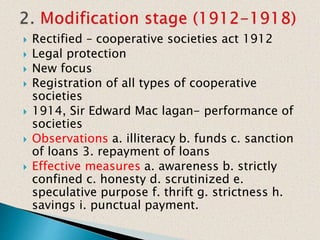

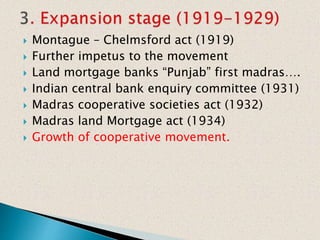

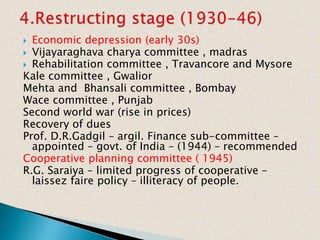

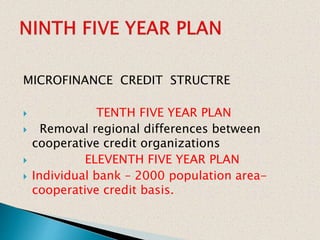

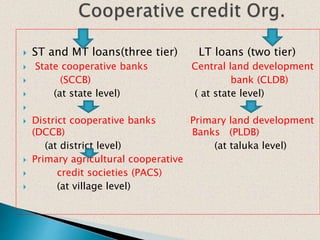

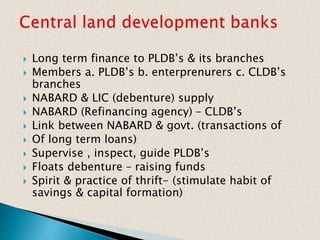

The document discusses the history and evolution of the cooperative movement in India from its initiation in 1904 up until recent times. It outlines the key principles of cooperation, the various committees and acts that helped develop the movement, and the multi-tiered structure of agricultural cooperative credit societies and marketing federations that were established at the national, state, district and local levels over time. The cooperative model has aimed to provide farmers with access to credit, inputs and marketing while promoting principles of self-help and mutual assistance.