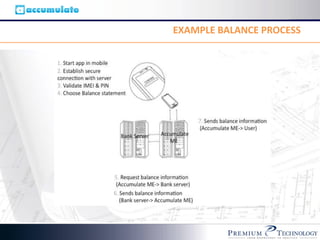

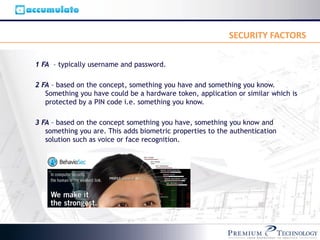

This document discusses Accumulate, a company that provides mobile security, payment, and banking services. It was founded in 2004 and has over 60 million installed applications. Their solutions offer strong authentication using factors like biometrics, behavior recognition, and mobile device identifiers. They also allow for secure mobile transactions and banking through features such as digital signatures and push notifications. Accumulate invites organizations to test their full-stack mobile services platform.