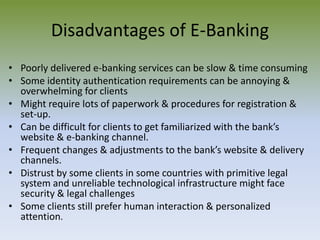

This document discusses e-banking and the new era of digital banking. It defines e-banking and online banking as conducting financial transactions through a bank's website. It describes the features of e-banking like online bill pay, transferring funds, and using mobile apps. It outlines the forms of e-banking like internet banking, ATMs, debit cards, and e-billing. It discusses the advantages of convenience and 24/7 access but also the disadvantages of security risks, technical difficulties, and some customers preferring human interaction.