The document summarizes several major financial institutions in India:

The Unit Trust of India (UTI) is an investment trust that mobilizes savings from small investors and channels them into shares and debentures of profitable companies to allow investors to participate in industrial growth.

The Industrial Development Bank of India (IDBI) was established to provide term financing to industry and coordinate other financial institutions. It aims to support industrial development.

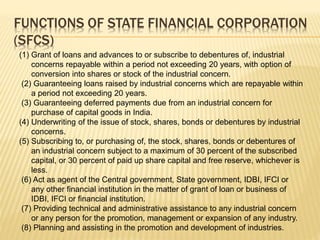

State Financial Corporations (SFCs) were established to meet the financial needs of small and medium enterprises. They provide loans and assistance.

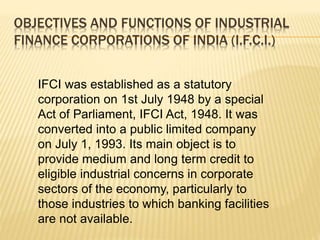

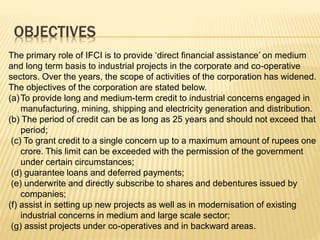

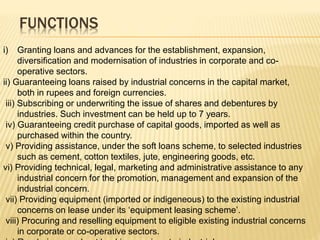

The Industrial Finance Corporation of India (IFCI) provides medium and long term credit to industrial projects in corporate and cooperative sectors. It aims