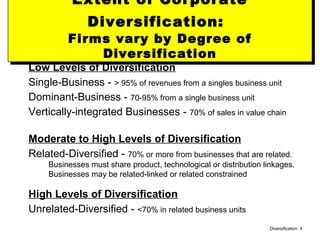

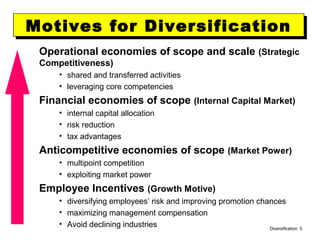

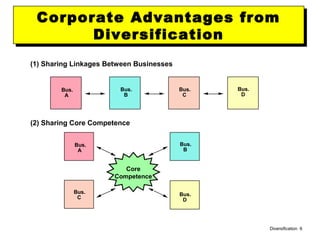

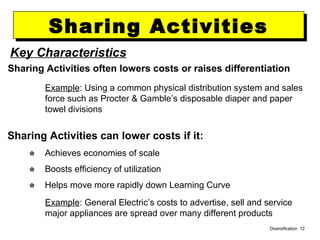

This document discusses corporate diversification strategies, including horizontal expansion into related and unrelated industries. It identifies three main dimensions of corporate strategy: business diversification, vertical integration, and geographic expansion. Several motives for diversification are provided, including economies of scope and scale, risk reduction, and avoiding declining industries. The advantages of diversification include market power, scope economies, internal transaction efficiencies, and an internal capital market. Related diversification can be more profitable when industries are related through shared activities, competencies, or linkages.