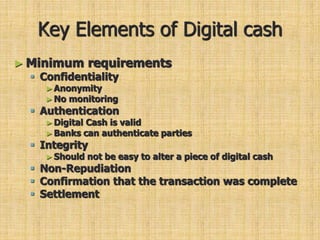

Digital cash aims to provide monetary freedom through digitally signed payments that can be used anonymously and without monitoring, though achieving true digital cash faces challenges around privacy, authentication, and preventing issues like double spending or technology failures that could undermine trust in the system. The document discusses the importance of digital cash, how it can be implemented through various technical approaches like electronic tokens or digital checks, and issues that must still be addressed around consumer resistance, dependability, and balancing anonymity with security.