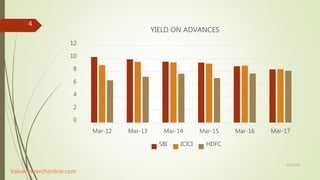

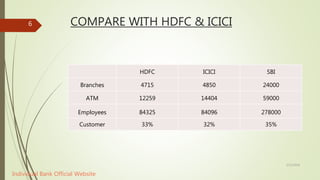

The document discusses business process re-engineering at State Bank of India. It provides details on the merger of SBI with its associate banks, including redundant processes, competitive advantages, and changes in central banking, retail banking, rural banking, and wholesale banking. Challenges of the merger include integrating a large number of branches and employees, resolving high levels of bad loans, and ensuring customer satisfaction during the transition period. The document also outlines improvements made by SBI and further areas for improvement post-merger.