The document discusses various corporate-level strategies including internationalisation strategies, cooperation strategies, and digitalisation strategies.

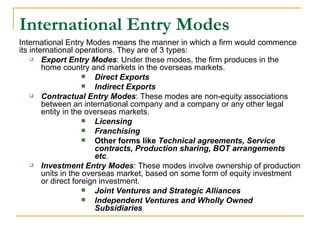

Internationalisation strategies allow companies to expand globally and there are various entry modes and factors to consider. Cooperation strategies like mergers and acquisitions, joint ventures, and strategic alliances allow firms to work together competitively or cooperatively. Digitalisation strategies transform value chains and involve three phases of choosing patterns, models, and designs to implement new technologies.