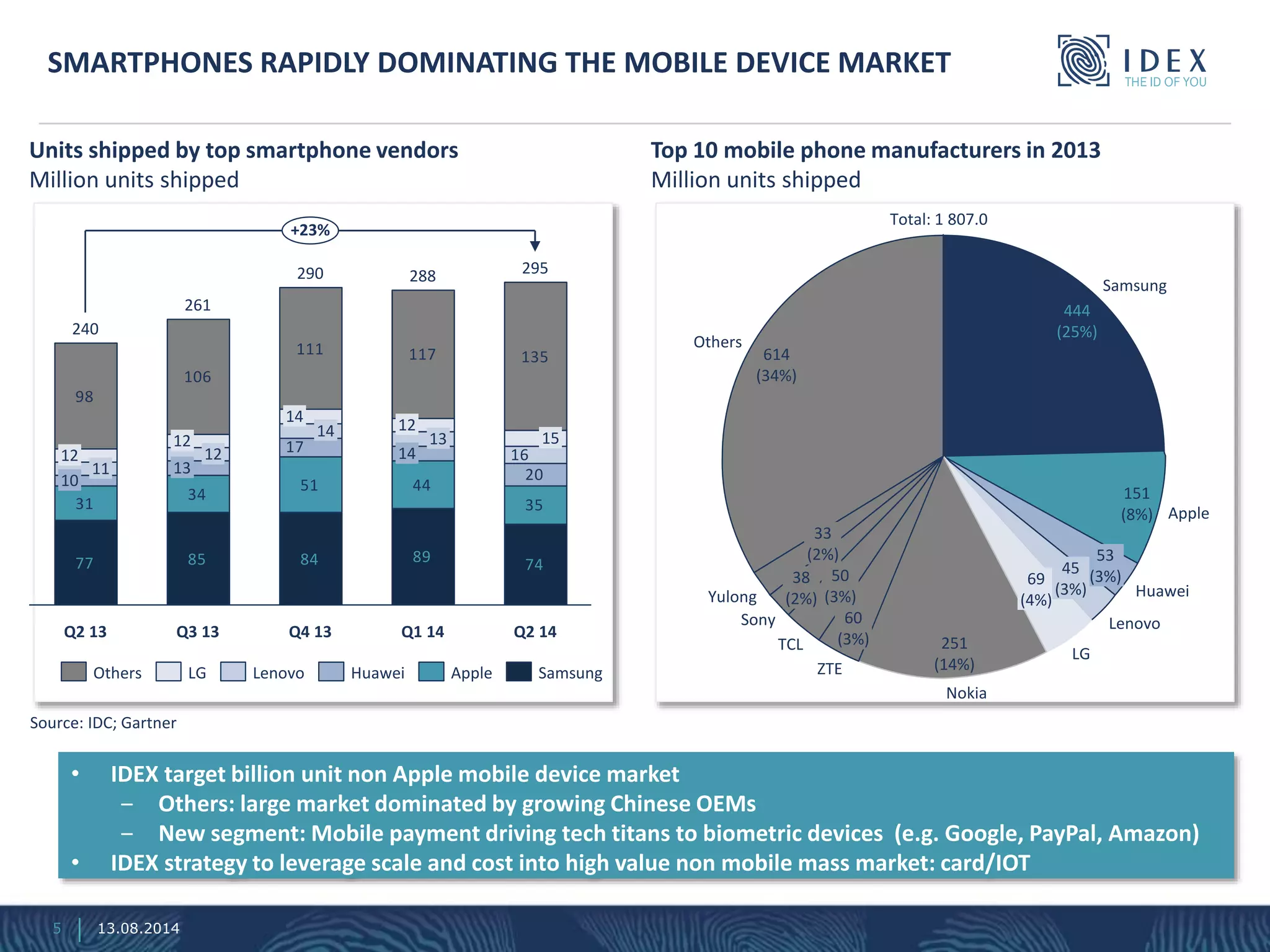

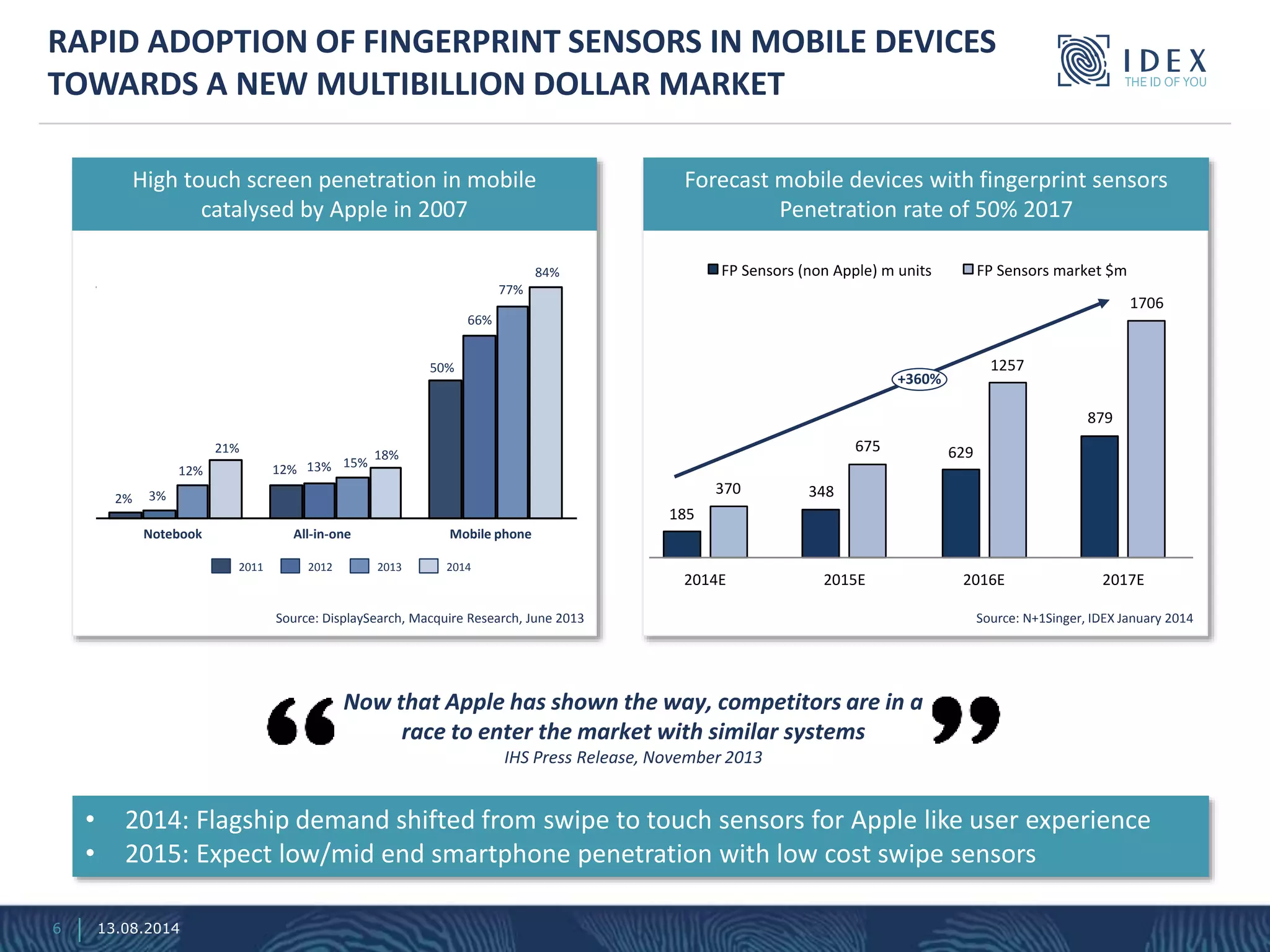

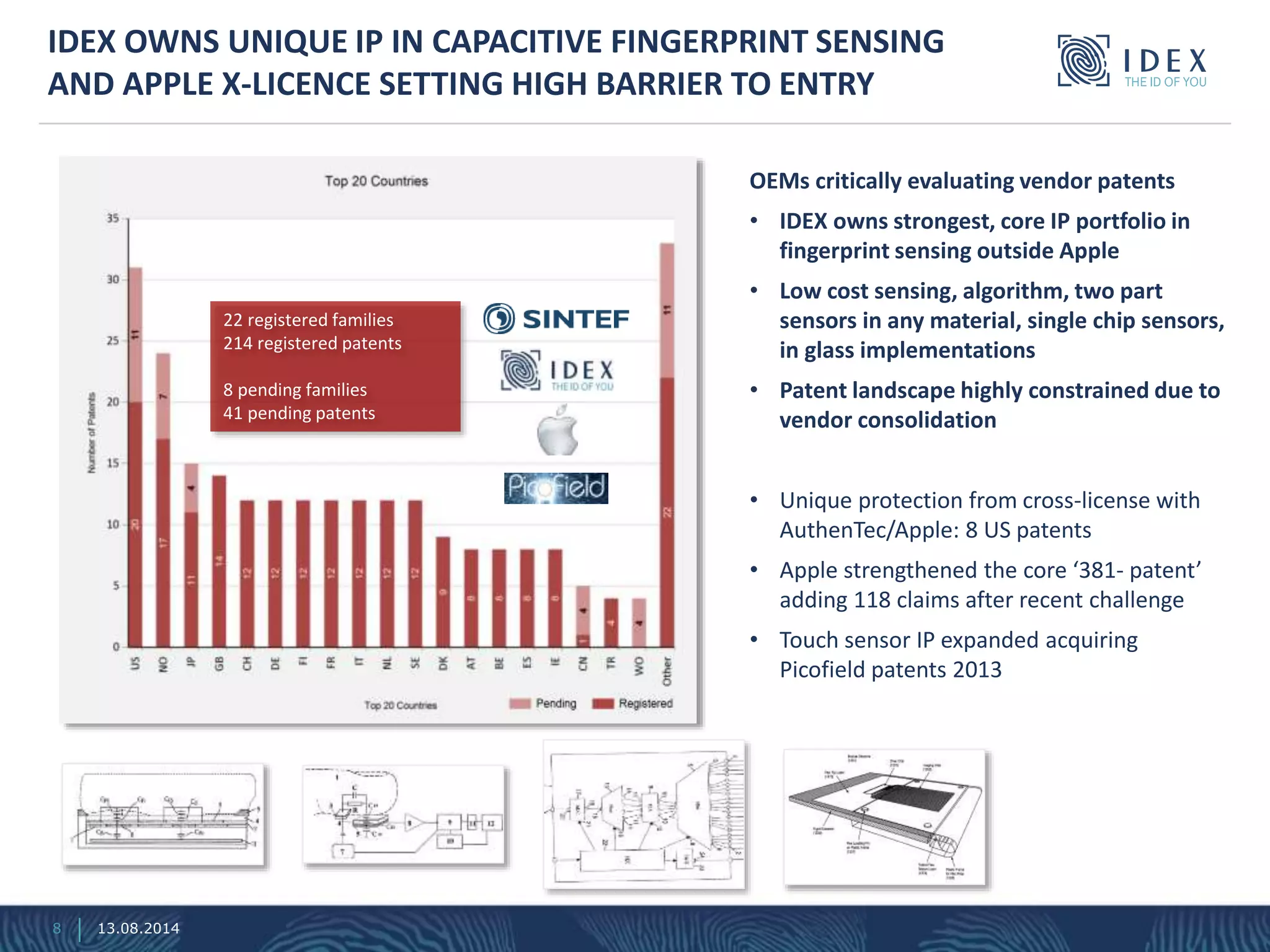

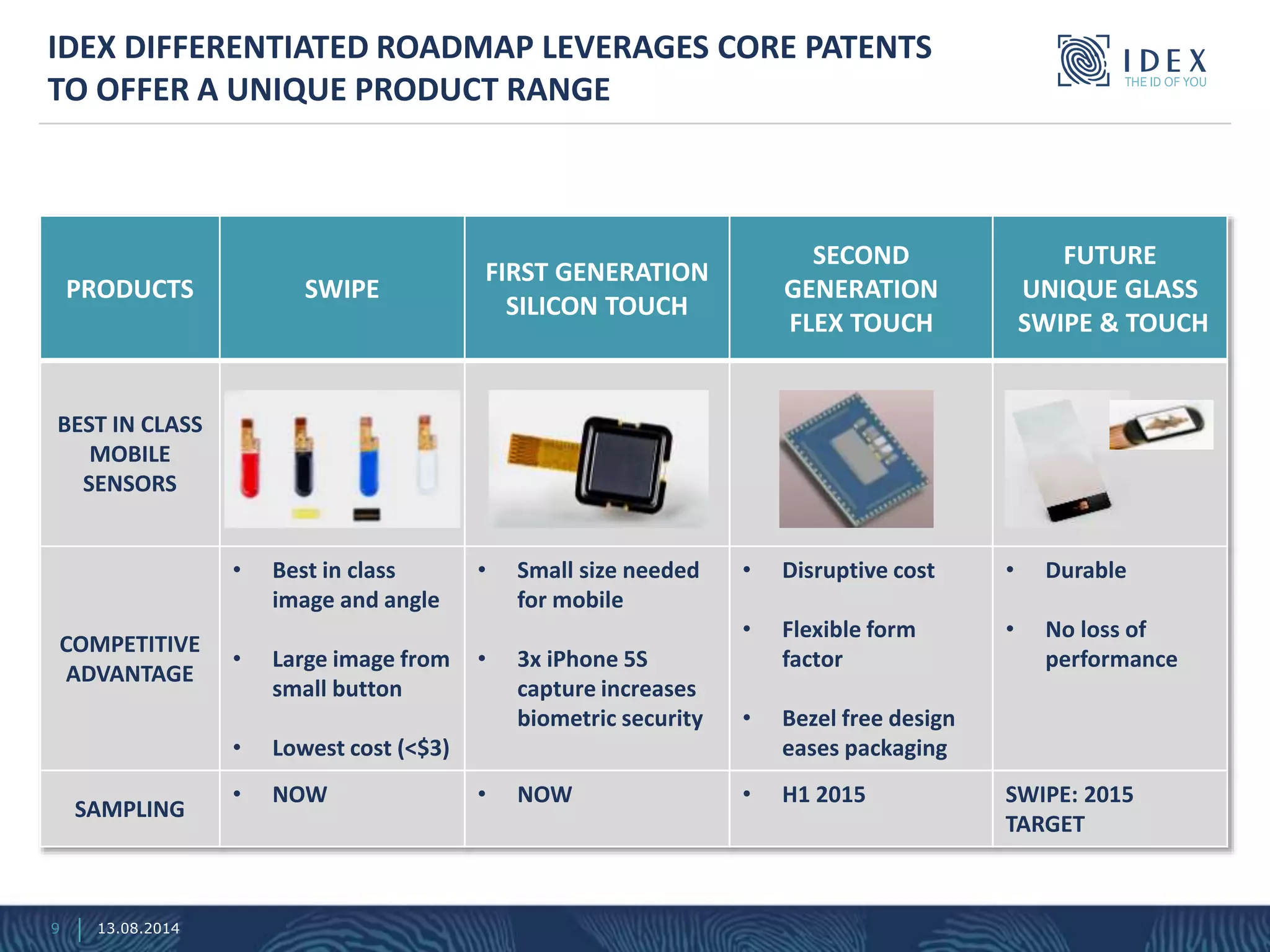

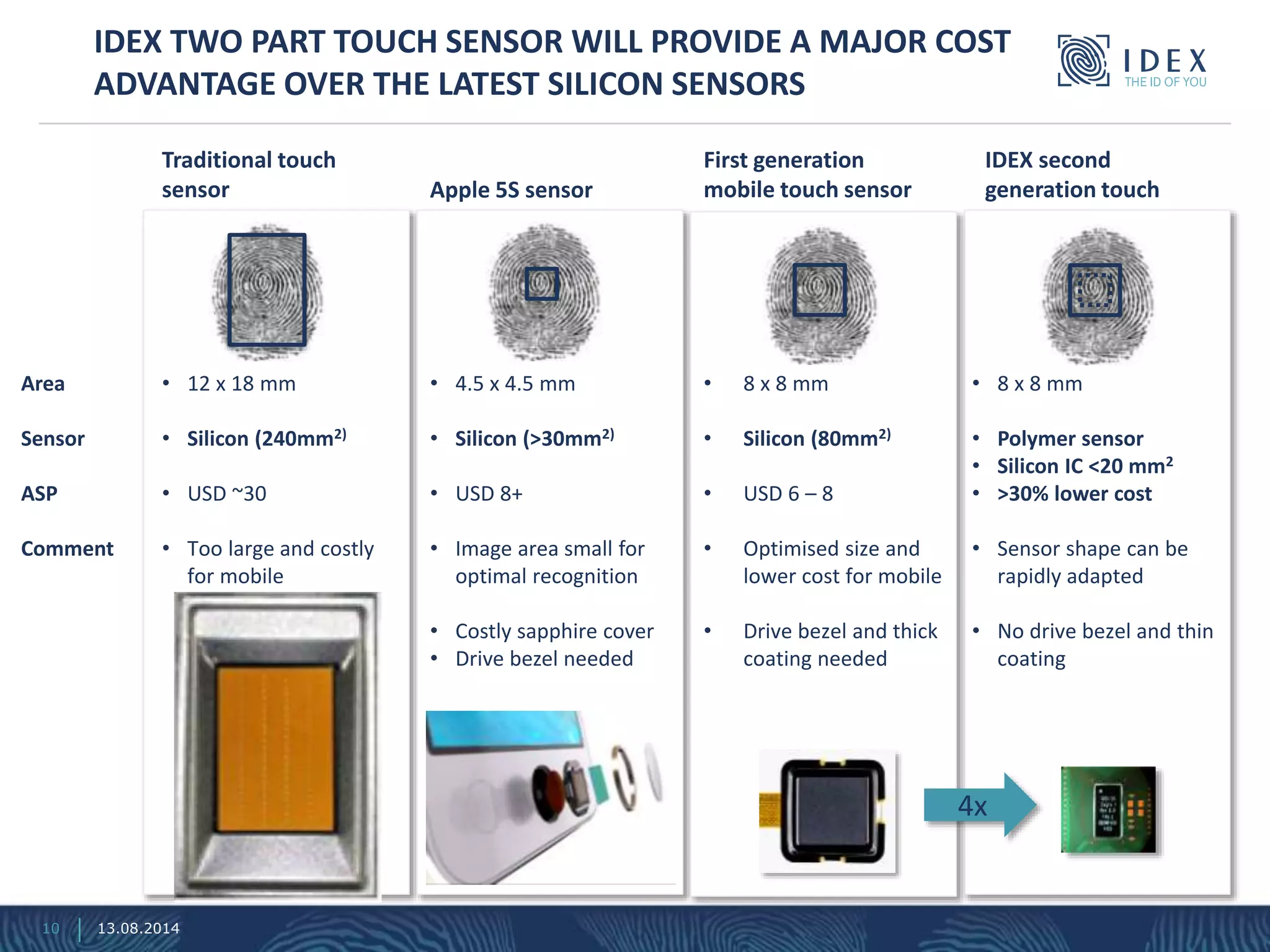

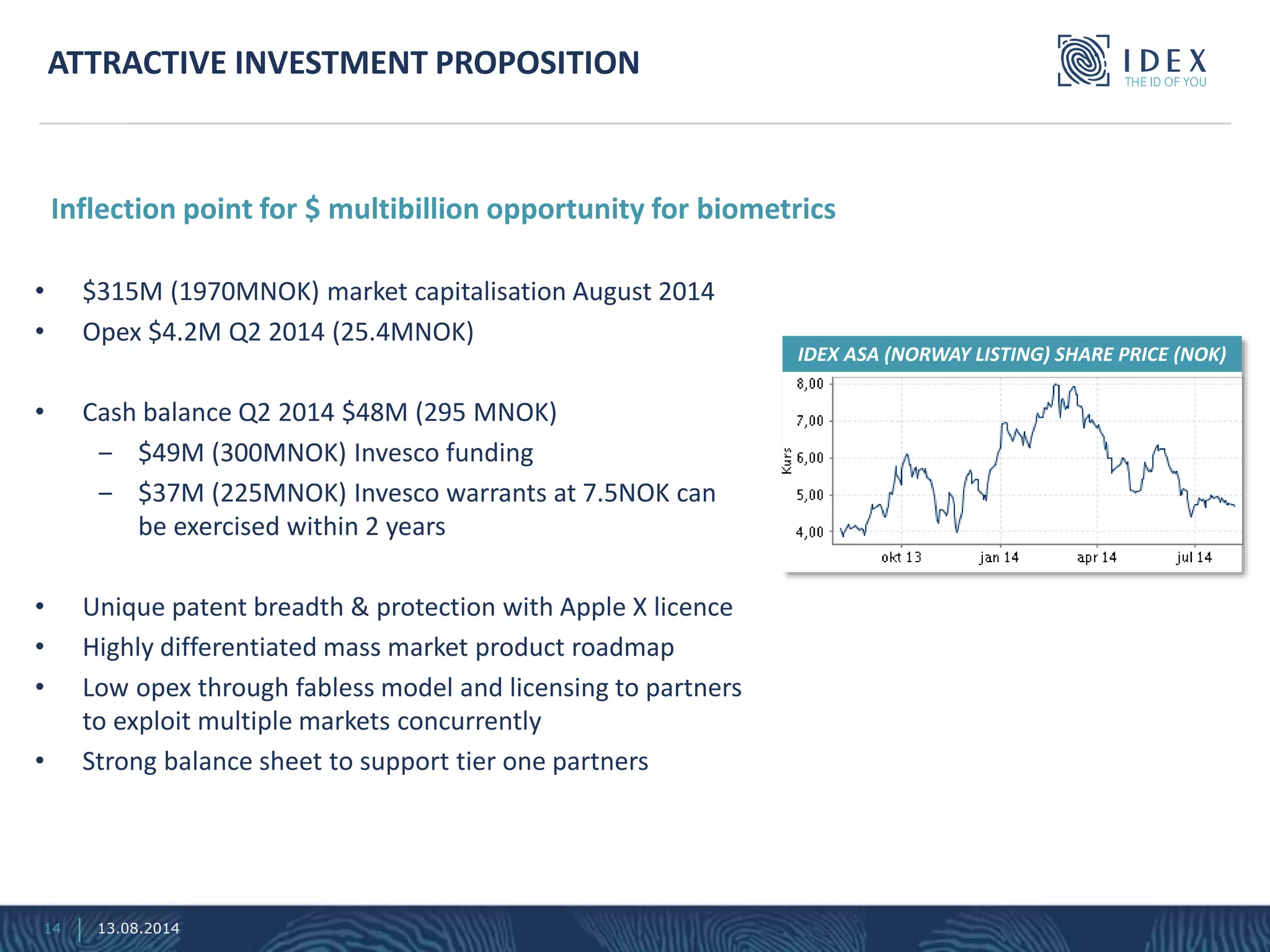

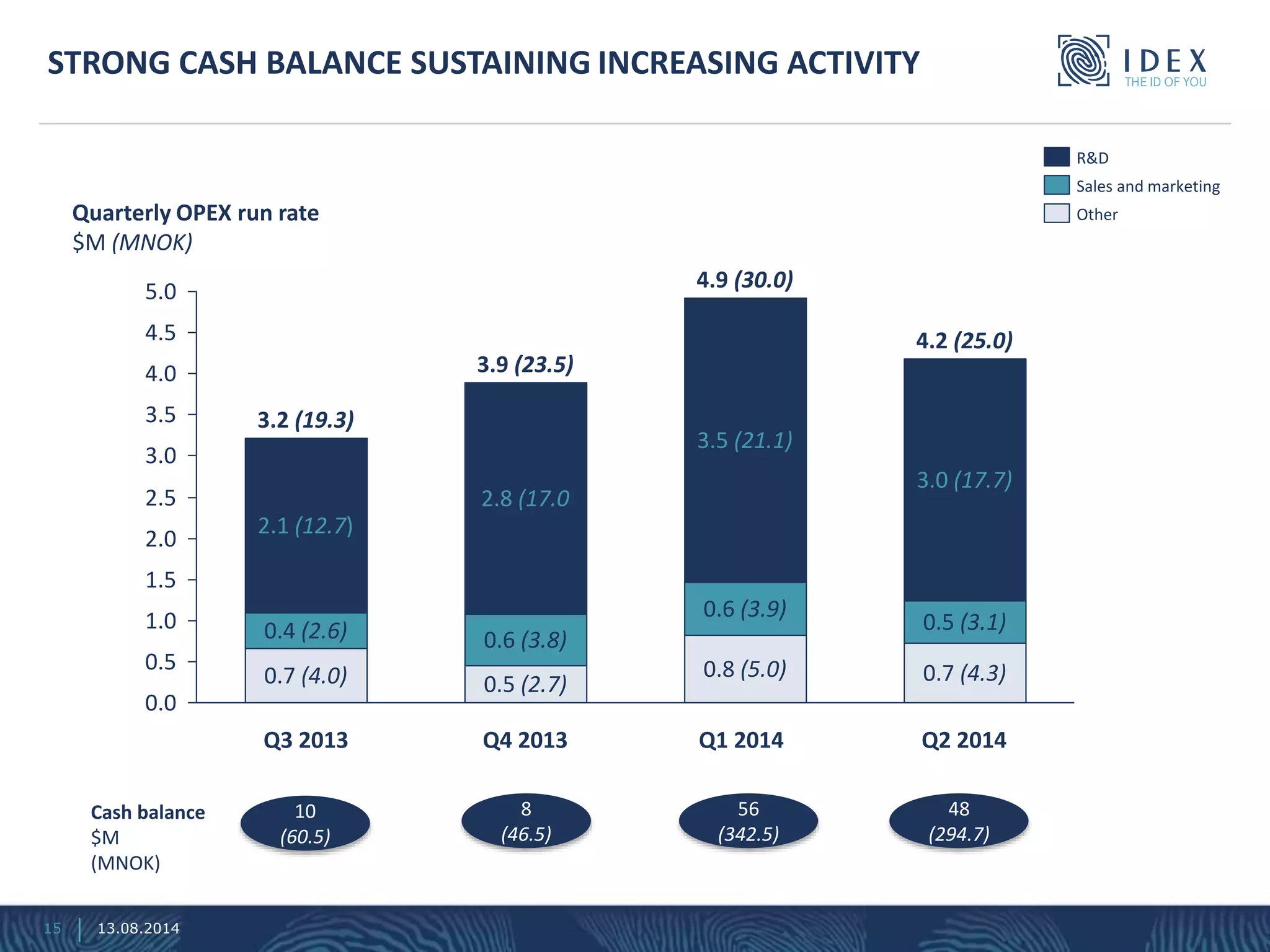

IDEX ASA is focused on enabling the mass market for secure identification through their proprietary smartfinger® technology, which includes fingerprint sensors and solutions catering to growing mobile adoption and payment trends. The company boasts a strong patent portfolio and strategic partnerships, positioning itself as a competitor in the billion-unit market. With anticipated product launches and increasing customer interest, IDEX aims to capitalize on the rapidly evolving biometric technology landscape.