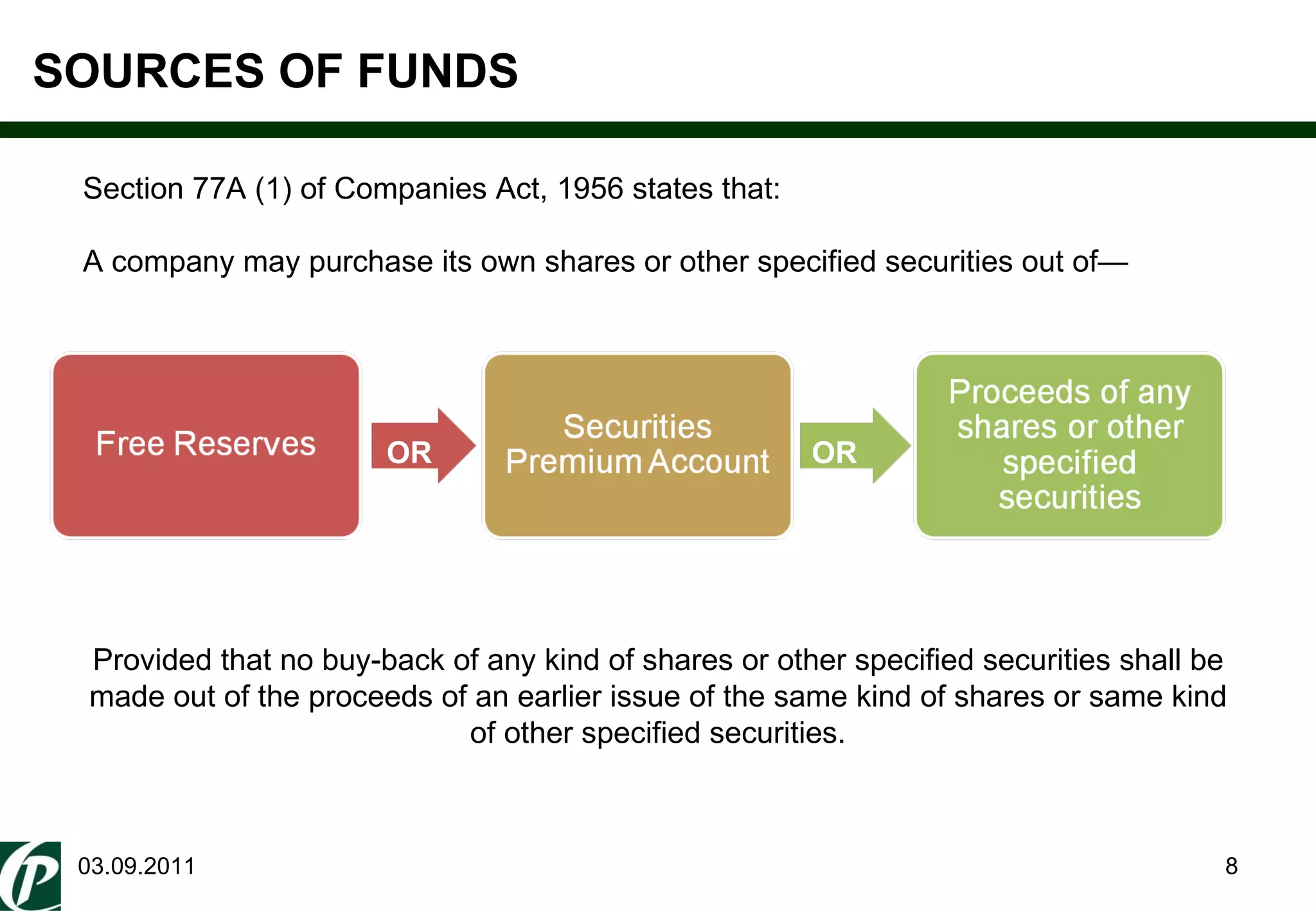

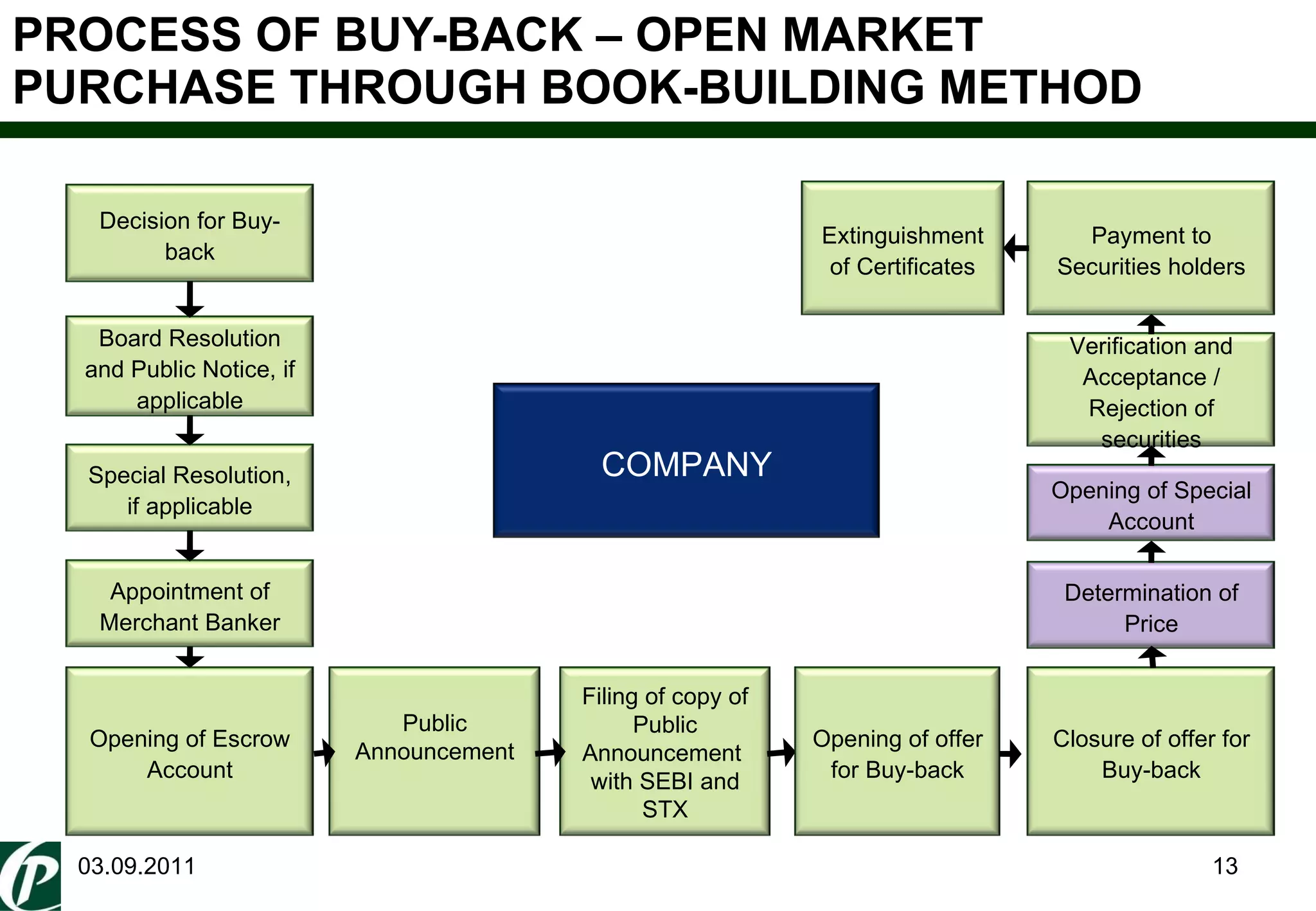

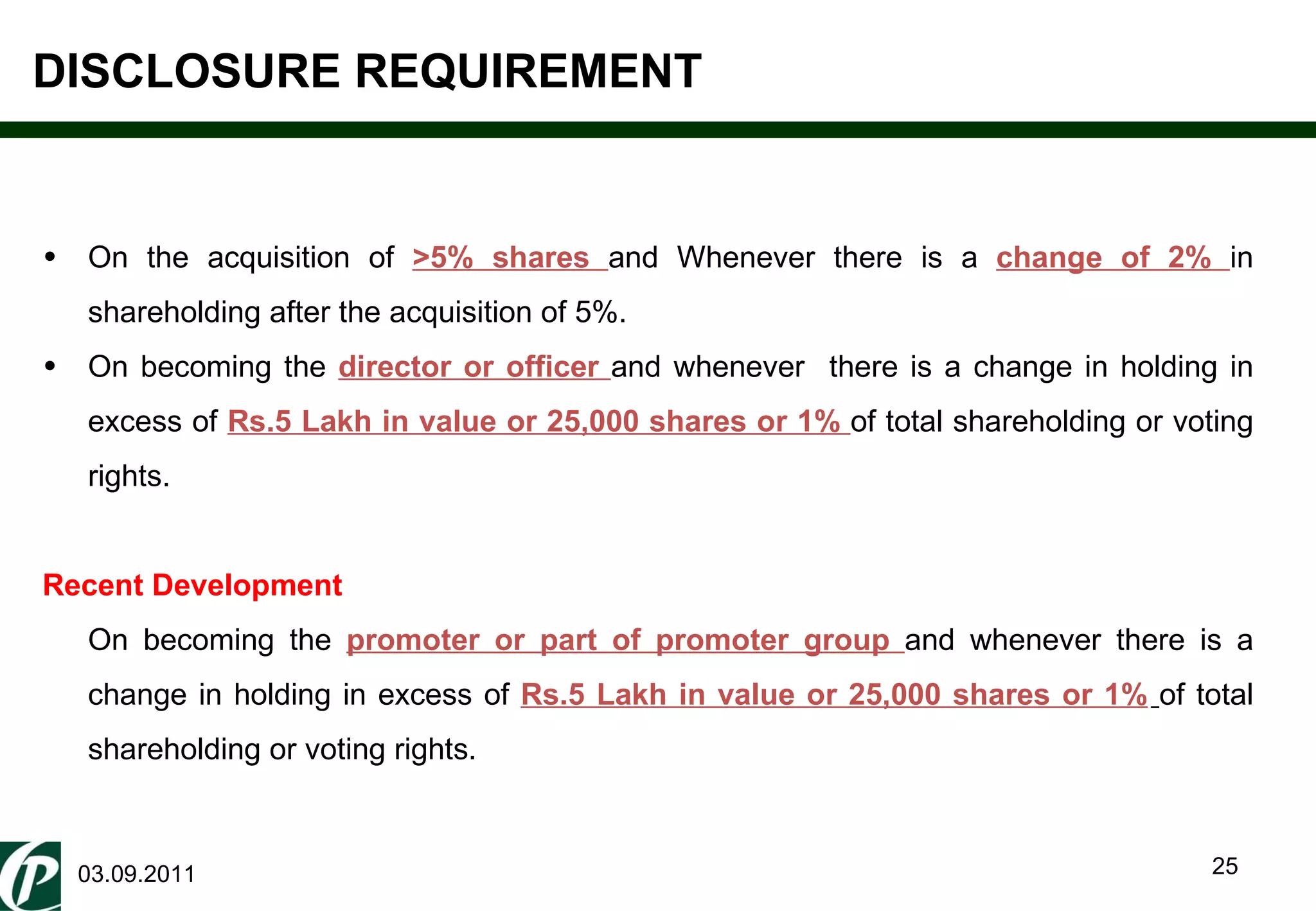

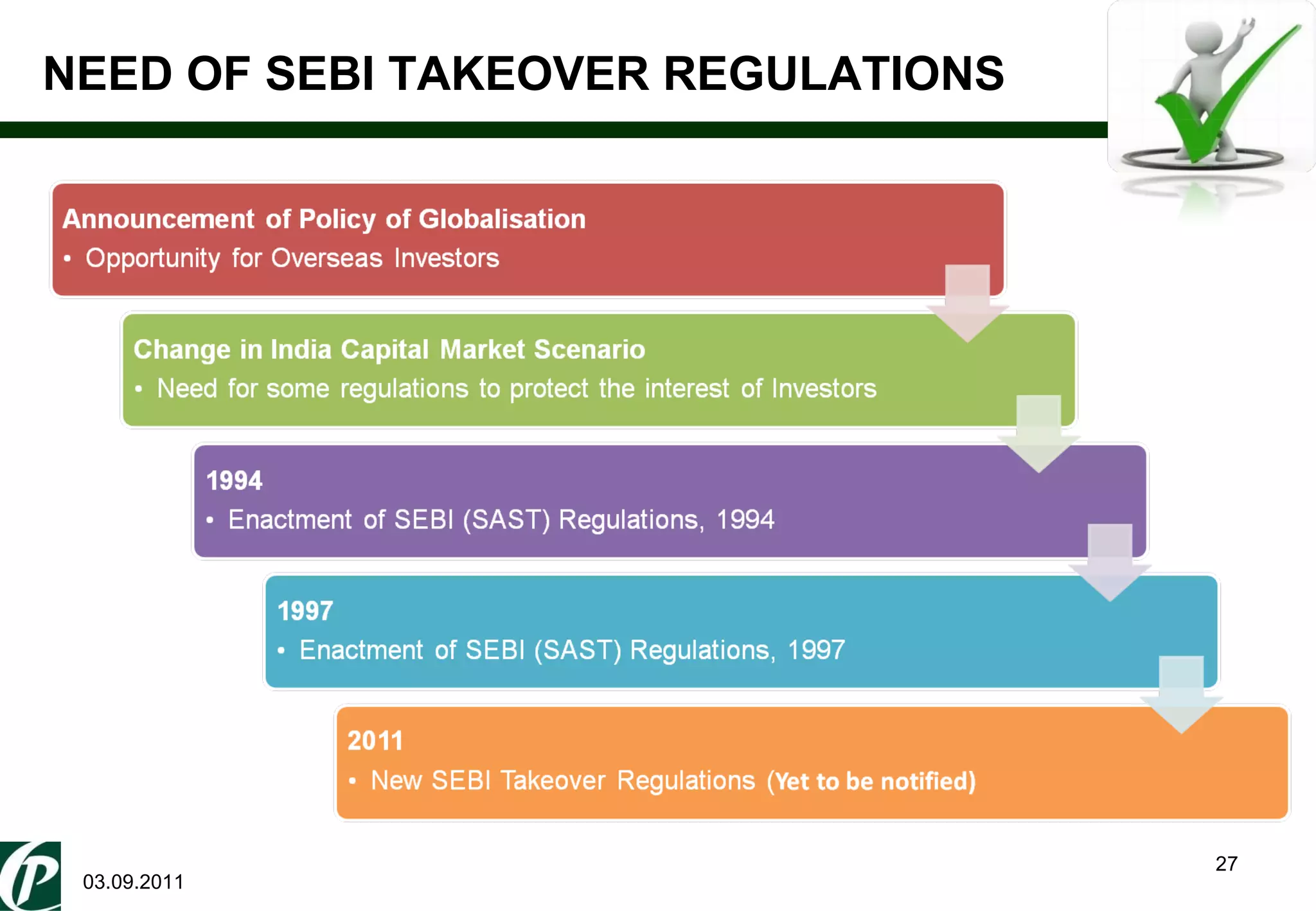

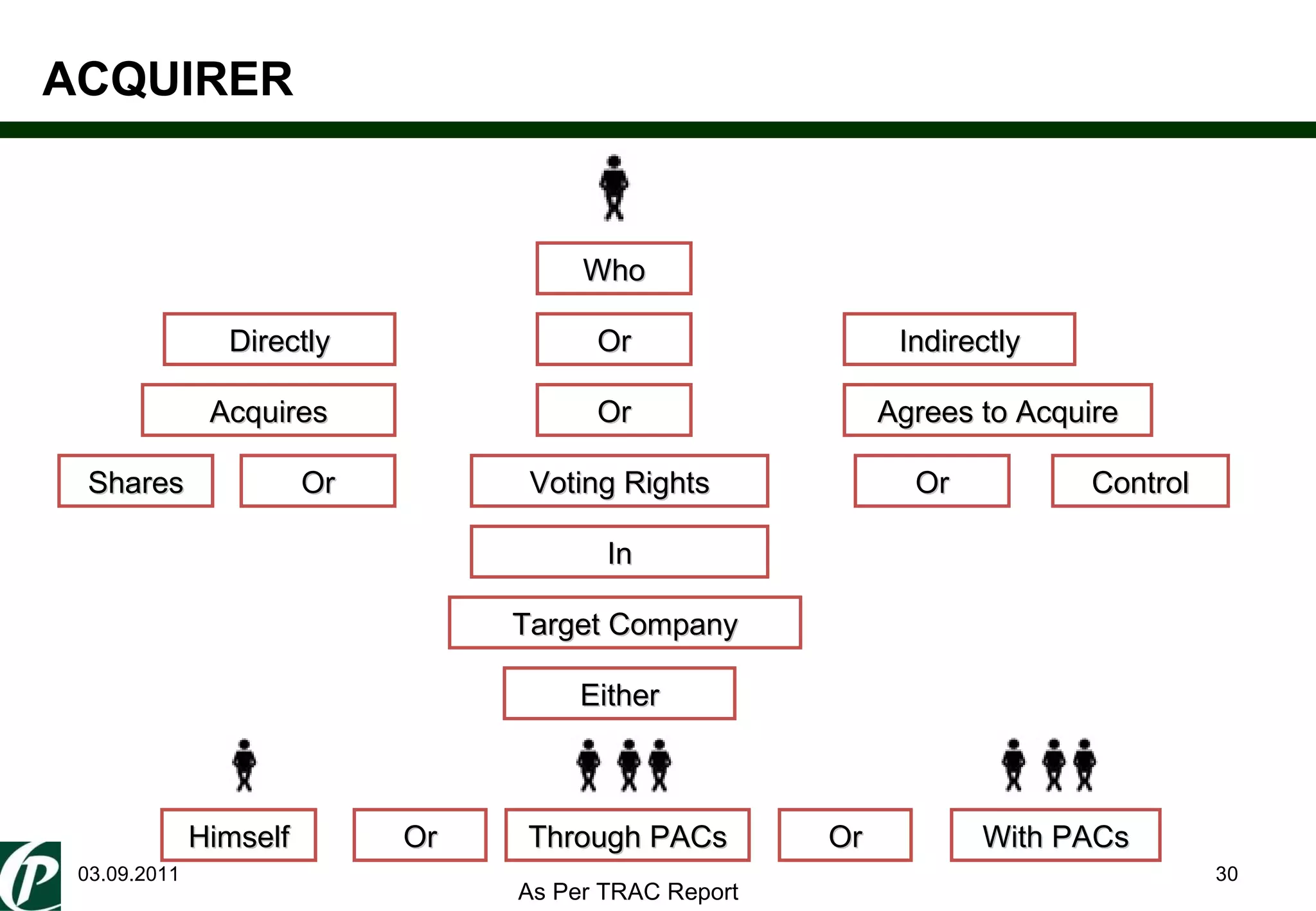

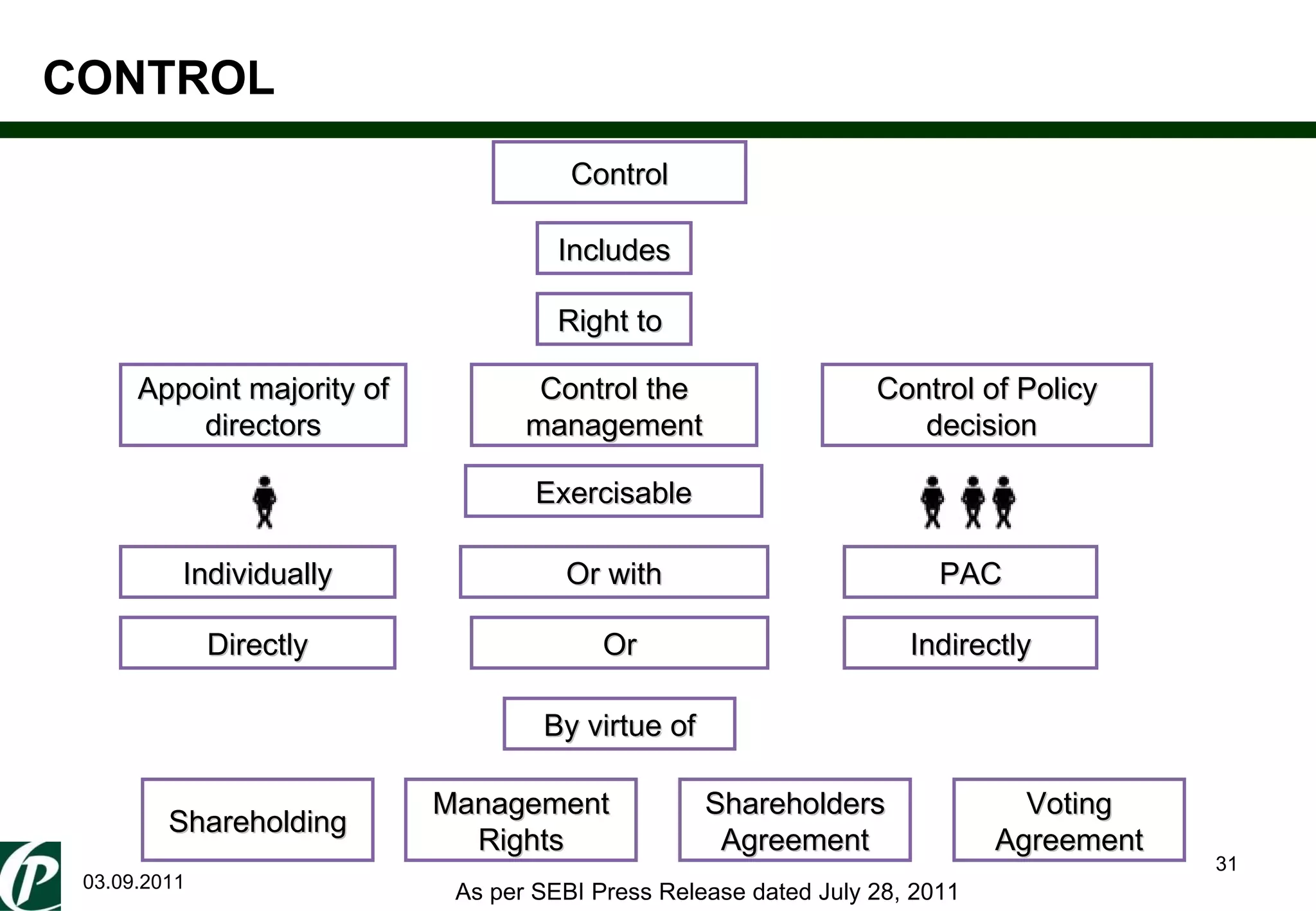

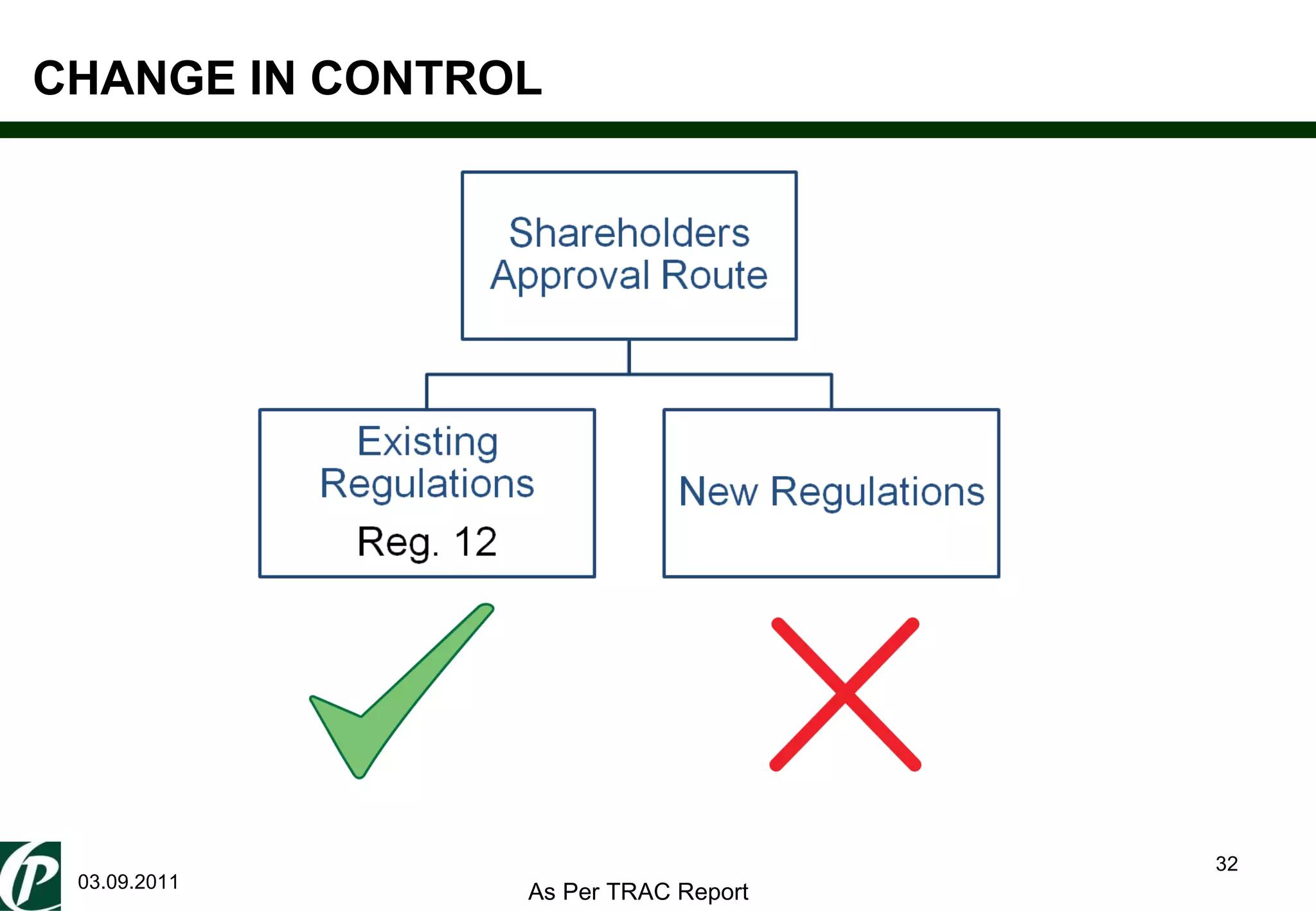

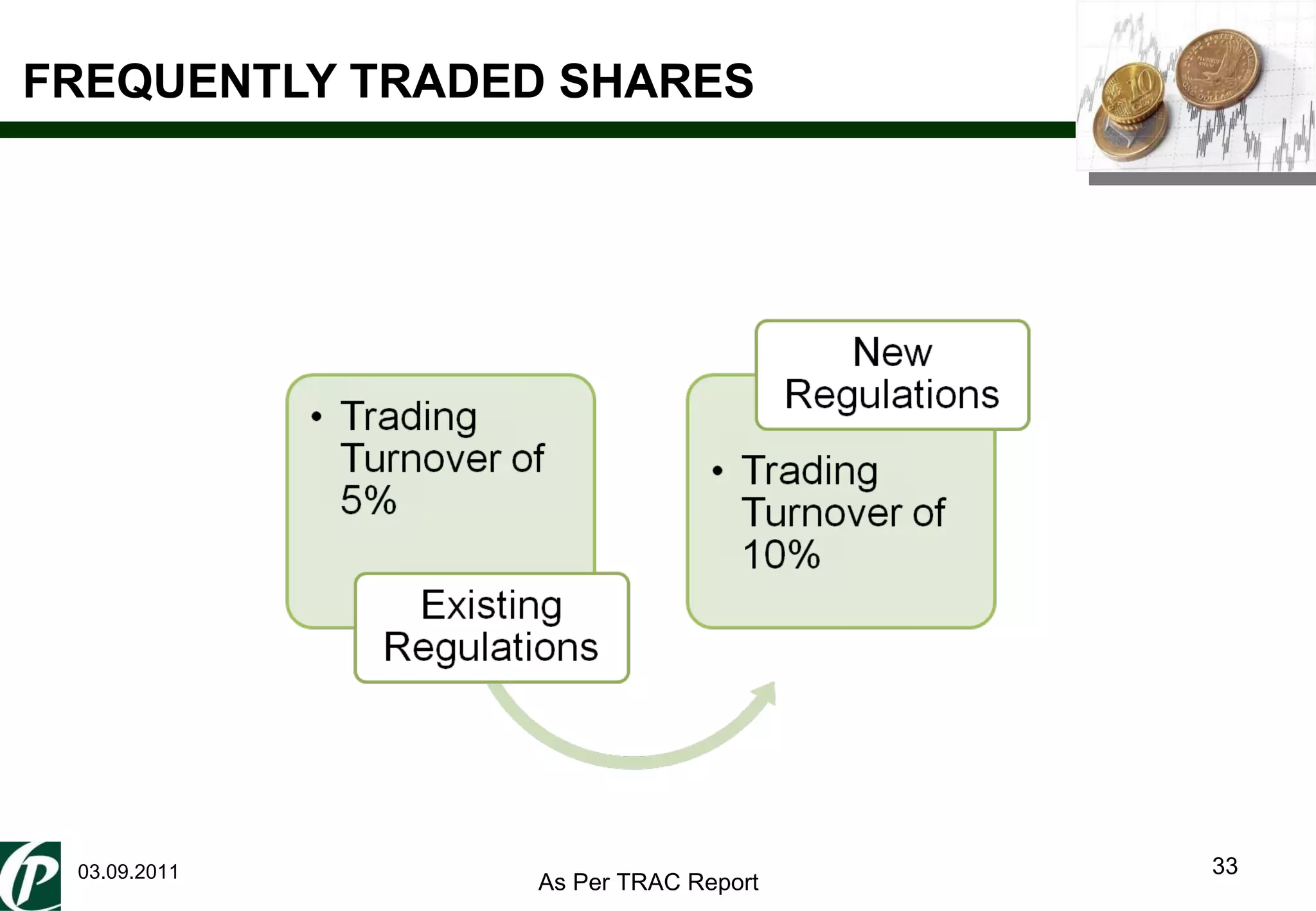

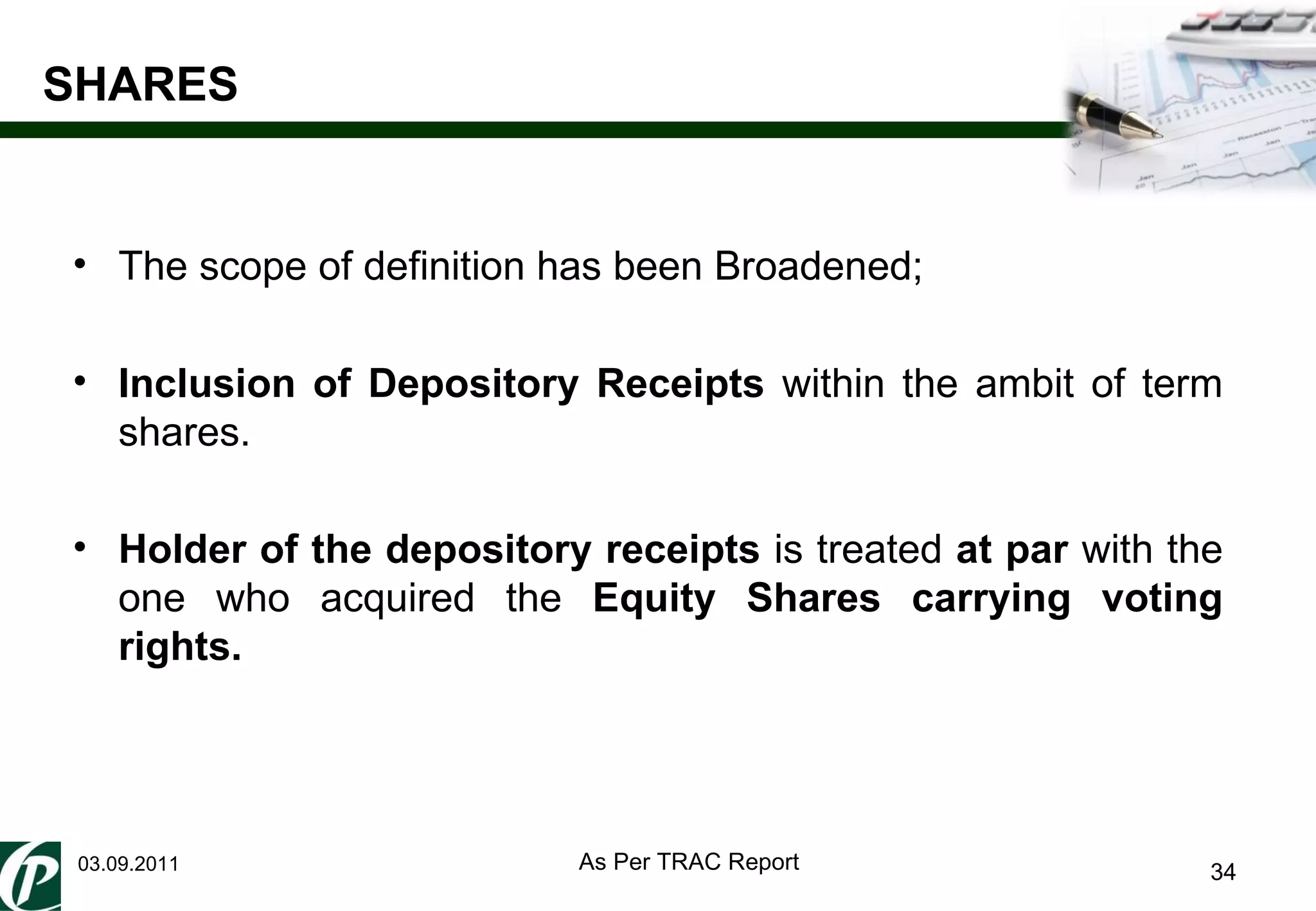

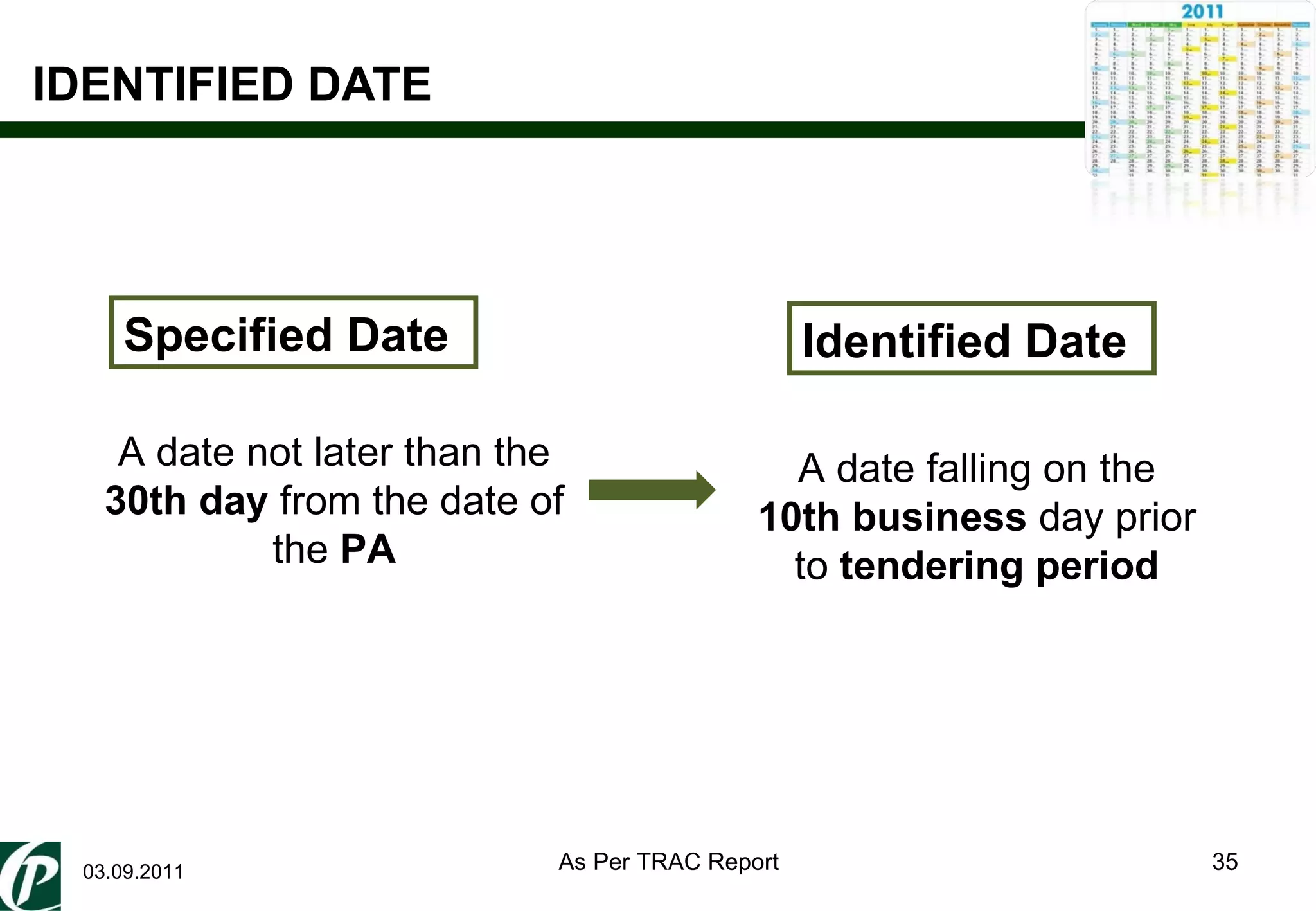

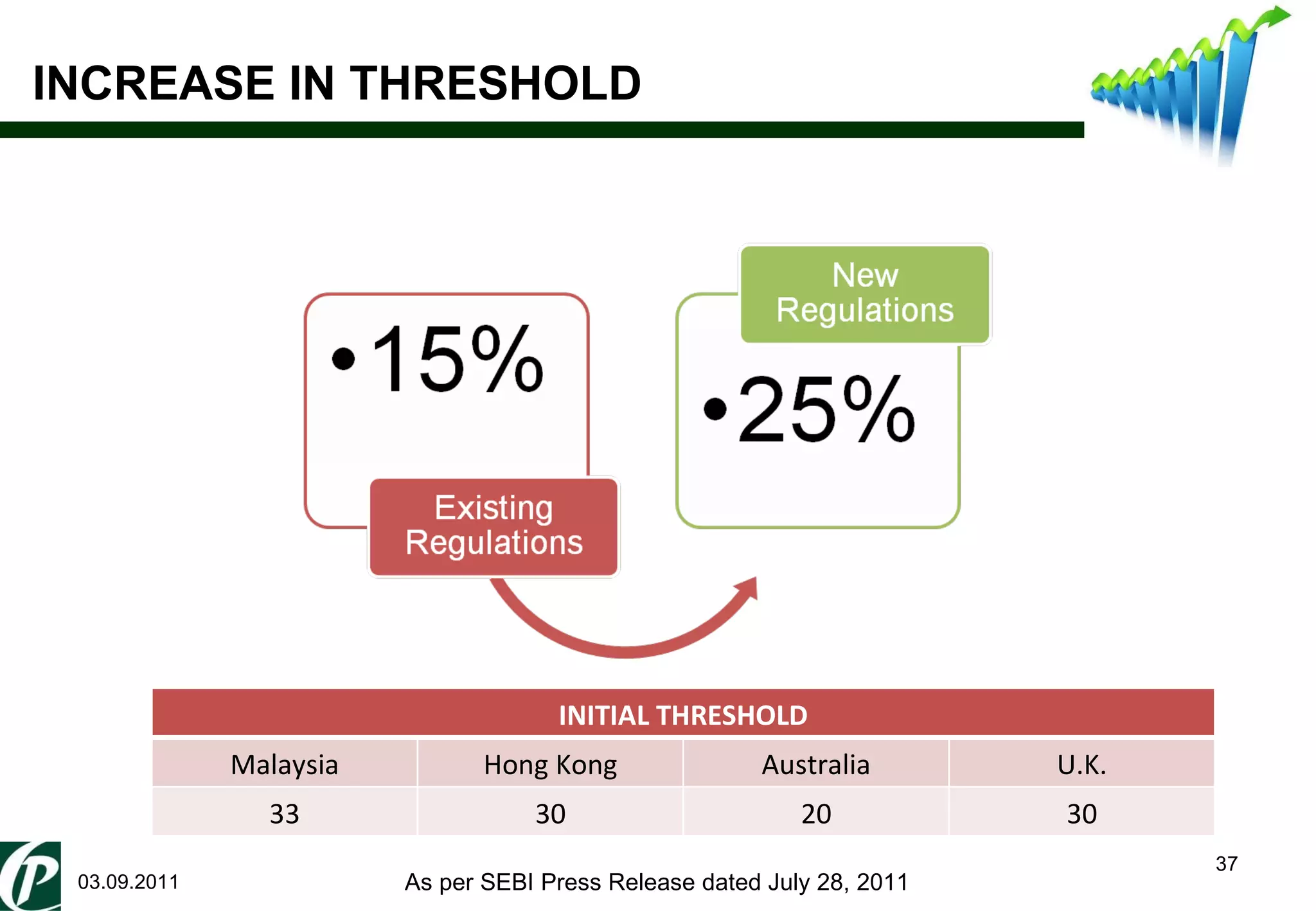

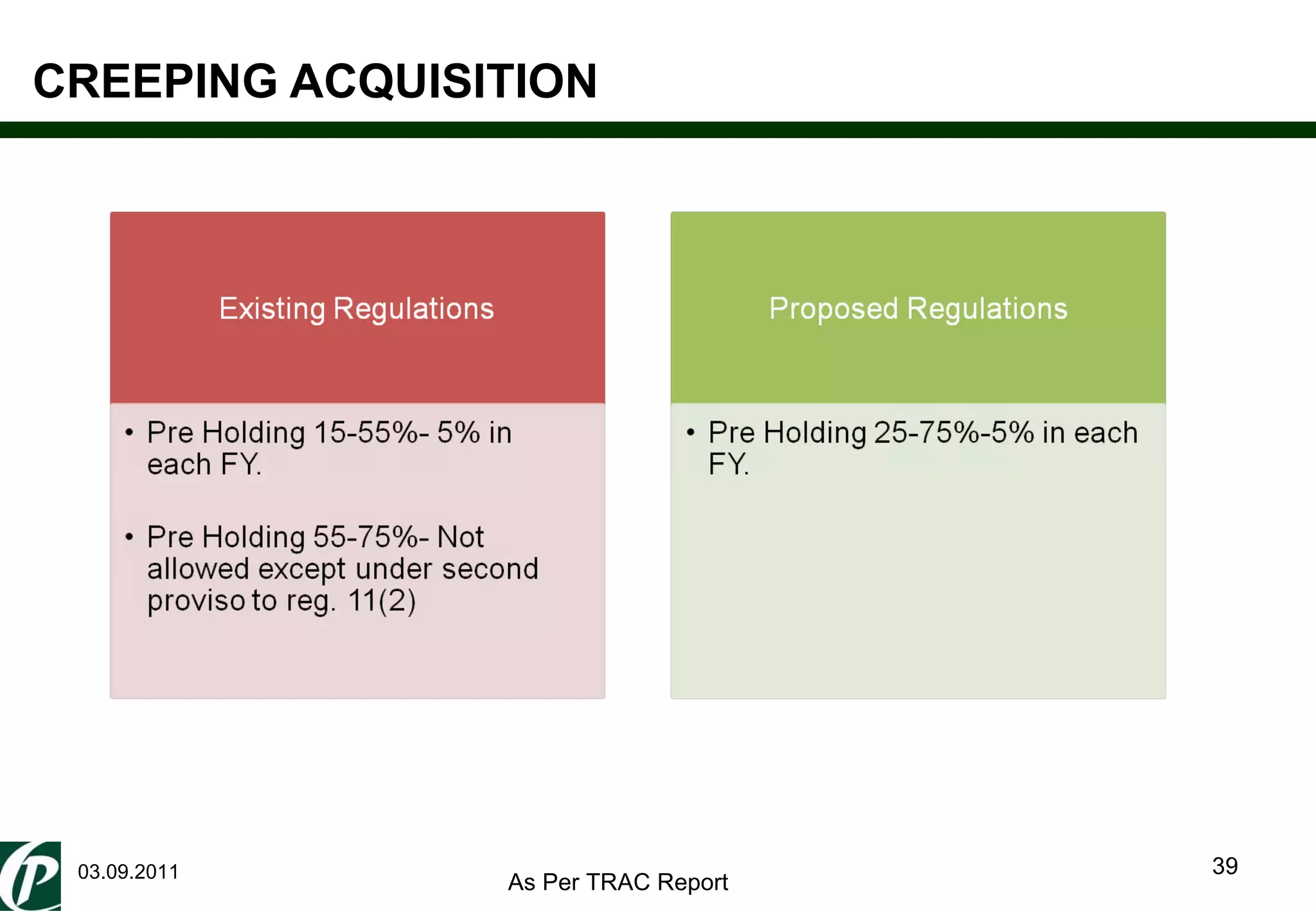

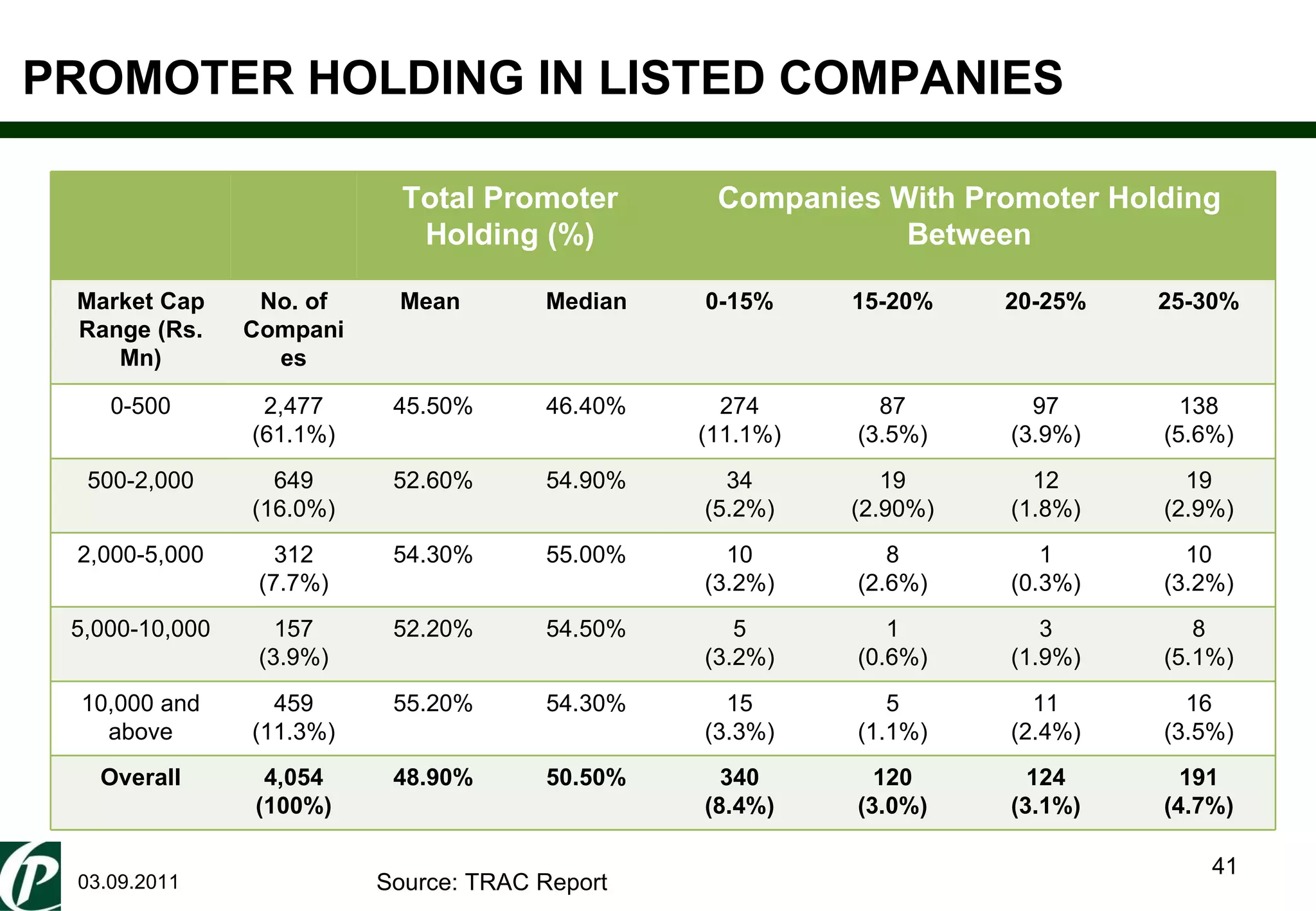

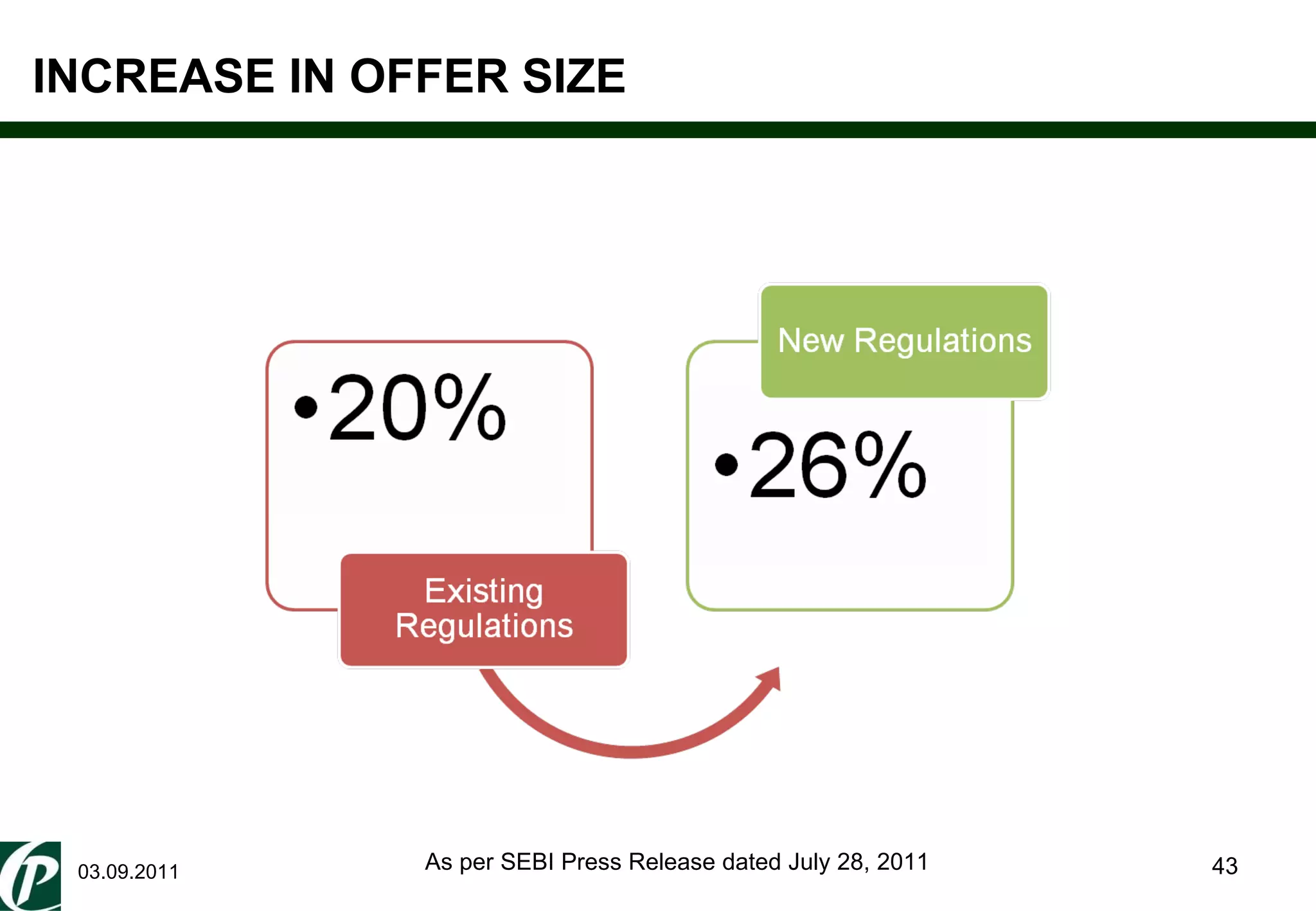

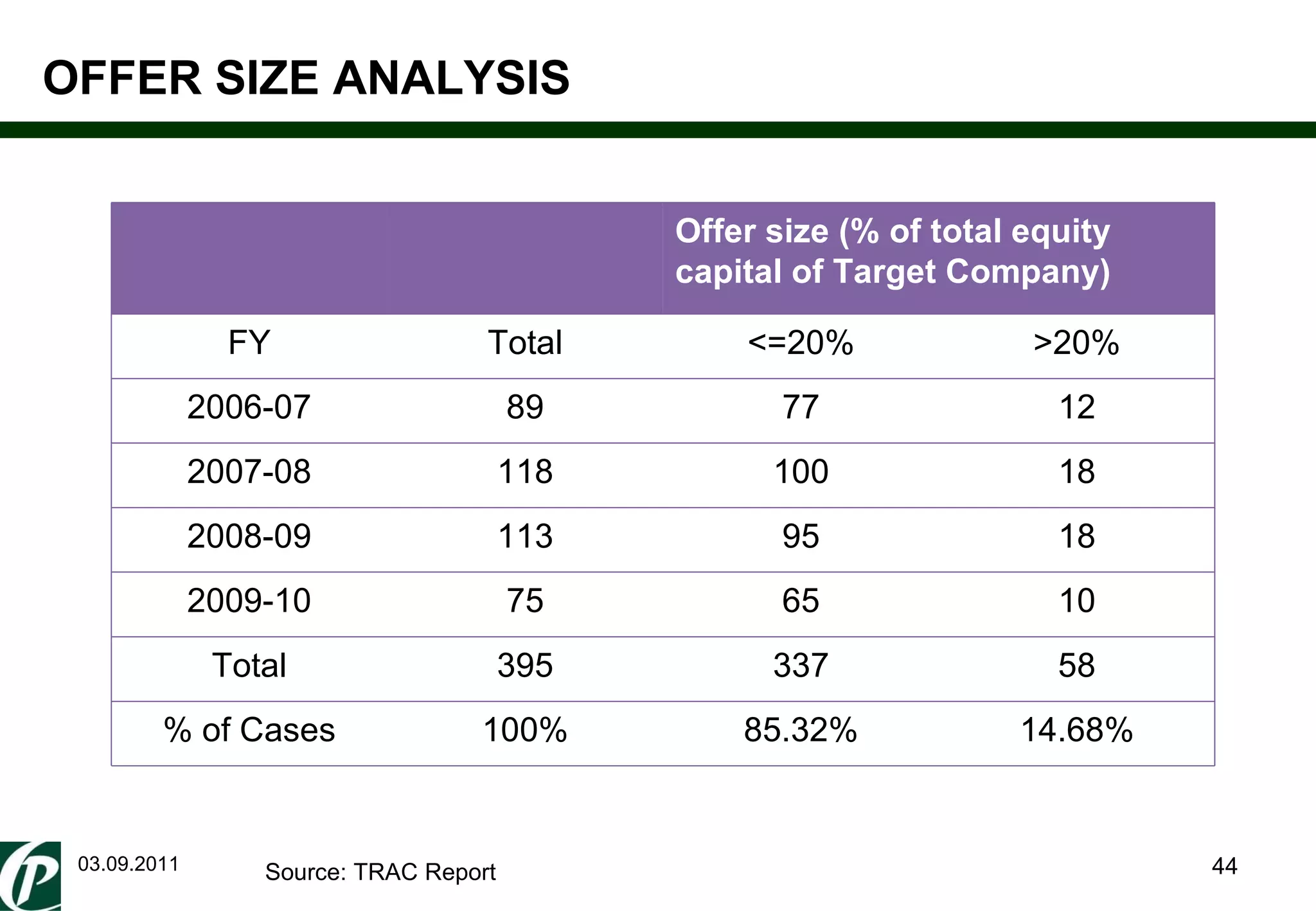

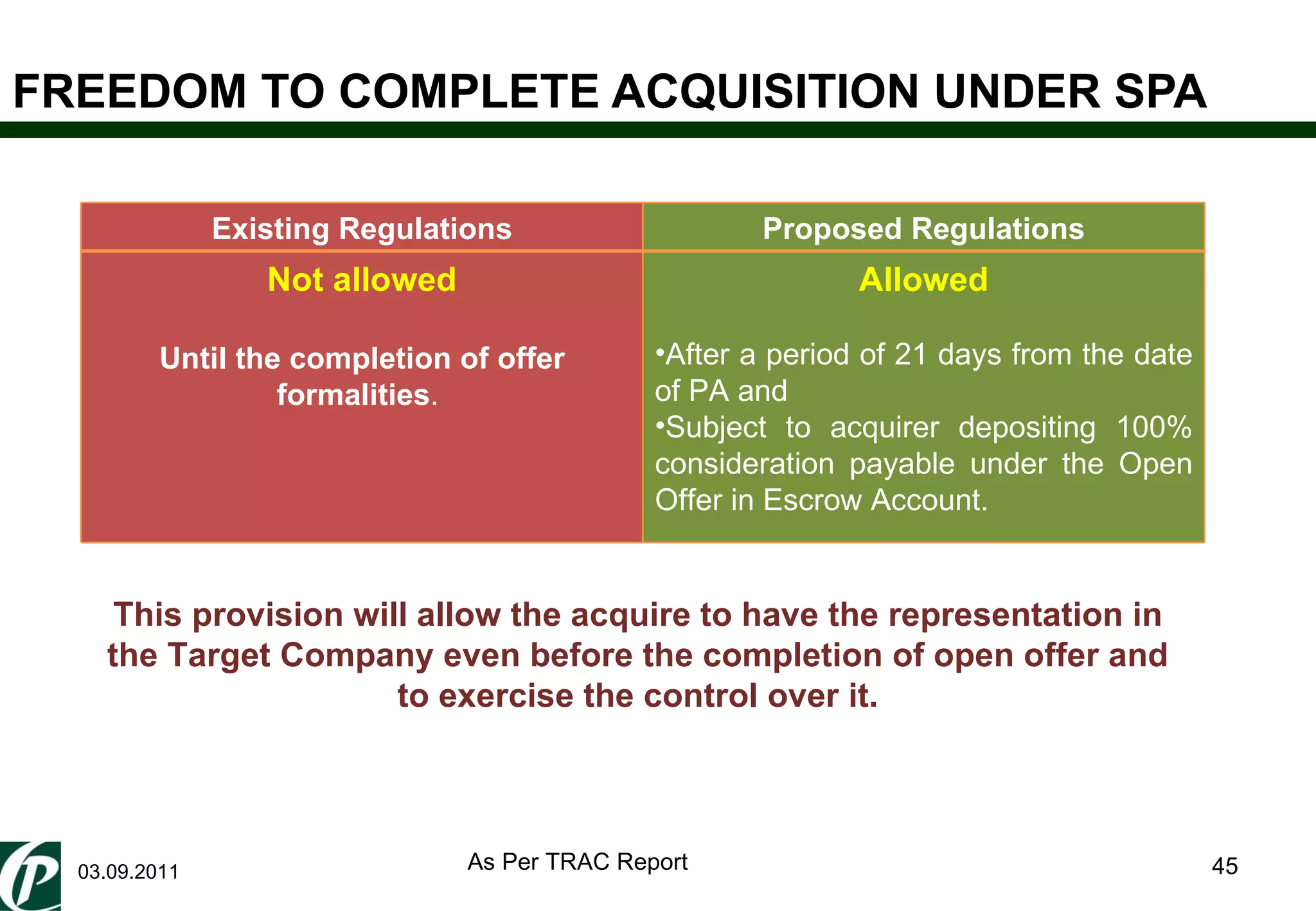

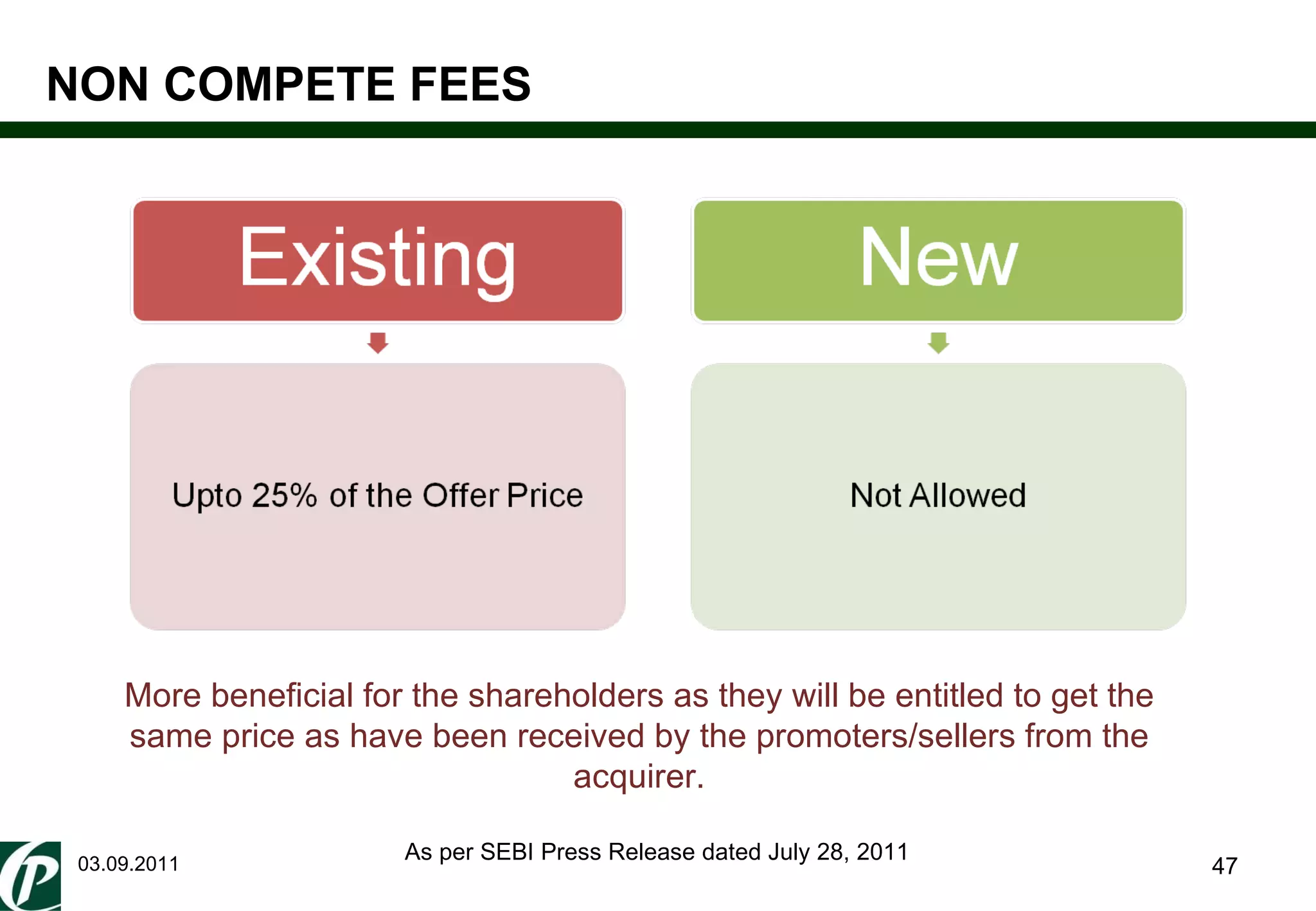

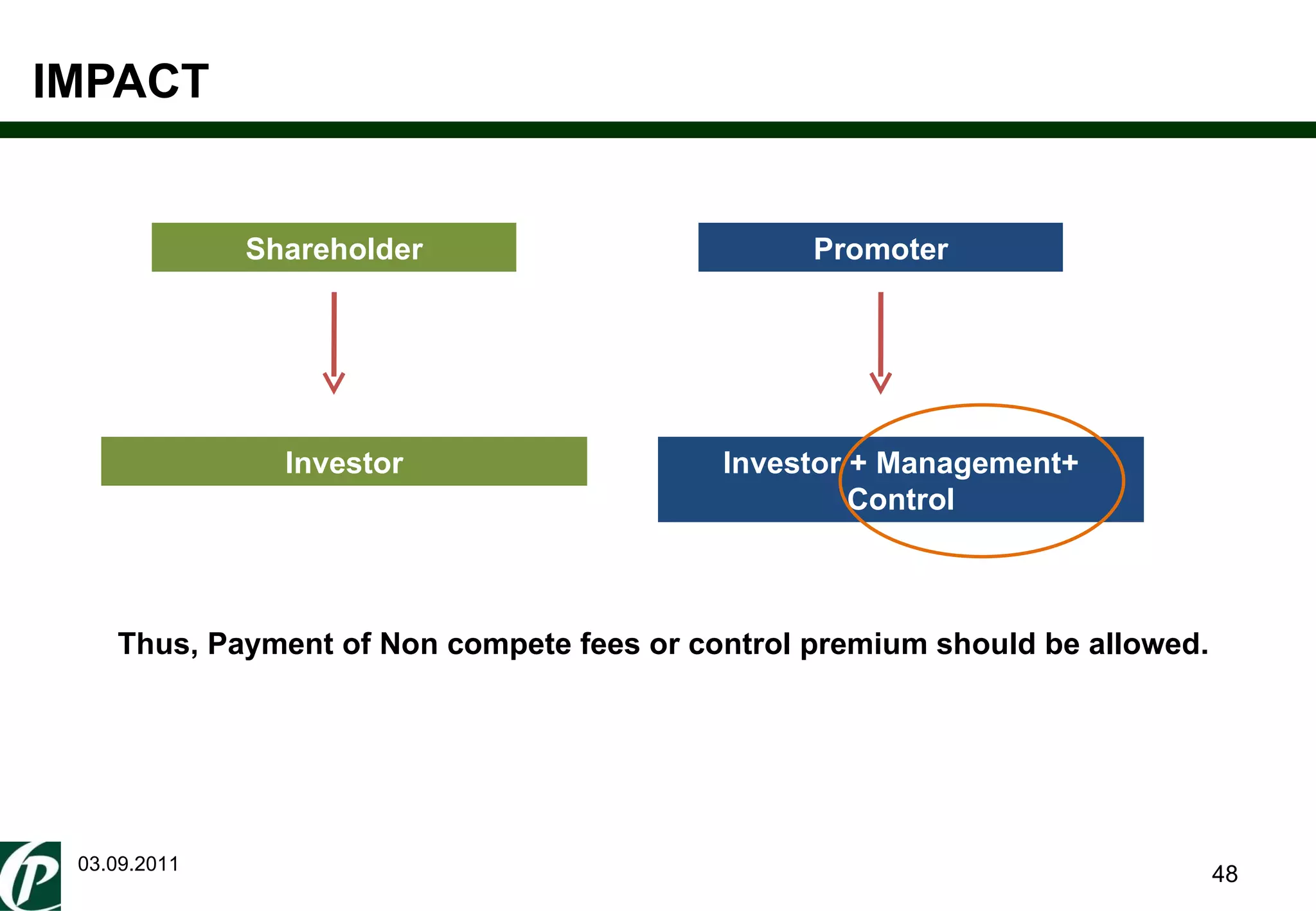

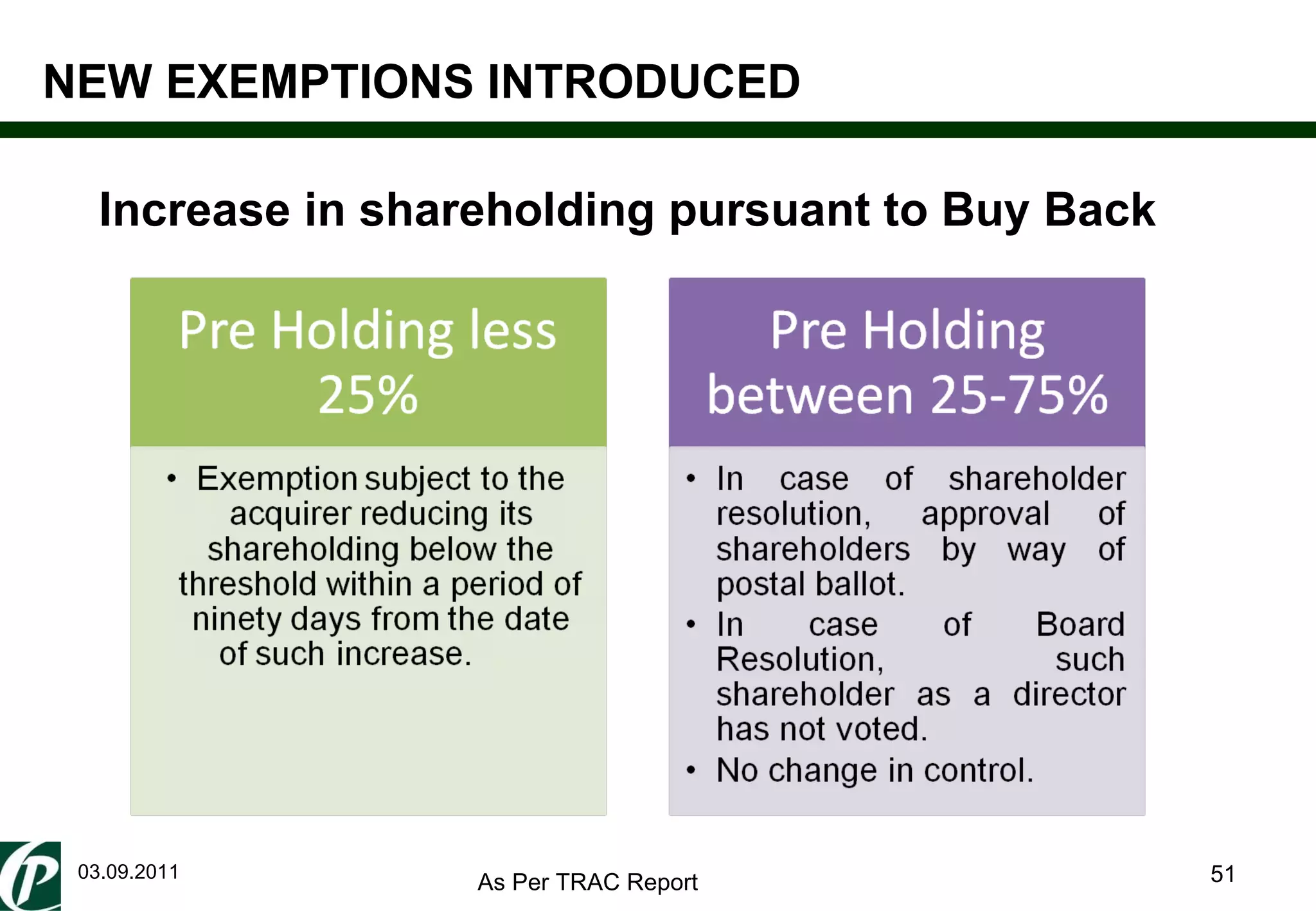

The document summarizes new developments in India's capital market regulations regarding buybacks and takeovers. It discusses changes to thresholds for mandatory open offers, increased offer size for open offers, and allowing acquisitions before open offer completion subject to escrowed funds. The changes aim to align Indian rules more closely with global standards and provide flexibility for acquisitions and private equity investments.