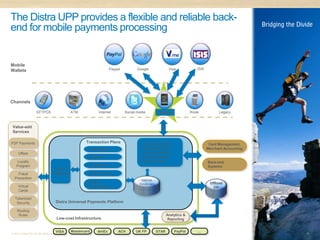

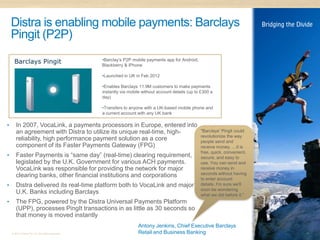

The document discusses the divide between traditional payment providers like banks and newer players like Google and PayPal in the mobile payments world. It identifies key drivers of change like faster payments, regulations, technology advances, and evolving customer expectations. The mobile payments opportunity is large with billions of phones globally and transaction values projected to grow substantially. Mobile is changing how payments are delivered from P2P transfers to mobile wallets to offers and loyalty programs. Successful mobile payment solutions require collaboration across different players and provide both flexibility and security in processing transactions.

![Distra is helping bridge the payments divide

• The security and performance of traditional payment

networks with the flexibility to enable rapid innovation

• Real-time payments processing for mobile and other

payments channels (POS, ATM, web, social media, kiosk)

• Java-based architecture offers flexibility, agility and speed

to market

• High levels of security, reliability, performance (> 3000

TPS)

• Message agnostic - financial and non-financial message

capture enabling customized offers, coupons & loyalty

programs

“We selected Distra’s technology as a key component of

our [Faster Payments] solutions because its uniquely

innovative architecture provides a combination of real-

time performance, reliability and agility.”

© 2011 Distra Pty Ltd. All rights reserved. 16](https://image.slidesharecdn.com/distraempowersmobilepayments-120321000910-phpapp02/85/Distra-empowers-mobile-payments-16-320.jpg)