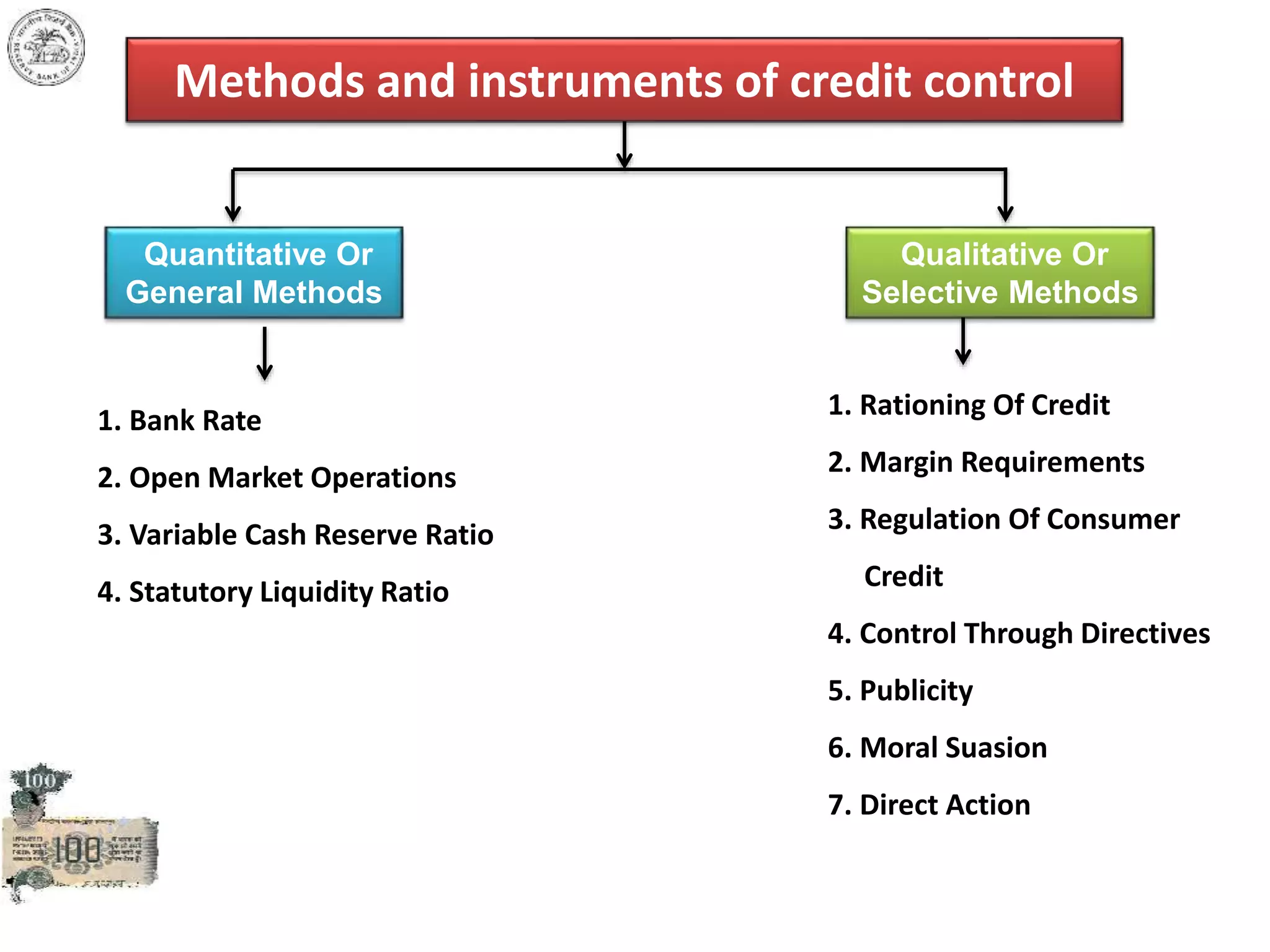

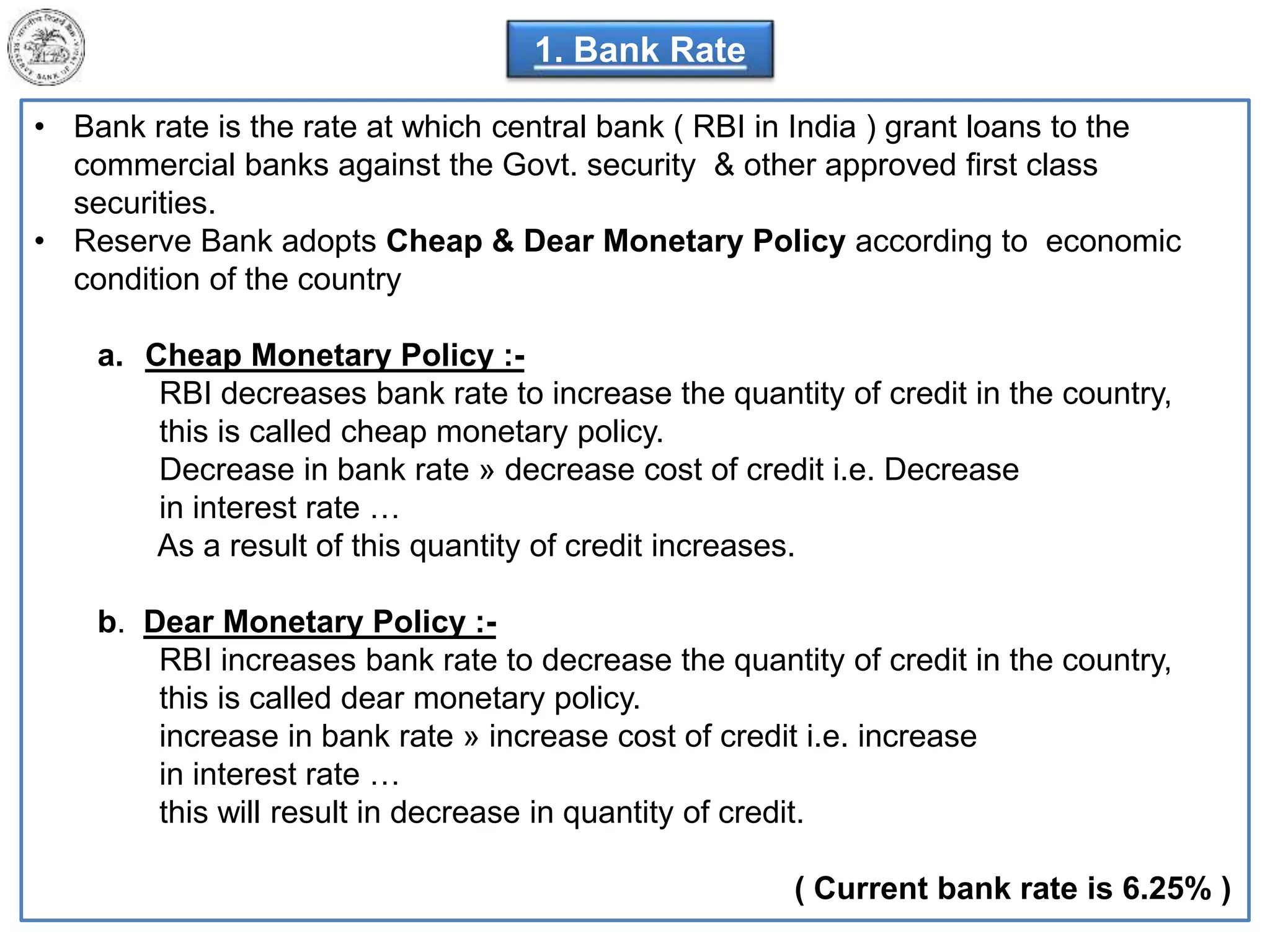

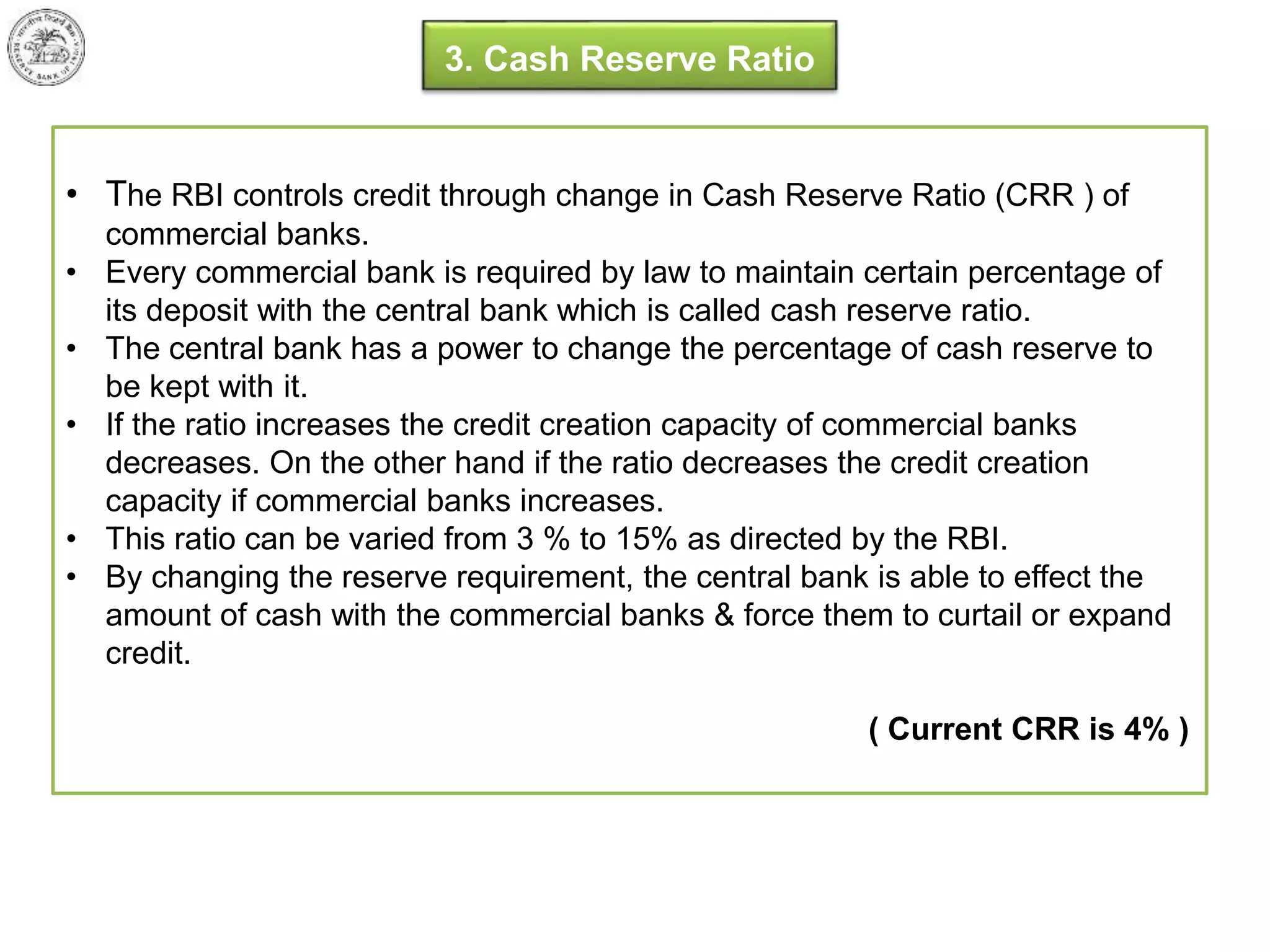

The document discusses credit control methods used by the Reserve Bank of India (RBI). It outlines both quantitative and qualitative methods. Quantitative methods like bank rate, open market operations, cash reserve ratio, and statutory liquidity ratio aim to control the total volume of credit. Qualitative methods like rationing credit, margin requirements, and directives aim to influence the use and direction of credit flows. The RBI uses these various tools to promote economic stability and growth.