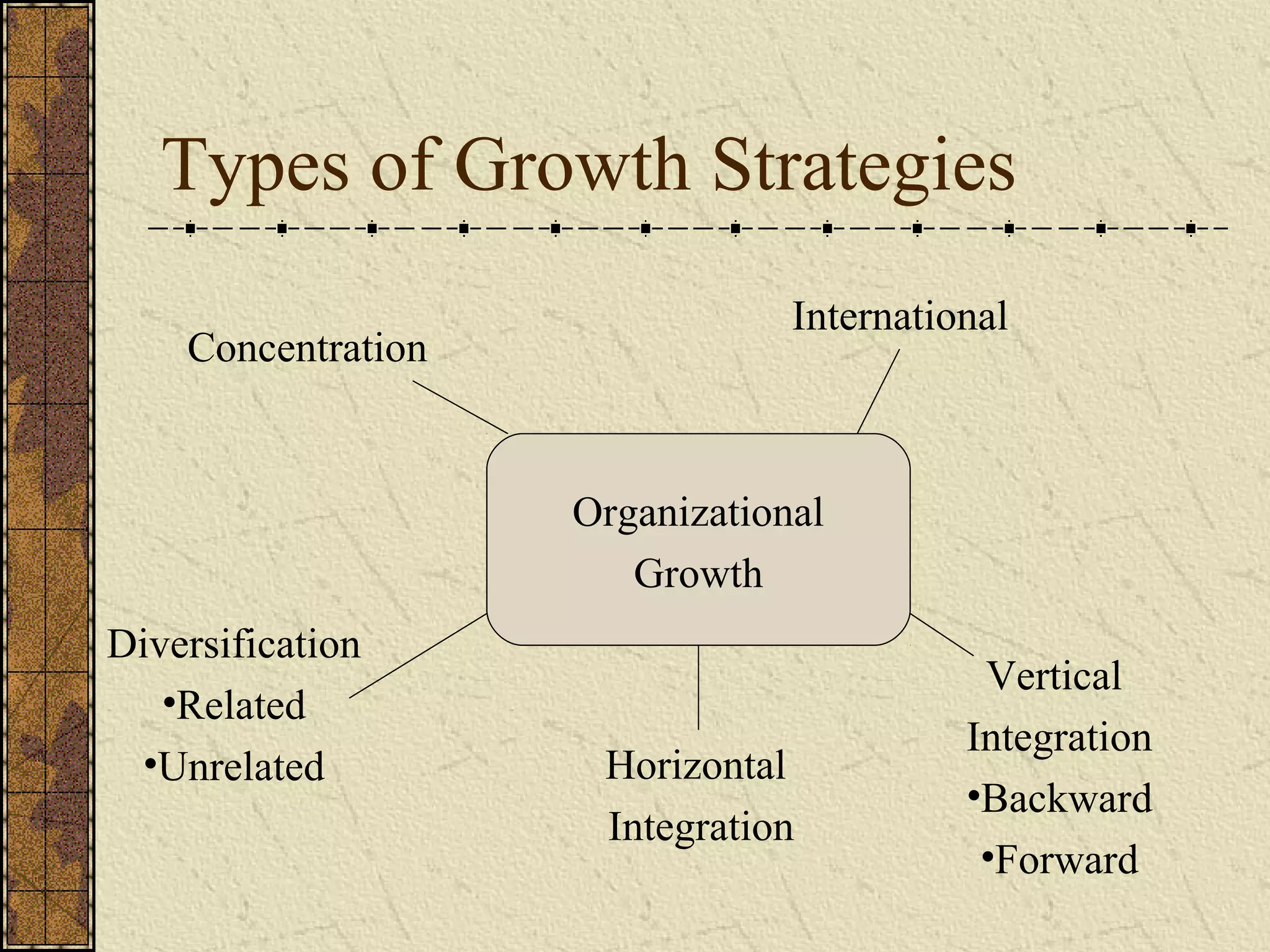

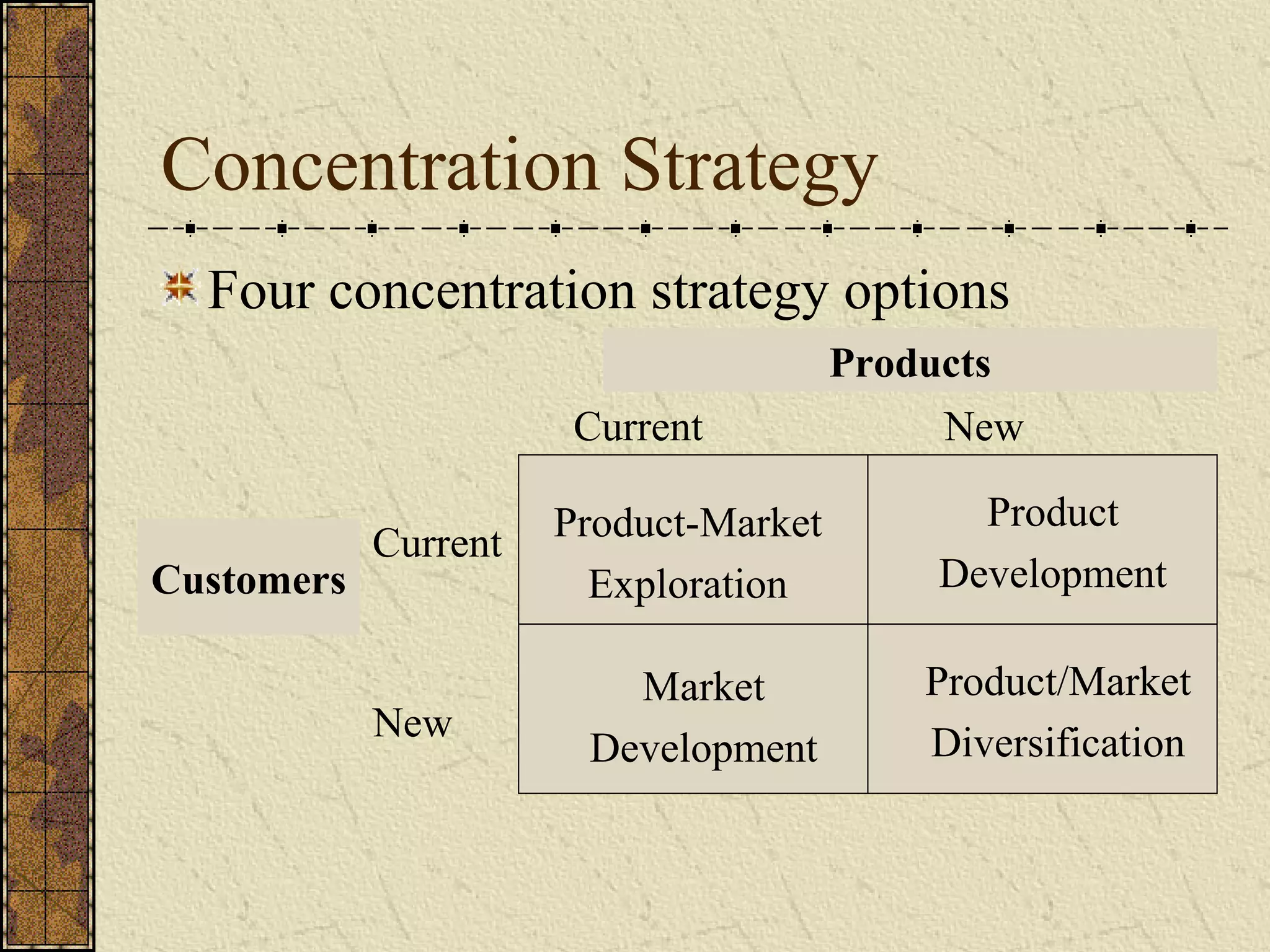

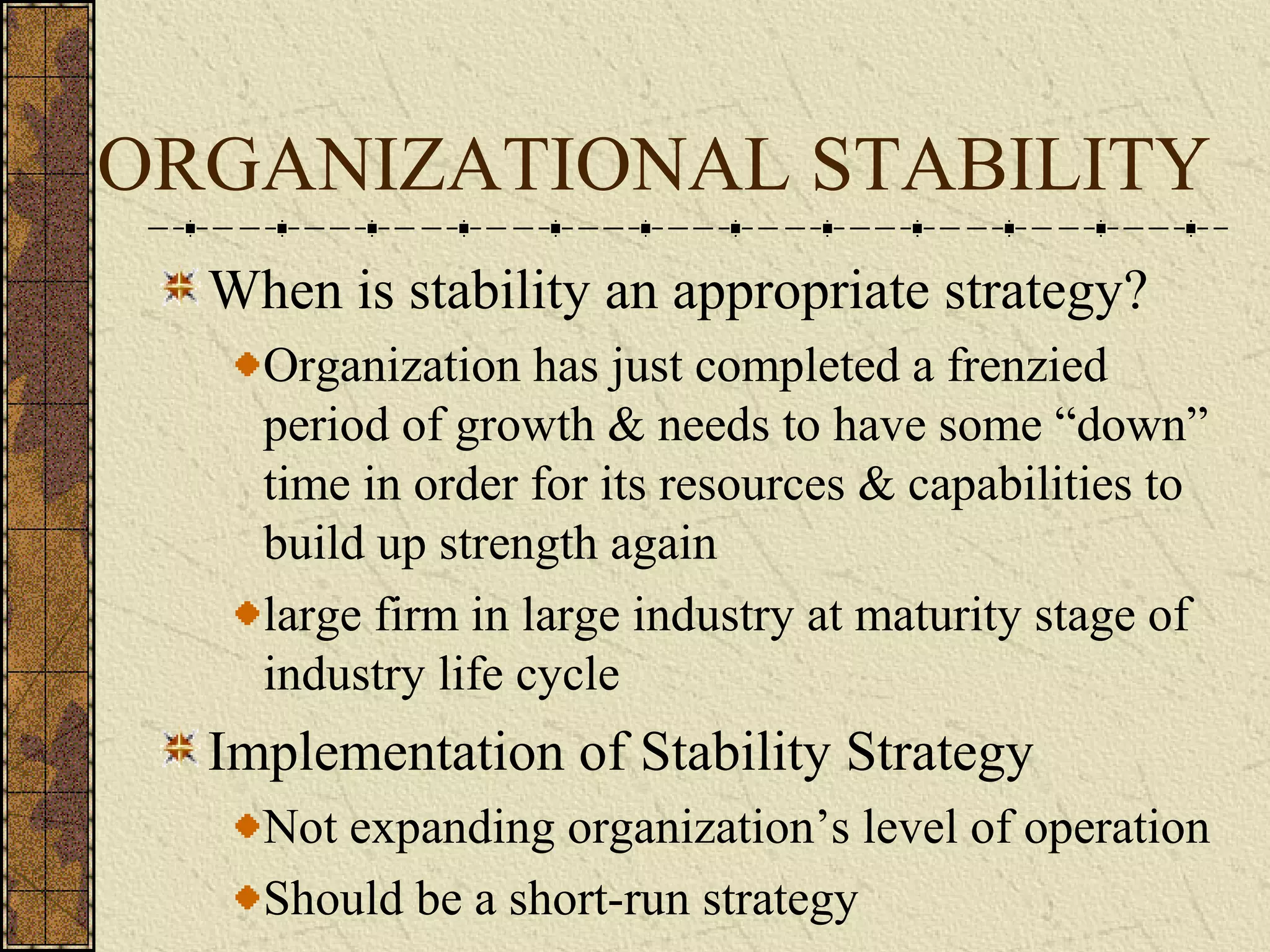

This document provides an overview of corporate strategy concepts. It defines corporate strategy as strategies concerned with the long-term direction of an organization's businesses. It distinguishes between single and multiple business organizations and explains how corporate strategy relates to competitive and functional strategies. The document outlines various corporate strategic directions including organizational growth, stability, and renewal. It also describes different growth strategies such as diversification, integration, concentration, and international expansion.