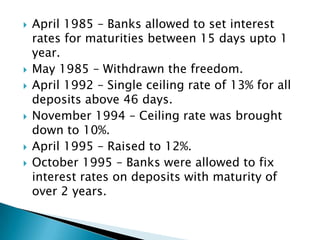

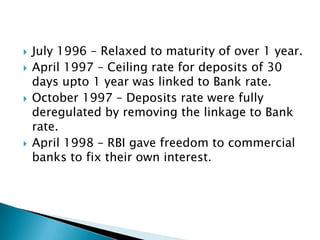

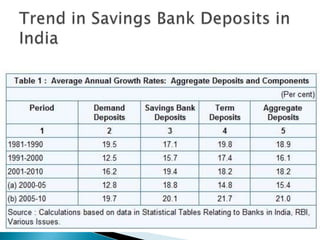

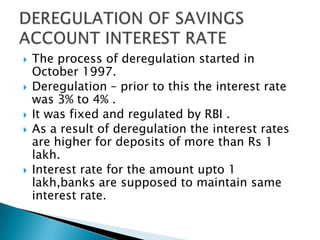

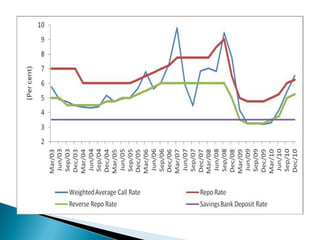

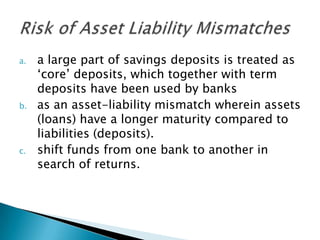

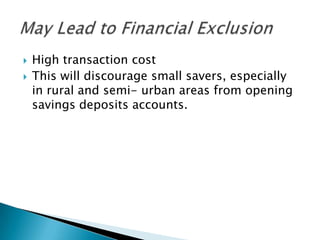

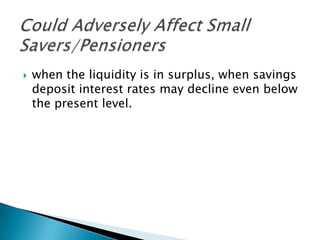

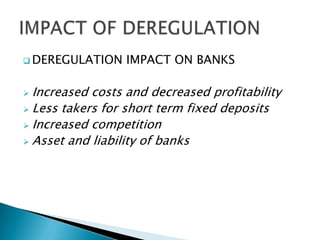

The document discusses the deregulation of interest rates on savings bank accounts in India. It provides background on the deregulation process starting in the 1990s. It outlines both potential benefits of deregulation, such as enhancing attractiveness of savings deposits and improving monetary policy transmission, and risks, like unhealthy competition and asset-liability mismatches for banks. Overall, the document examines the impact of interest rate deregulation on banks, customers, and the financial system.