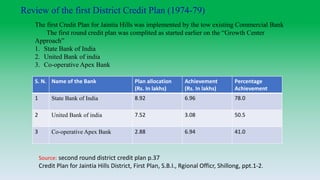

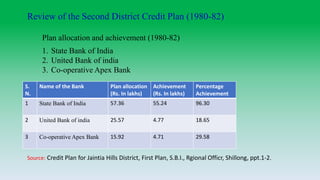

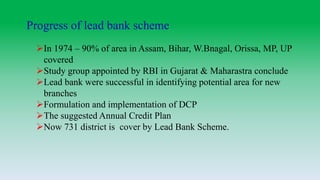

The document discusses the Lead Bank Scheme and District Credit Plans in India. It provides background on the Lead Bank Scheme, including its objectives to provide credit to rural areas and prepare credit plans. It explains that under the scheme, banks with large rural branch networks in a district are designated as the lead bank. It also summarizes the key aspects of District Credit Plans, which are developed by lead banks to provide financing for viable agriculture, industry and service sector schemes based on the economic activities and potential of a district. Examples are provided of early District Credit Plans implemented in Jaintia Hills district.