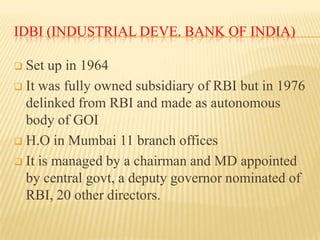

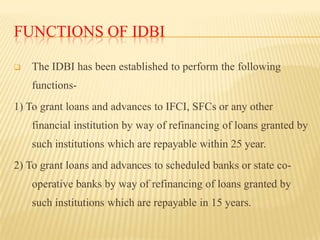

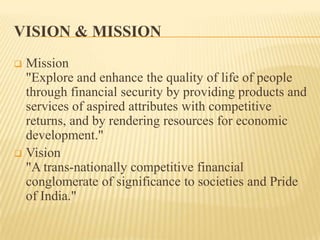

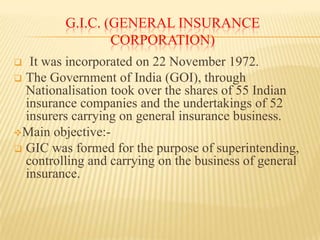

This document provides information on different types of development financial institutions in India. It discusses term lending institutions like IFCI, IDBI, ICICI, and EXIM Bank that provide medium and long-term financing for industry, agriculture, and other sectors. It also covers refinancing institutions like NABARD, SIDBI, and NHB that help allocate funds to other financial organizations. Finally, it mentions investment institutions like LIC and GIC that collect money and invest in other securities.