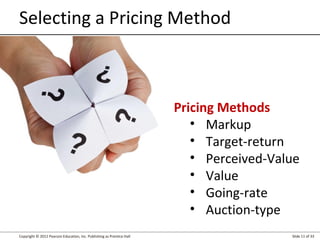

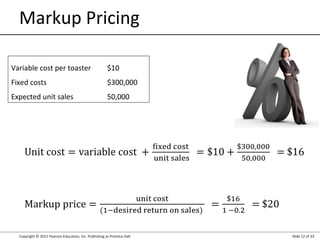

The document discusses various pricing strategies and concepts from the 14th edition of the marketing management textbook by Kotler and Keller. It covers topics such as the marketing mix, consumer psychology and pricing, methods for setting prices, selecting a pricing objective, estimating costs, and selecting a pricing method. The slides provide examples and explanations of pricing terms and considerations.