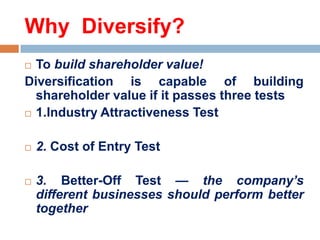

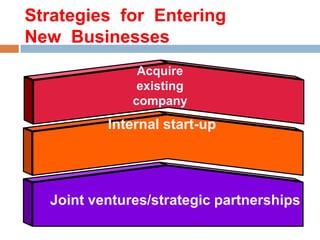

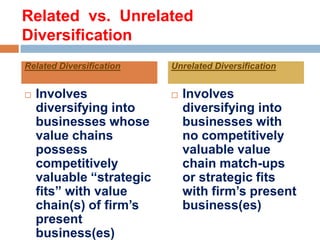

This document discusses diversification strategies for companies. It defines related and unrelated diversification, and outlines various reasons for and approaches to diversification. Related diversification involves entering businesses with strategic value chain fits to the company's core business, while unrelated diversification has no meaningful strategic relationships. Diversification can be done through acquisition, internal startup, or joint ventures. The key motives for diversification are growth, risk spreading, and profit. Managers play a crucial role by developing mental models of how diversification creates synergies and should be managed.