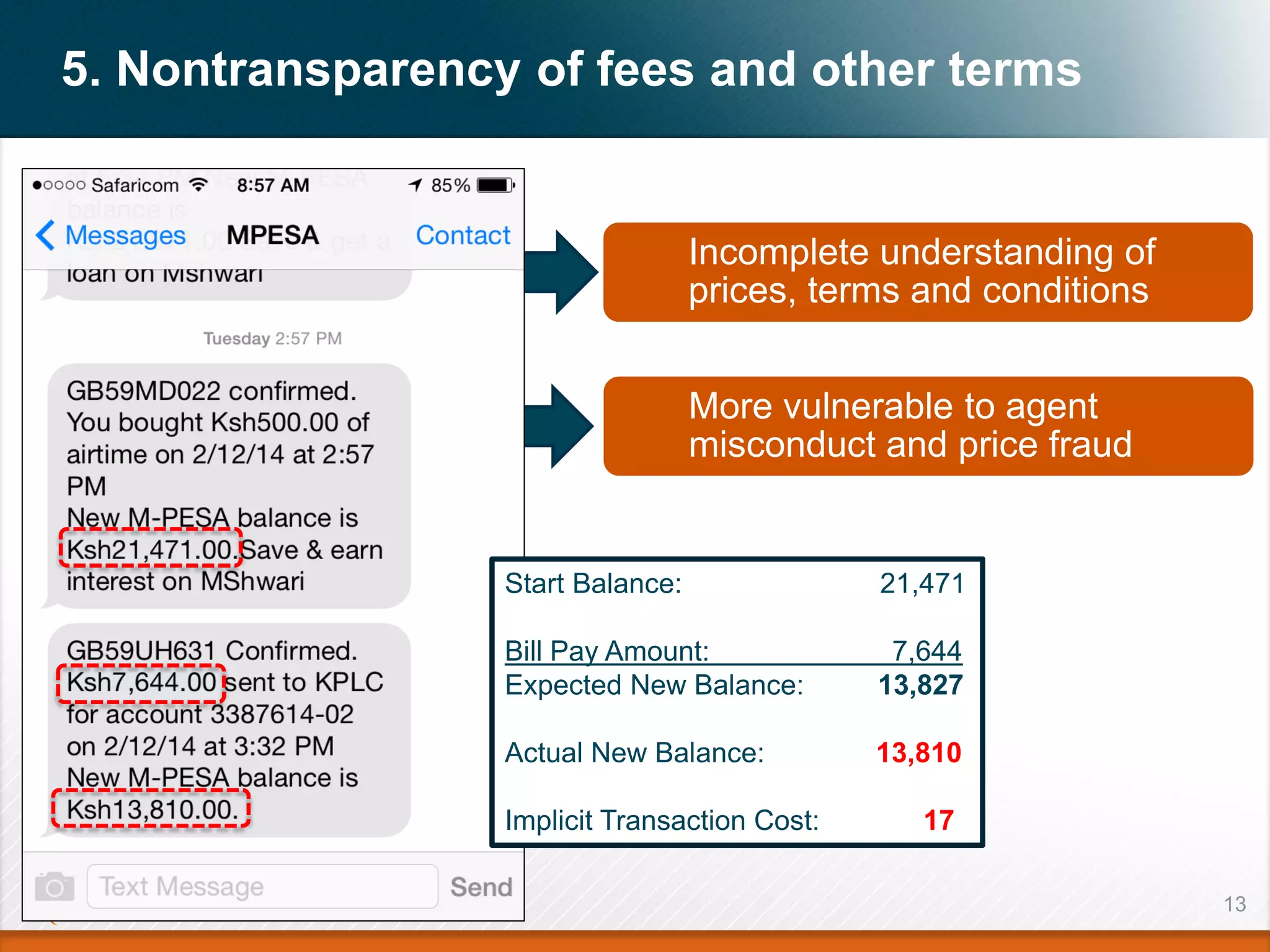

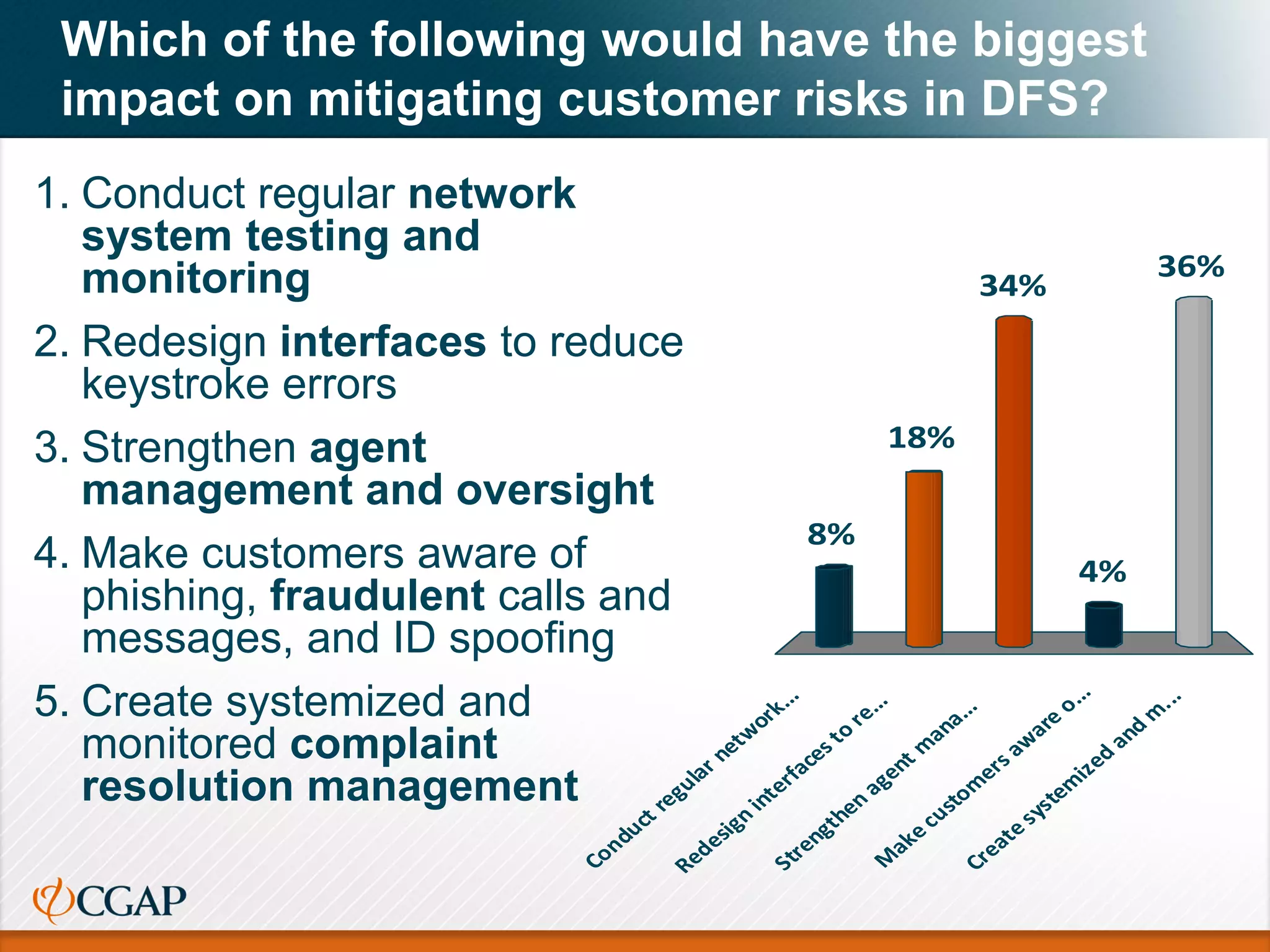

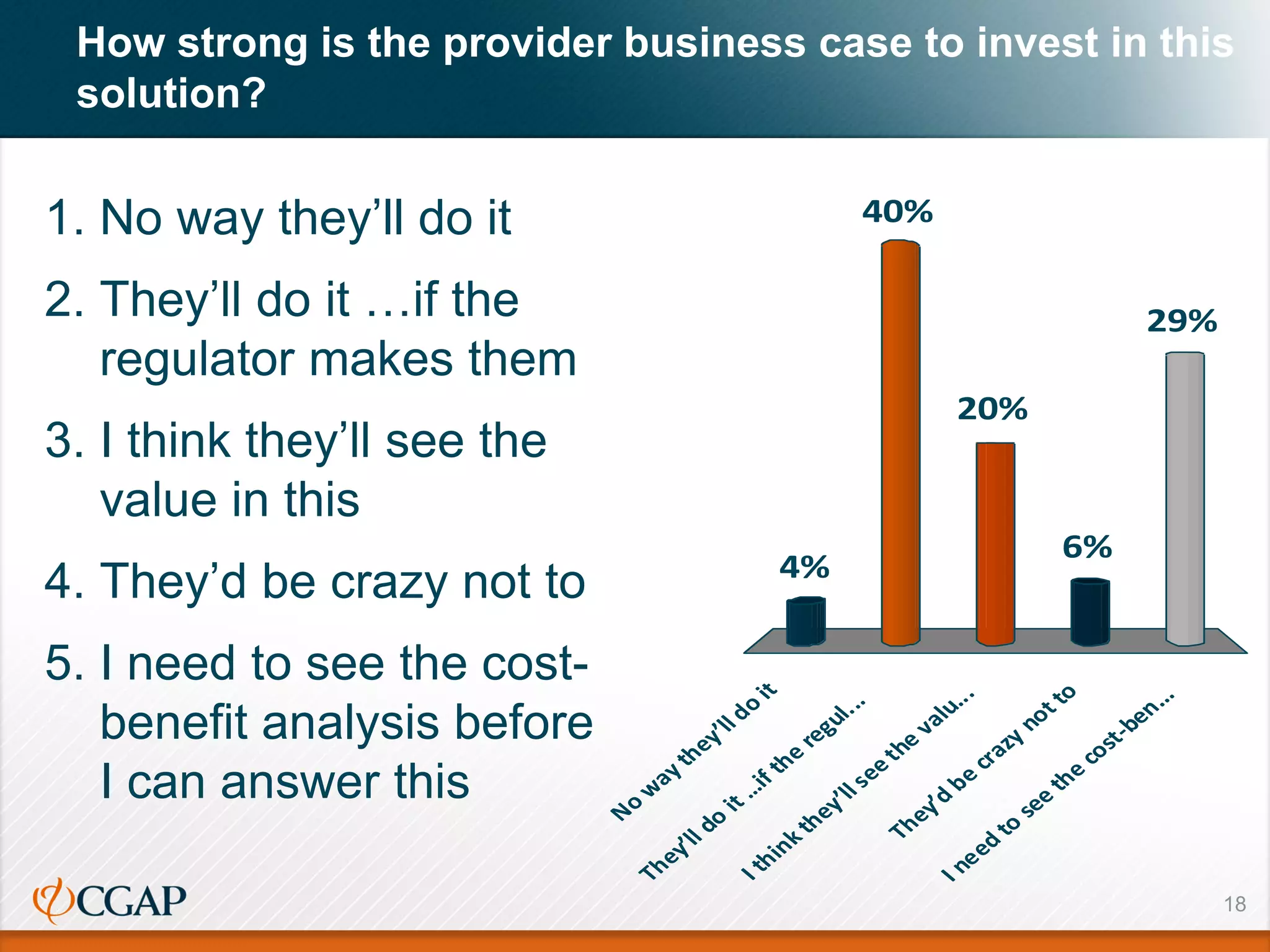

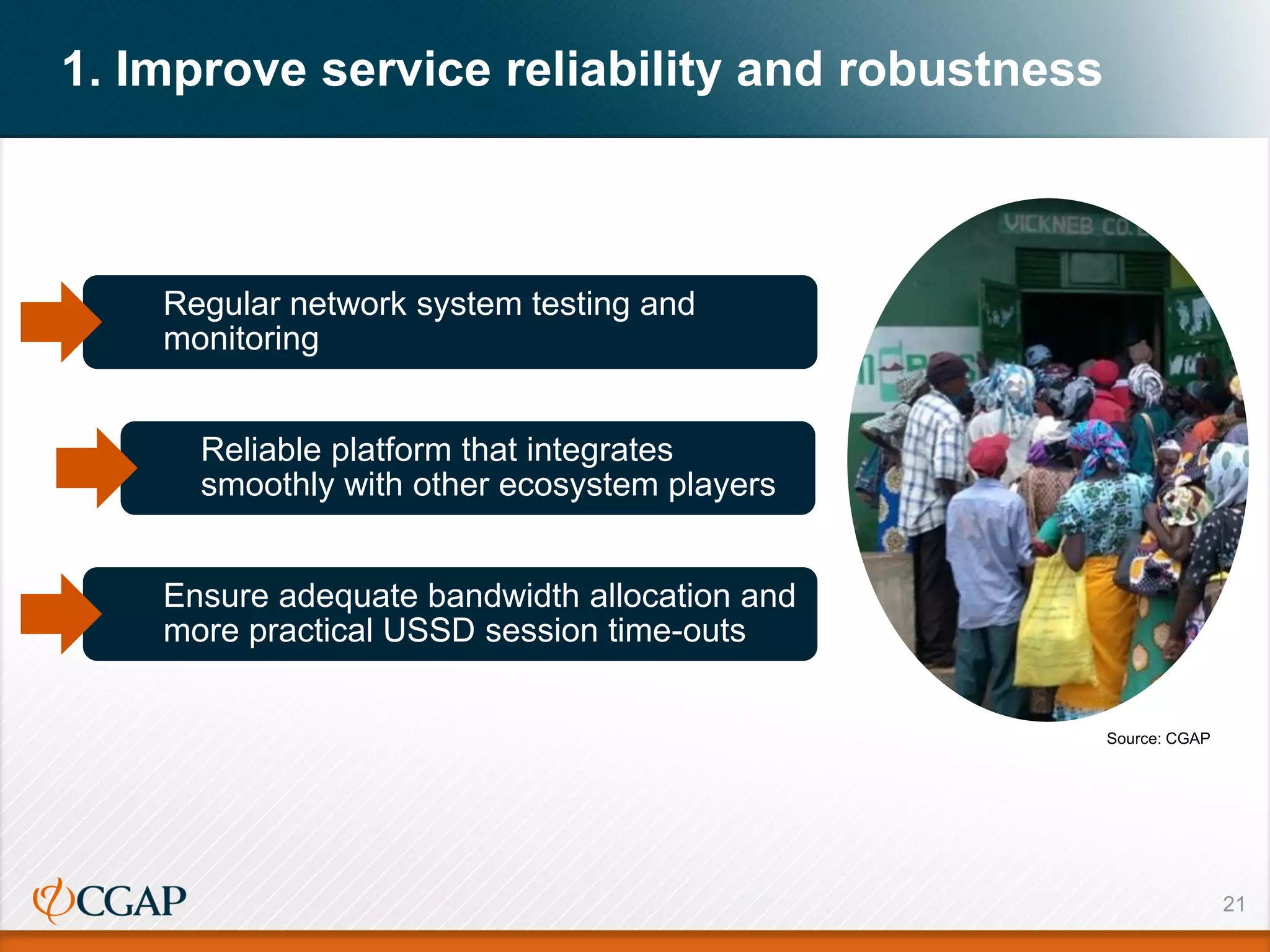

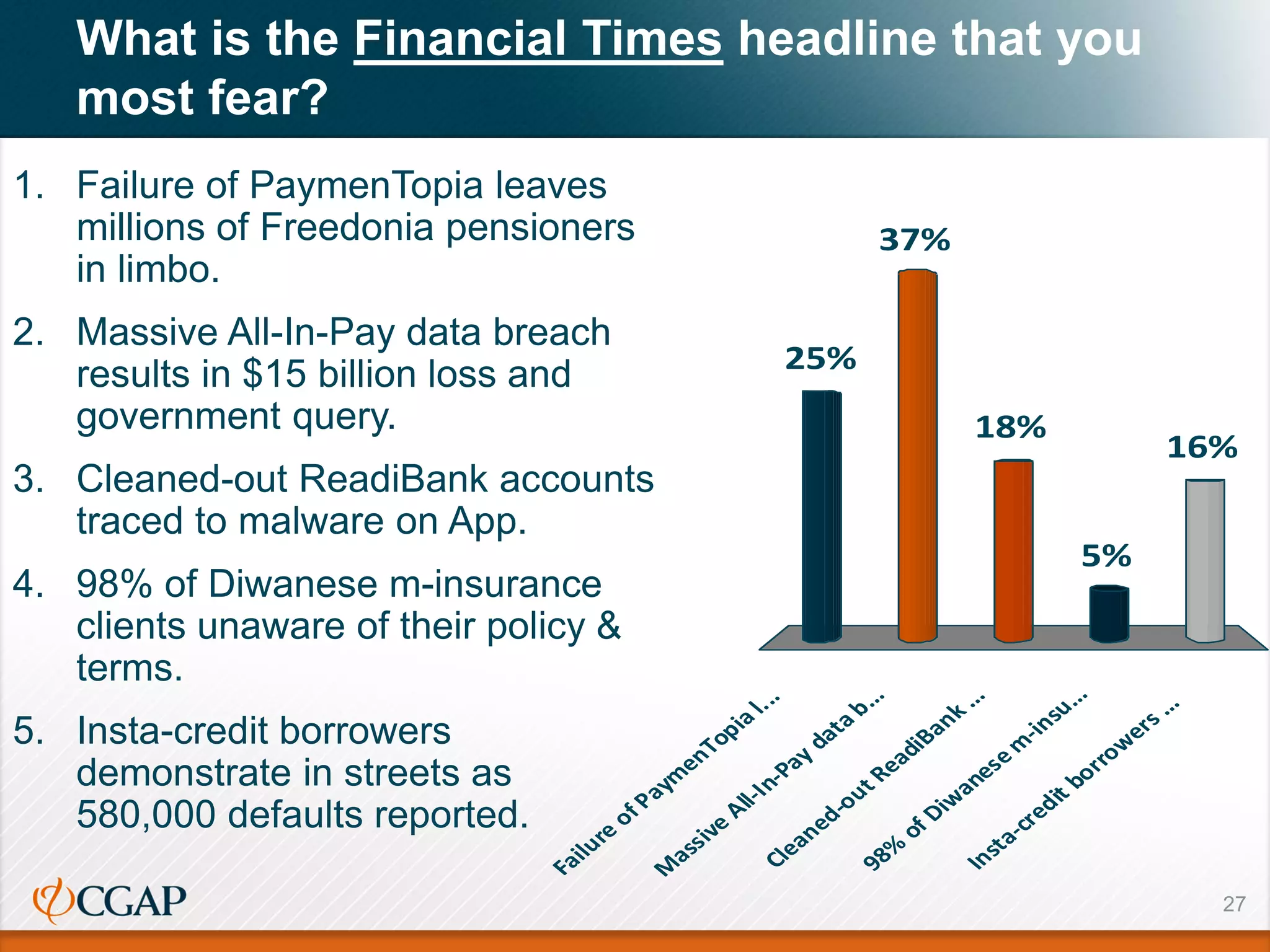

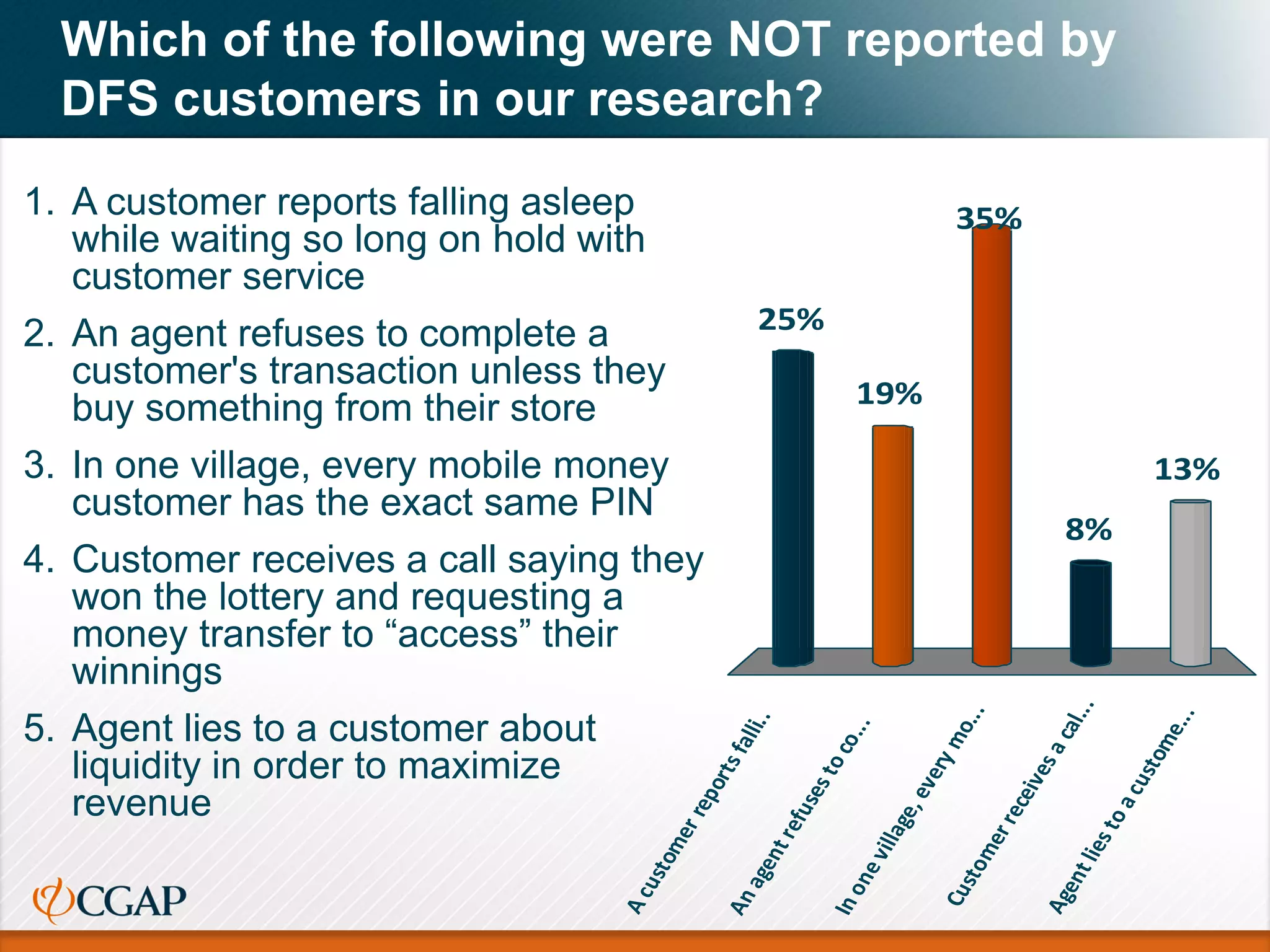

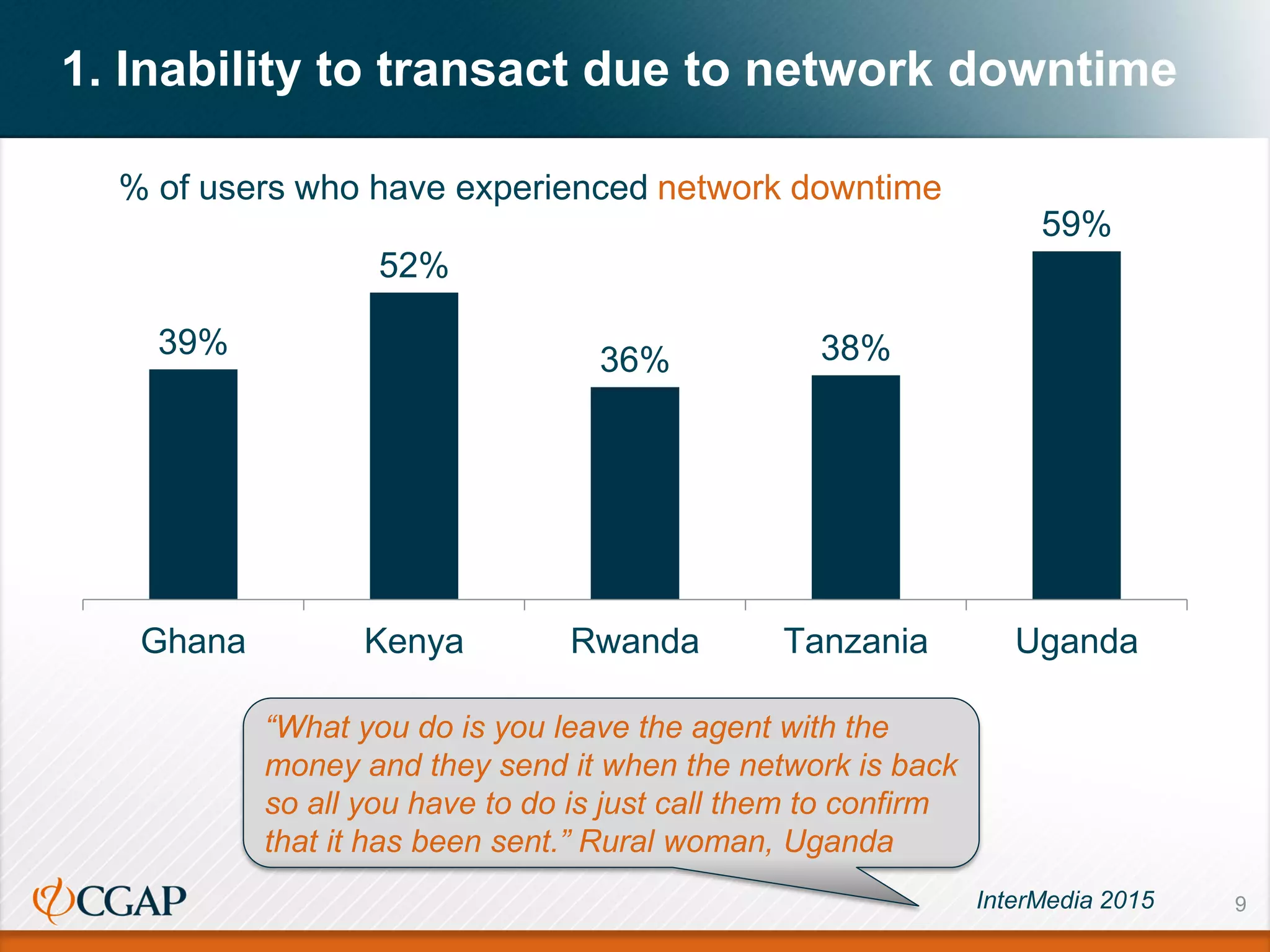

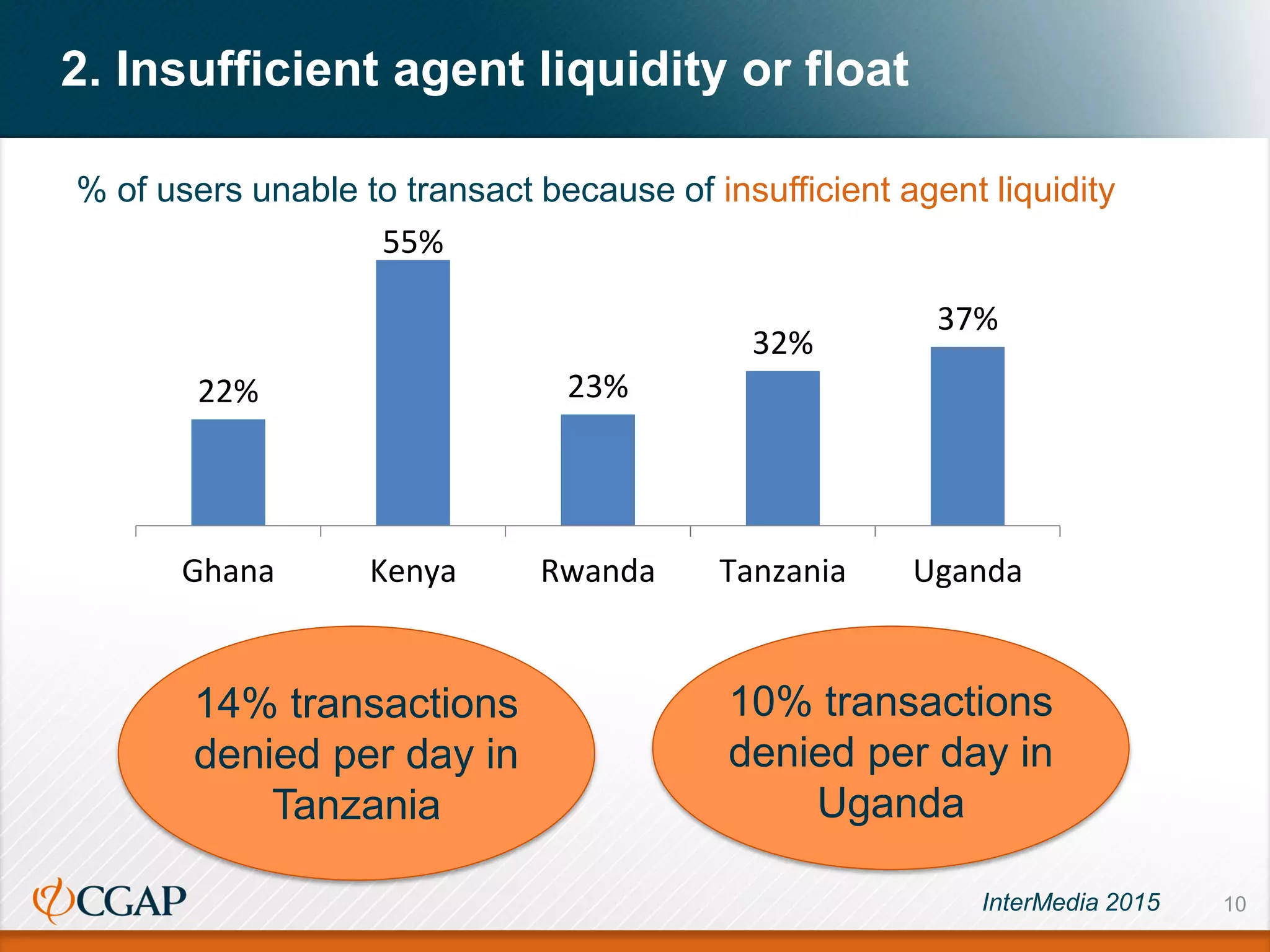

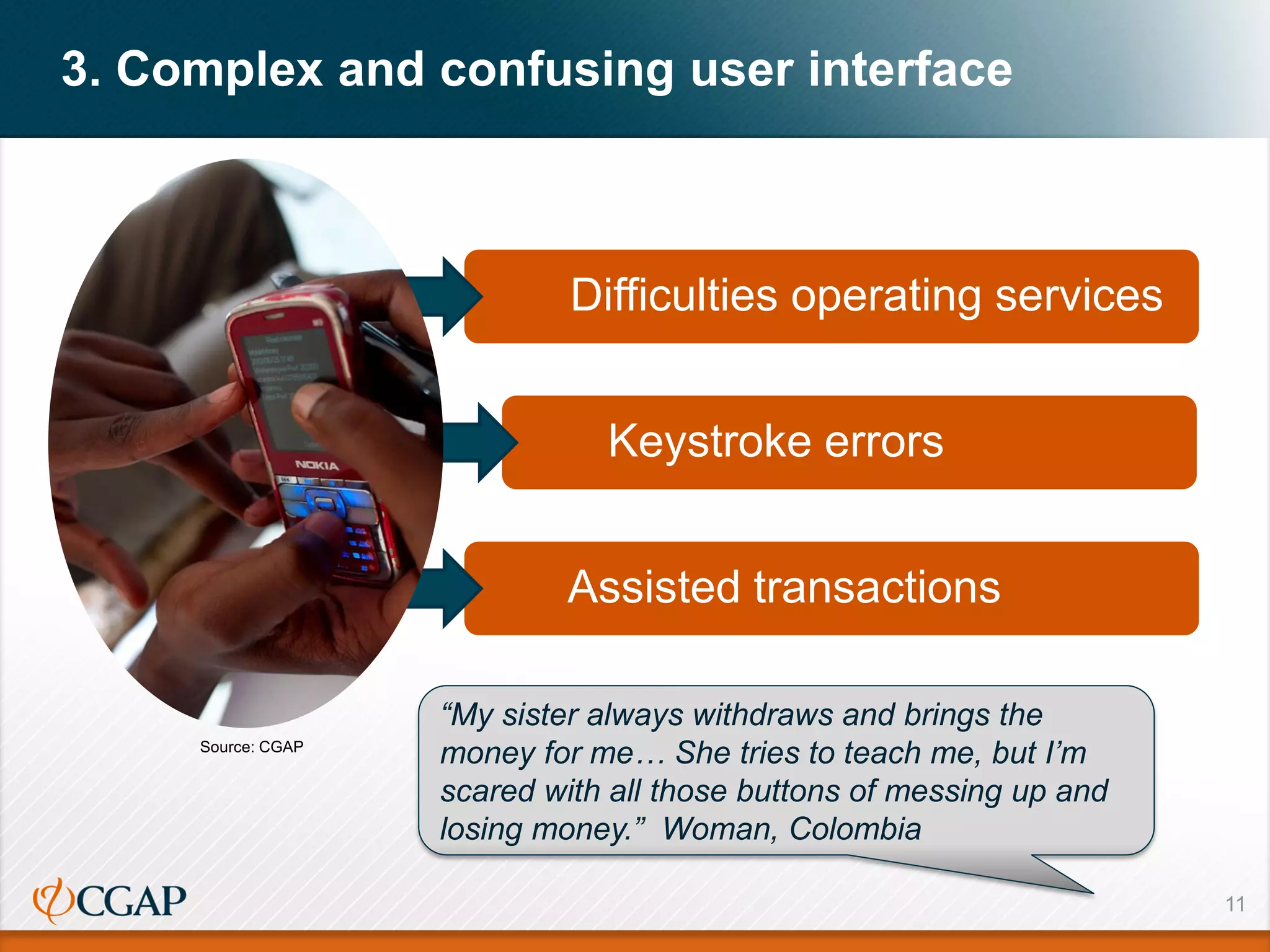

This document summarizes research on customer risks in digital finance and proposes solutions to mitigate those risks. It finds that while digital finance now serves over 300 million customers, many experience problems like network downtime, agent liquidity issues, complex interfaces, and fraud. The research identifies 7 key customer risk areas and provides examples of risks reported in various countries. It then proposes 5 priorities for industry to address through solutions like improving network reliability, simplifying interfaces, strengthening agent oversight, combating fraud, and improving complaint resolution. The goal is to increase trust in digital finance and improve the customer experience.

![4. Inadequate provider recourse

12

Unclear, costly, and time-consuming

procedures

Often turn to agents

Particularly problematic for G2P

recipients

“…I waited for three days for them to answer my

complaint but I [never got it resolved]. This

experience led me to worry: what if it happens

when I’m paying my bills?” Male, Colombia

Source: CGAP](https://image.slidesharecdn.com/doingdigitalfinanceright-eventpresentation2015-06-29-150825131043-lva1-app6892/75/Doing-Digital-Finance-Right-10-2048.jpg)