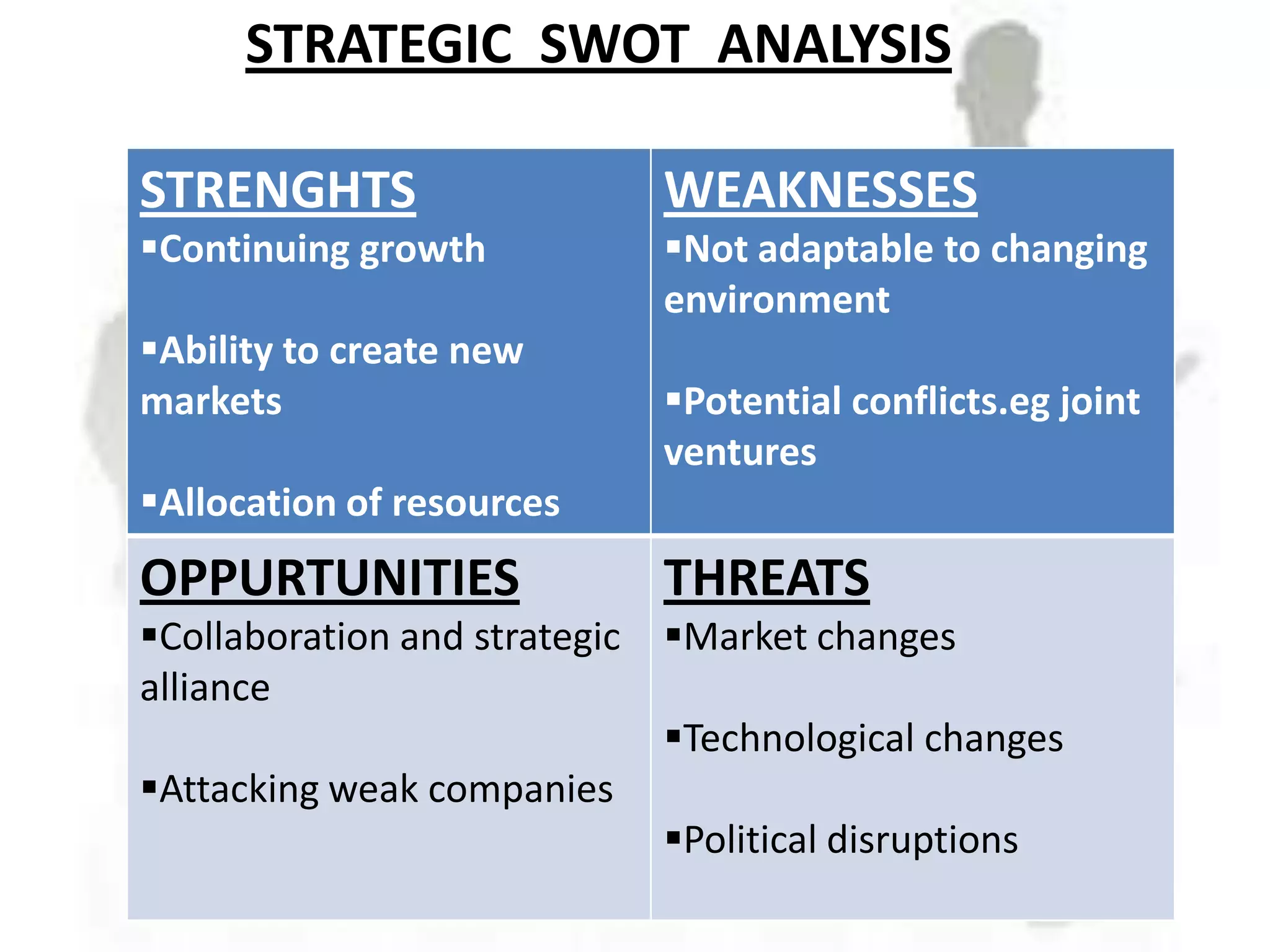

This case study examines diversification strategies used by multinational corporations (MNCs). MNCs have expanded their operations in recent decades due to changing business environments. They diversify to pursue growth, manage risk, and increase profits. Common diversification strategies include entering new industries through joint ventures, mergers, and acquisitions. MNCs also diversify through related and unrelated business expansion, new product lines, and internationalizing production. Strategic analysis helps MNCs leverage opportunities and address threats in pursuing diversification.