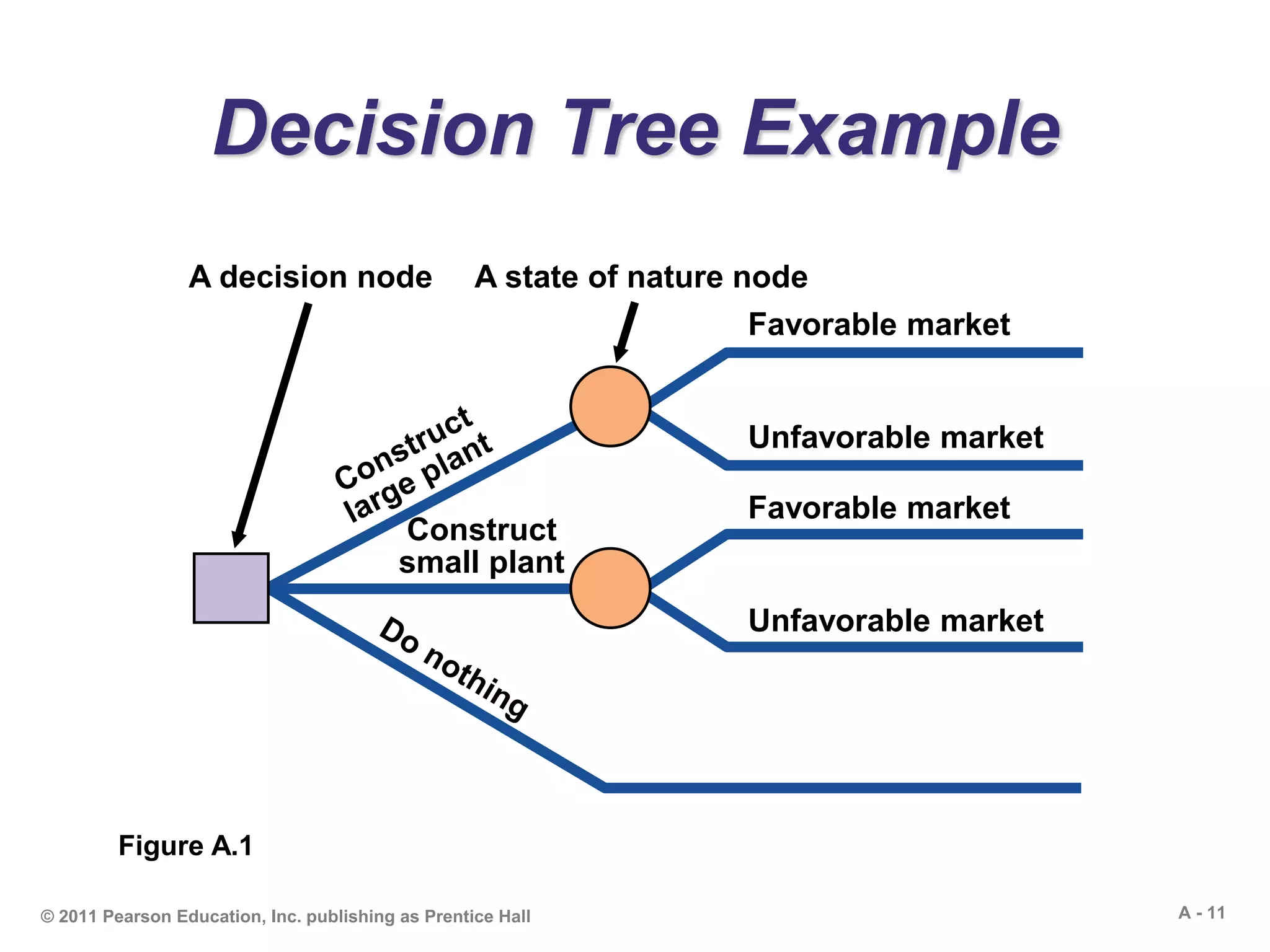

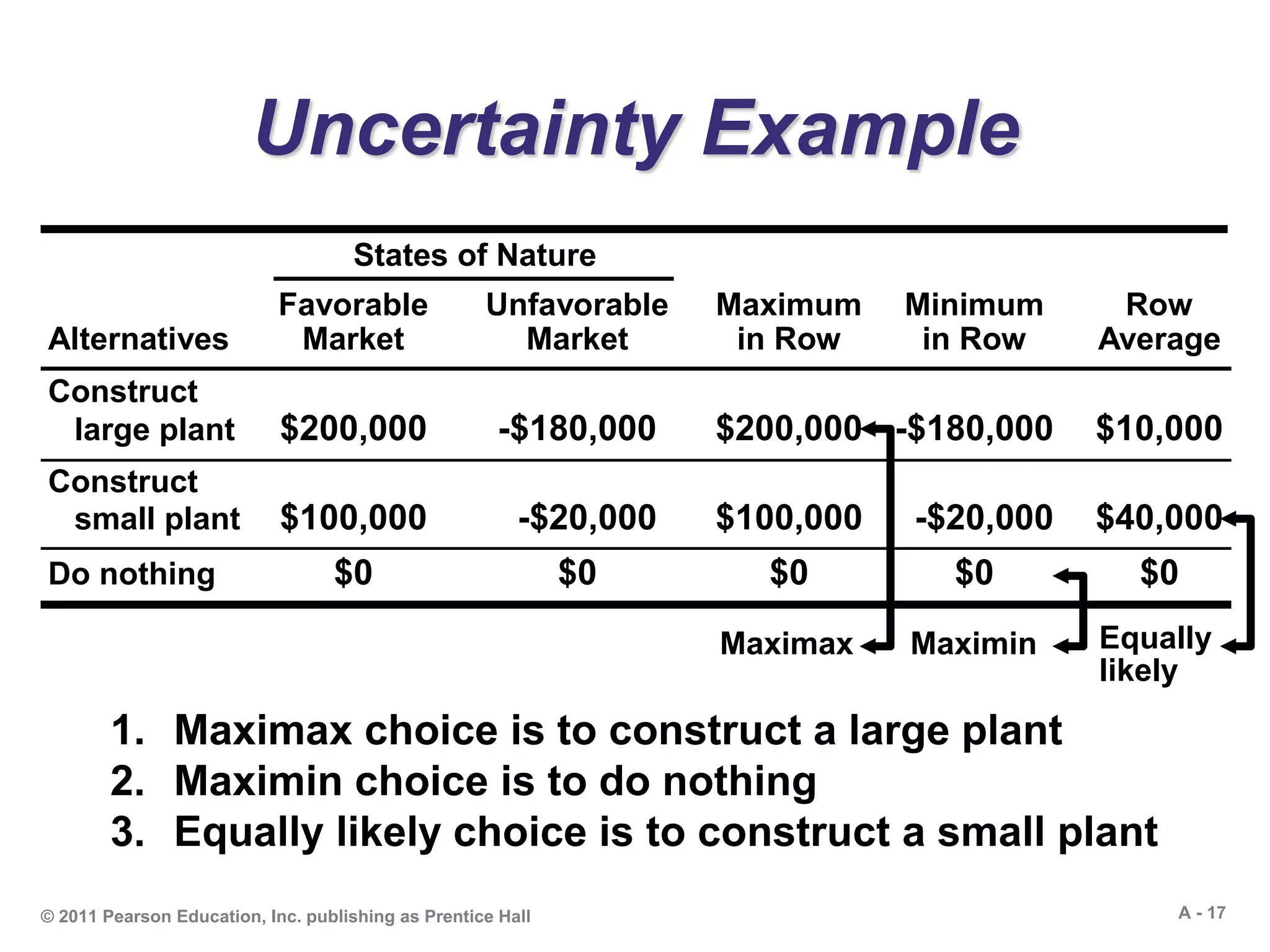

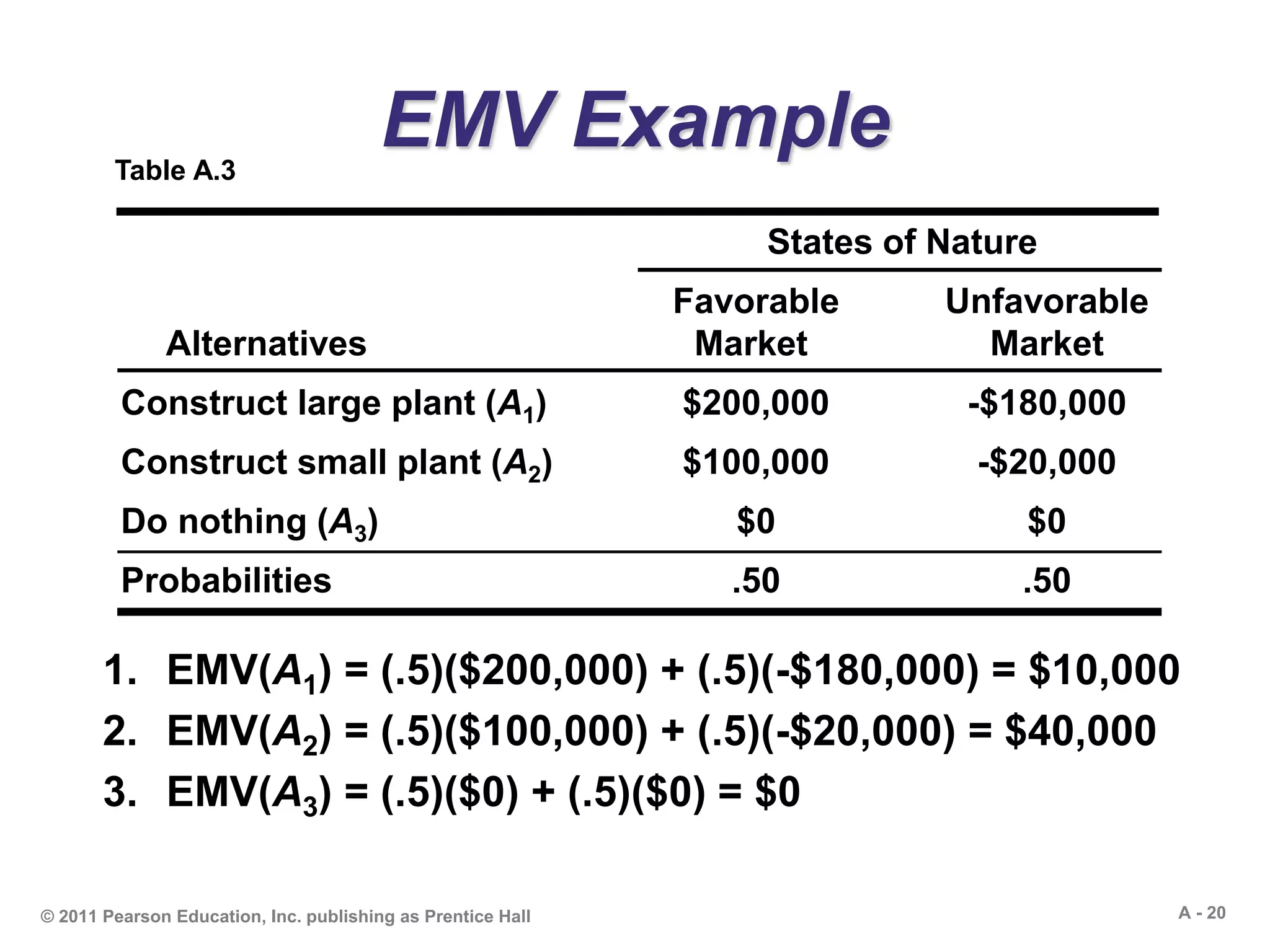

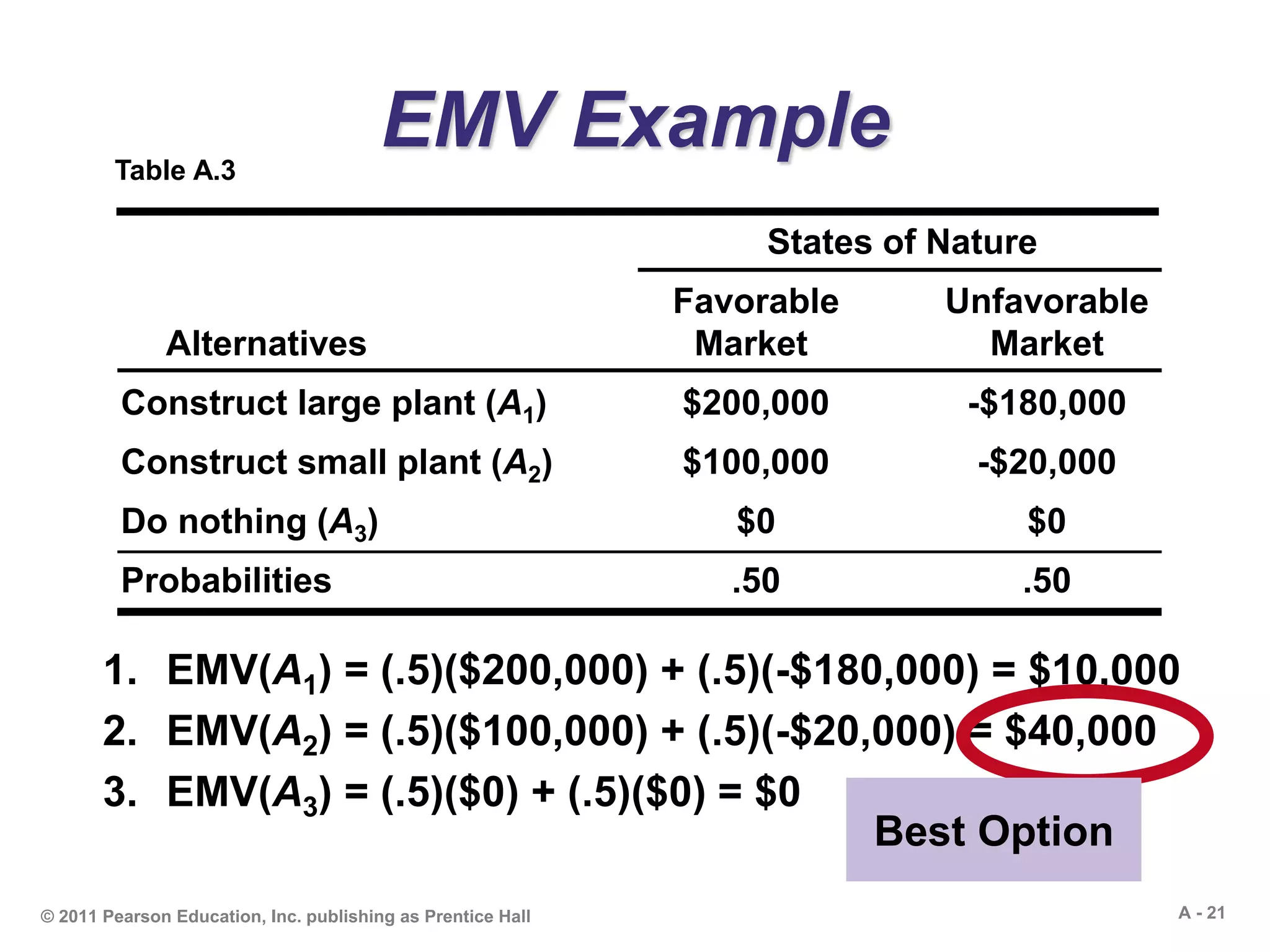

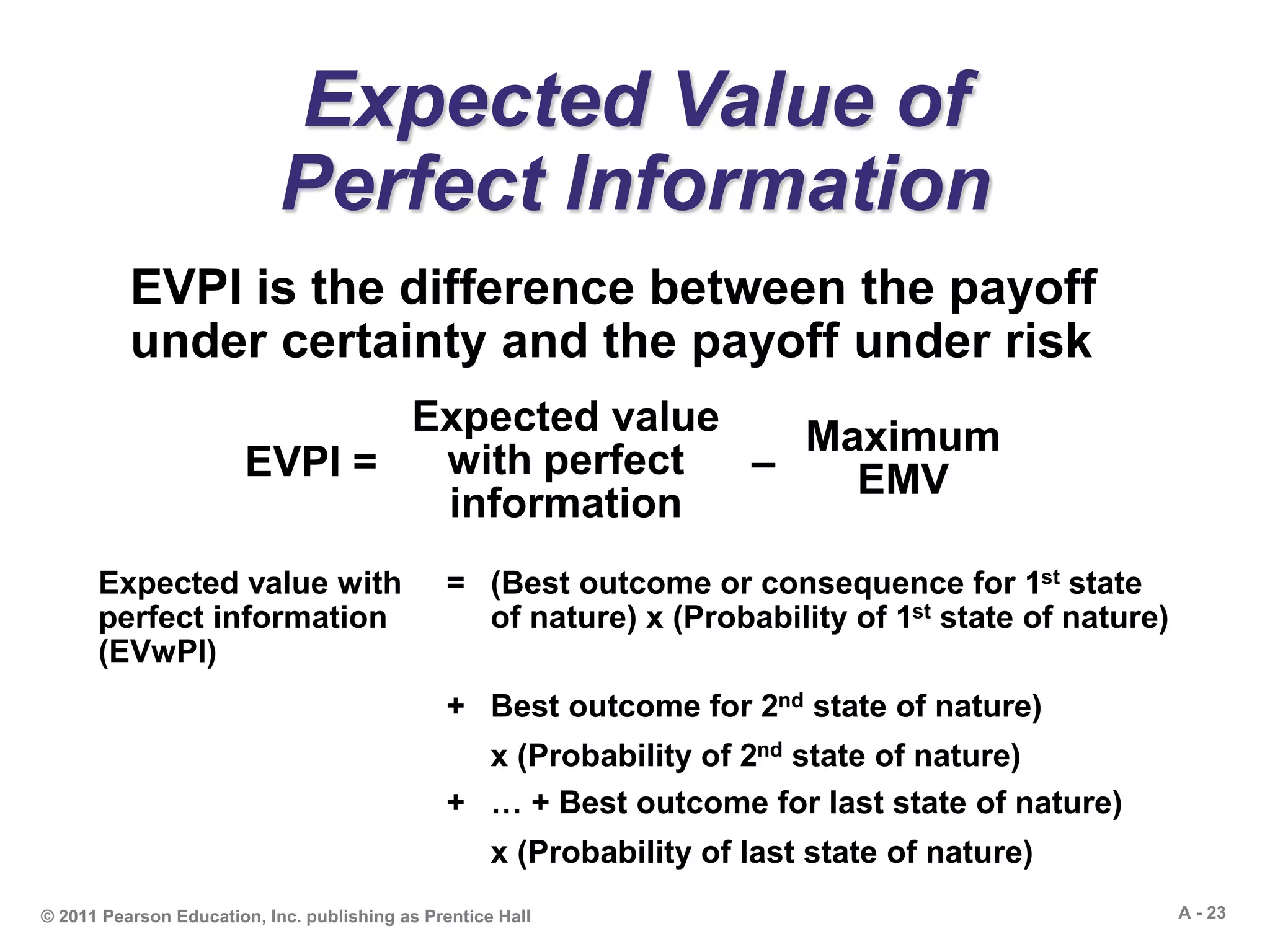

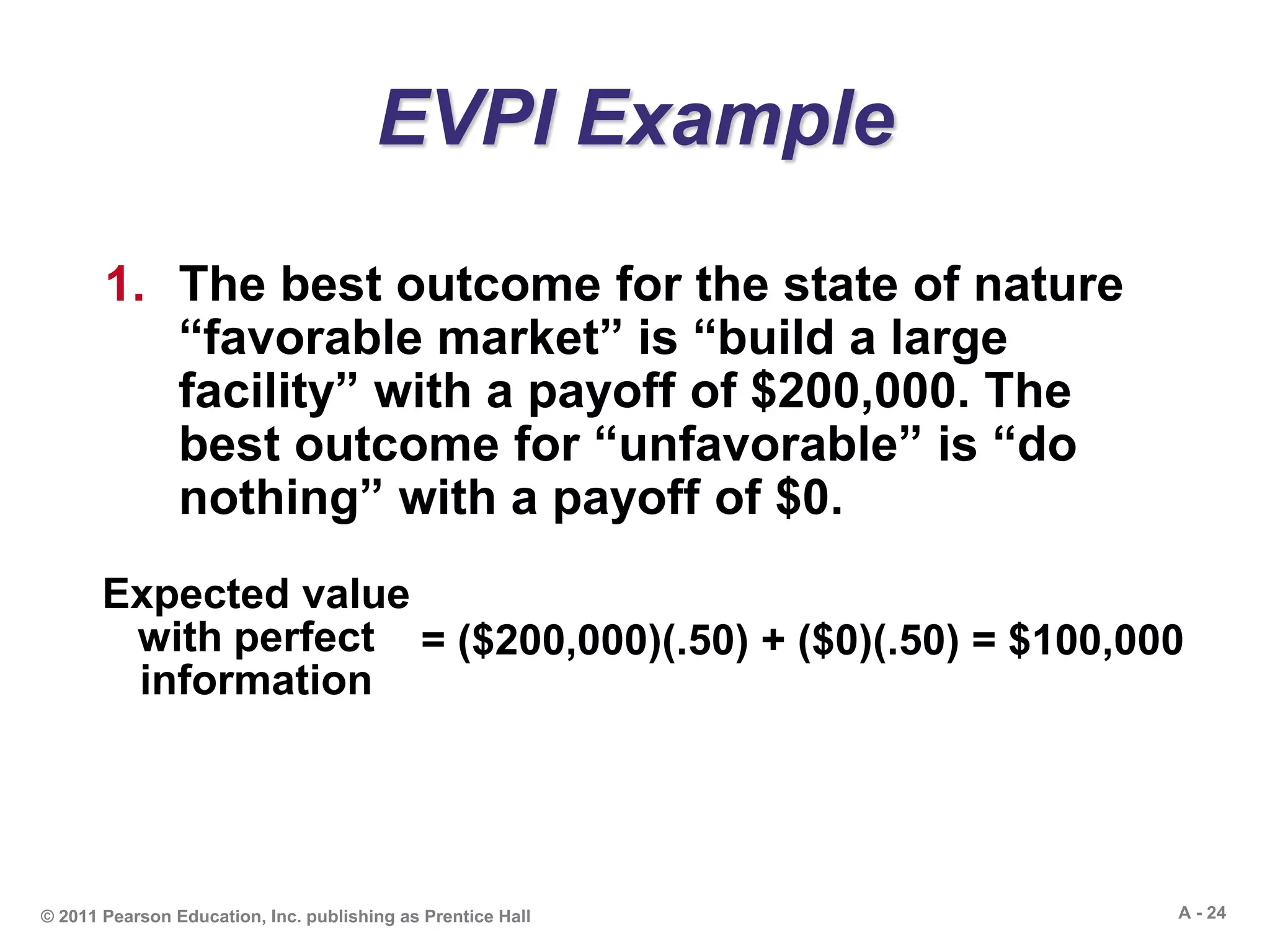

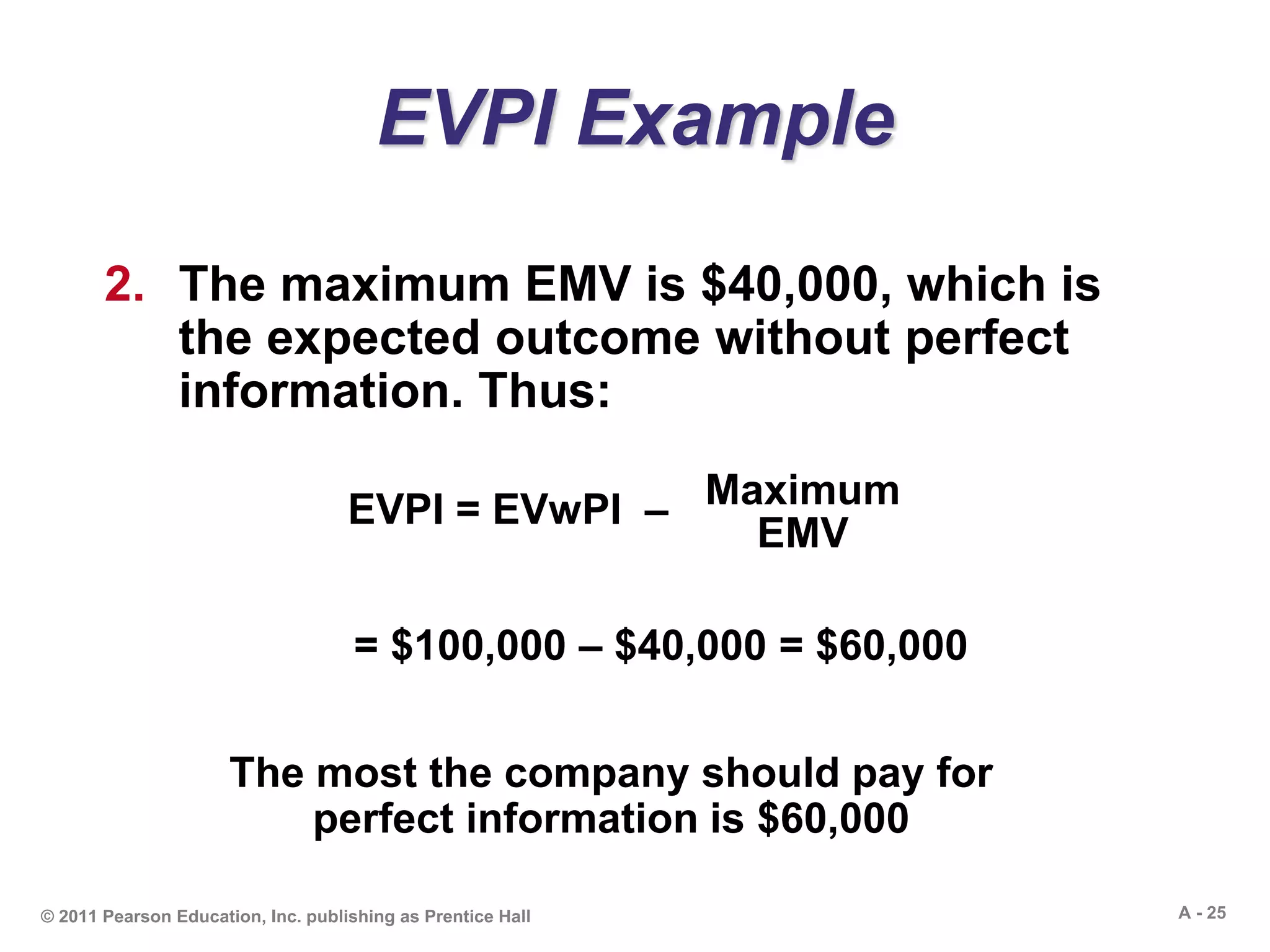

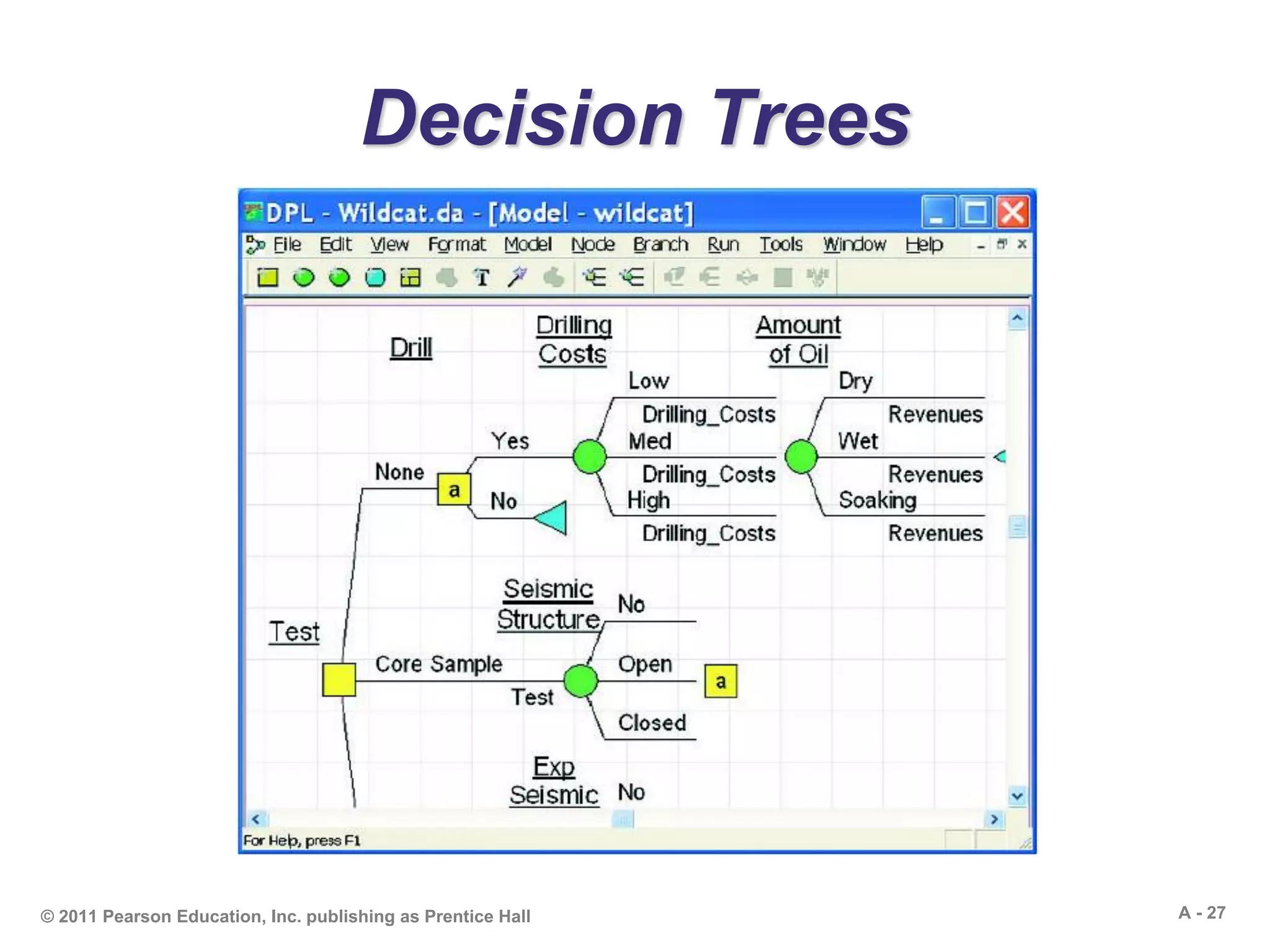

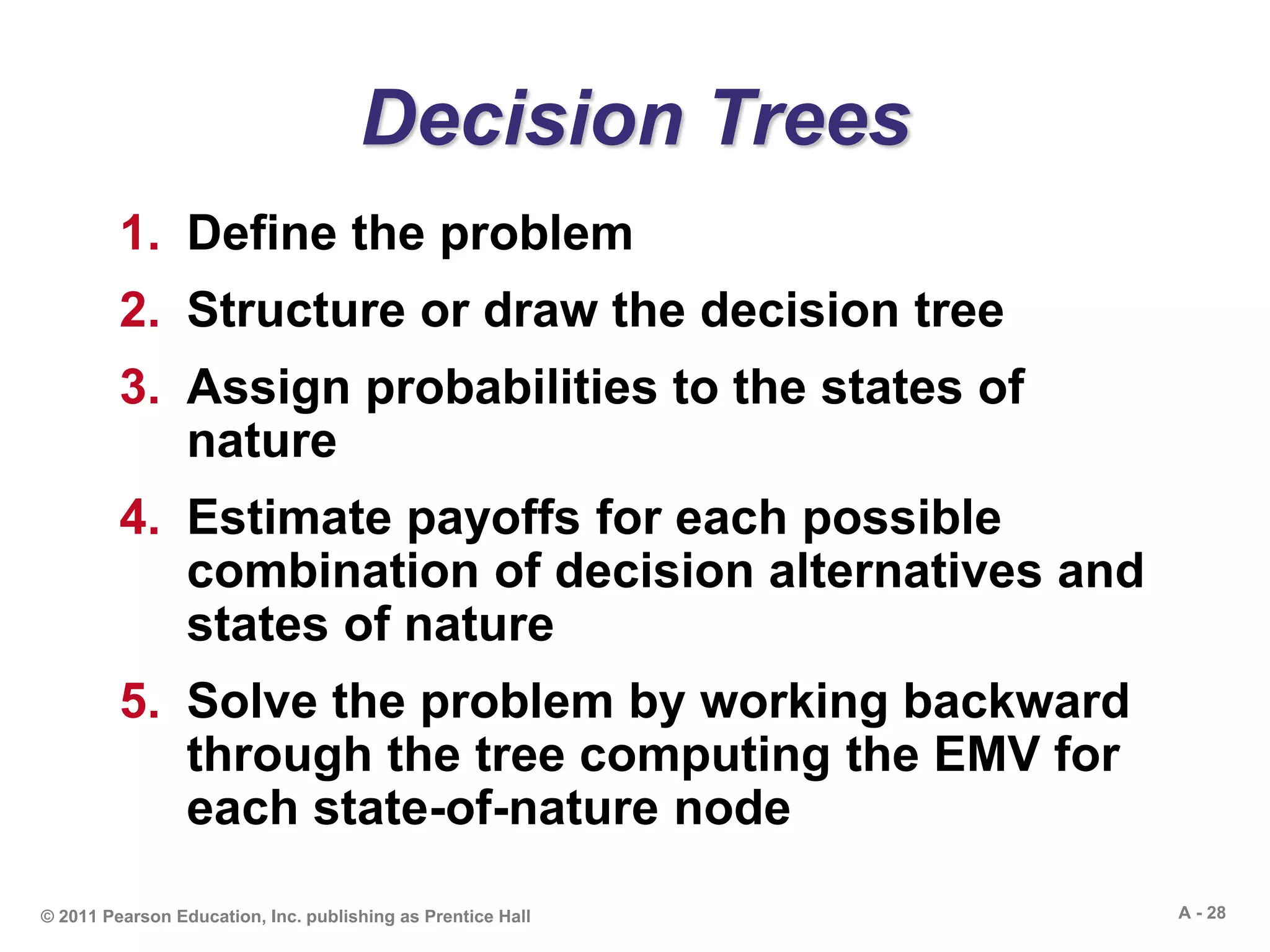

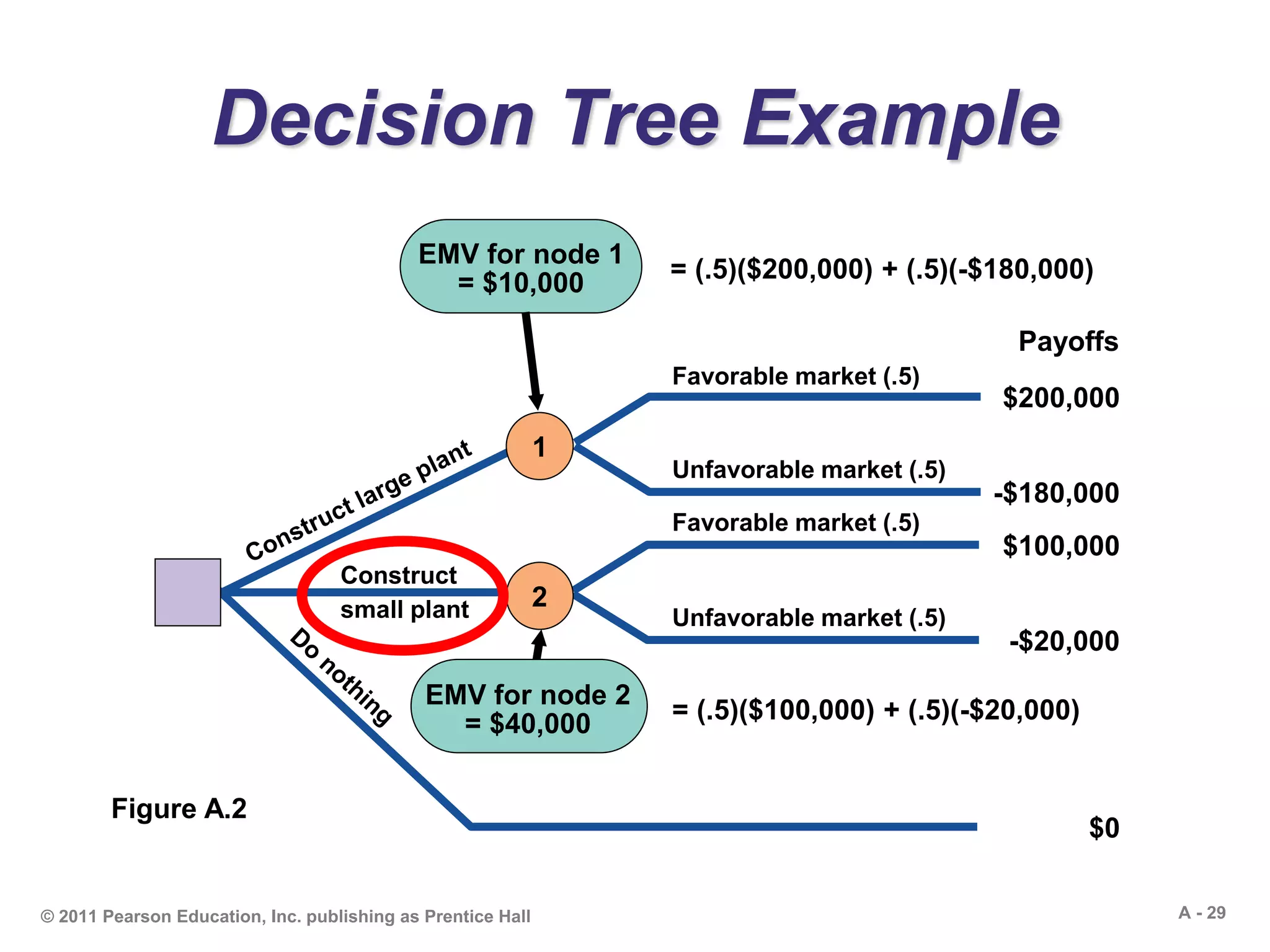

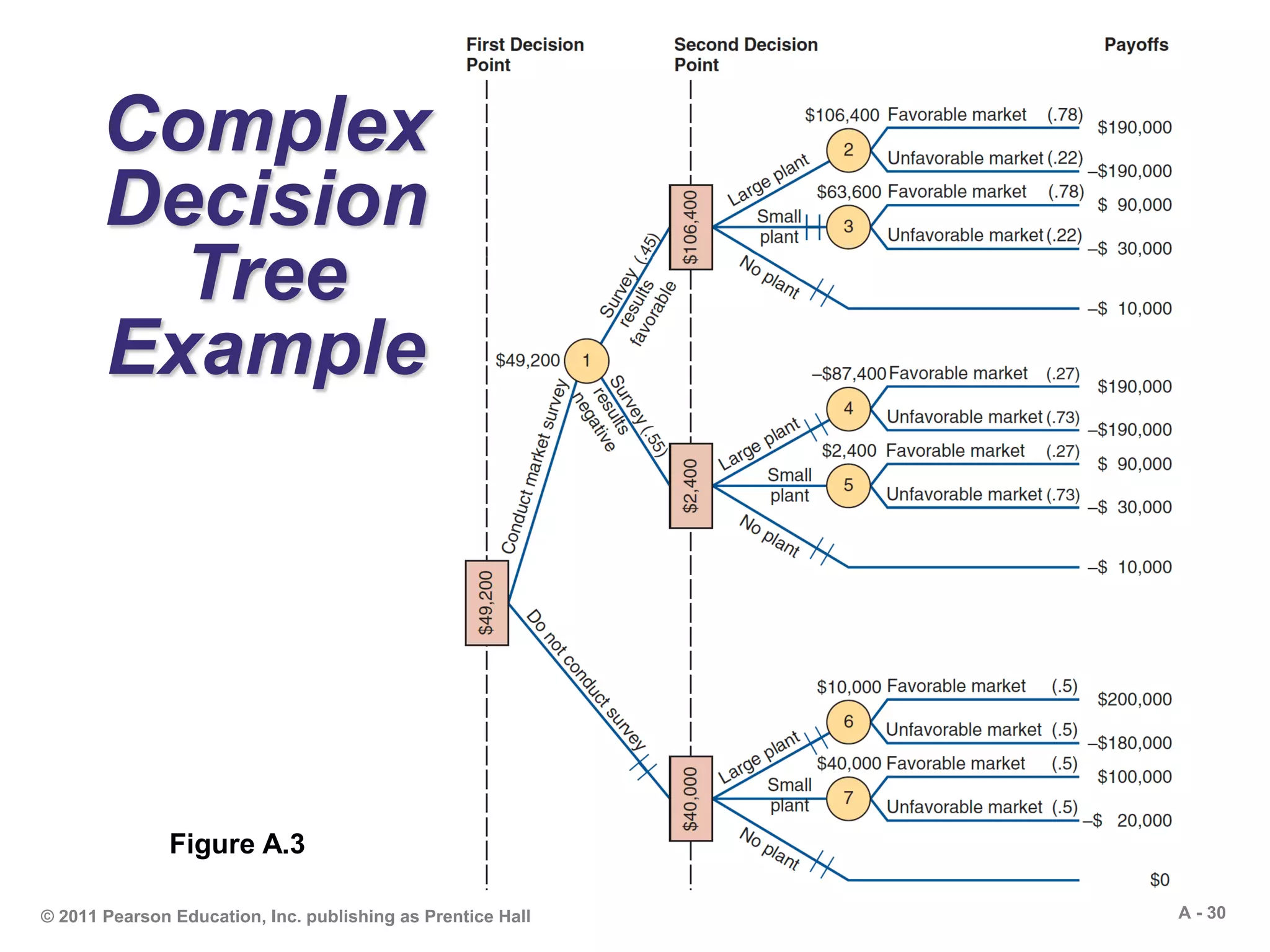

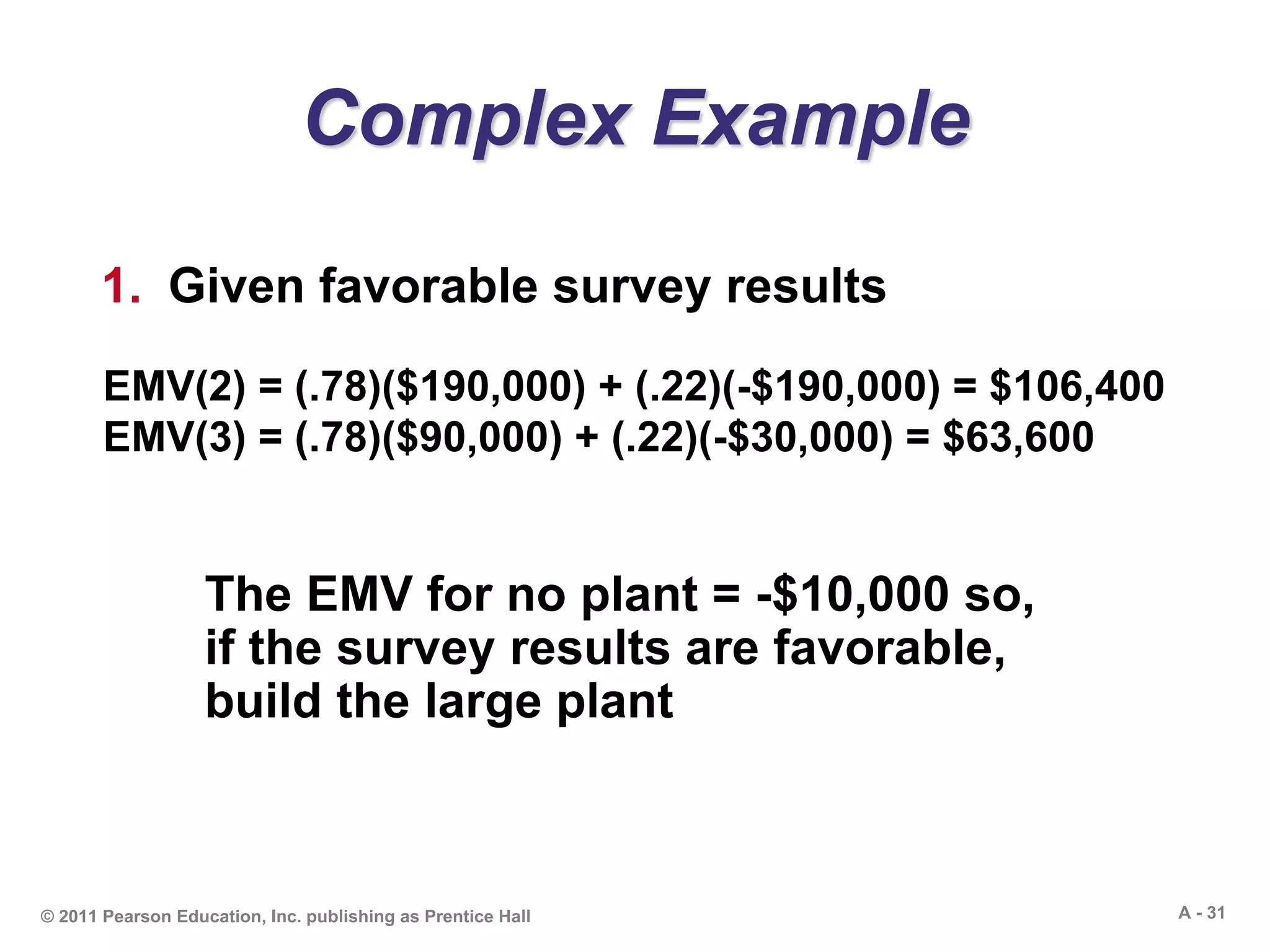

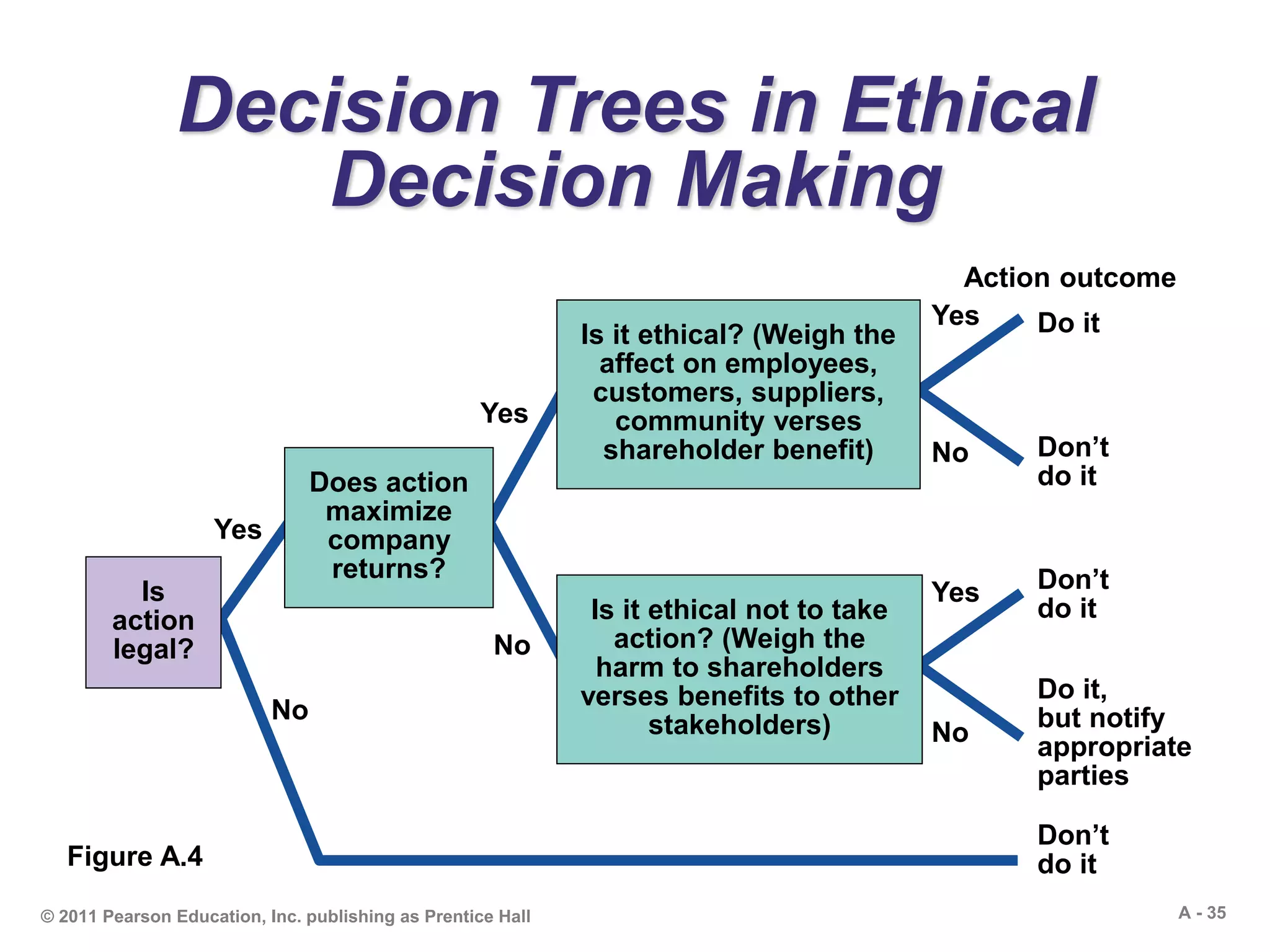

This document outlines the key concepts and methods for decision making under uncertainty, risk, and certainty. It discusses tools like decision trees and tables that can be used to evaluate alternatives and choose the best option. Specific techniques covered include expected monetary value, maximax/maximin, and expected value of perfect information. Examples are provided to demonstrate how to use decision trees to model sequential or complex decisions and calculate the expected monetary value at each decision node. The document is intended to teach students the fundamentals and applications of quantitative decision making.

![A - 36© 2011 Pearson Education, Inc. publishing as Prentice Hall

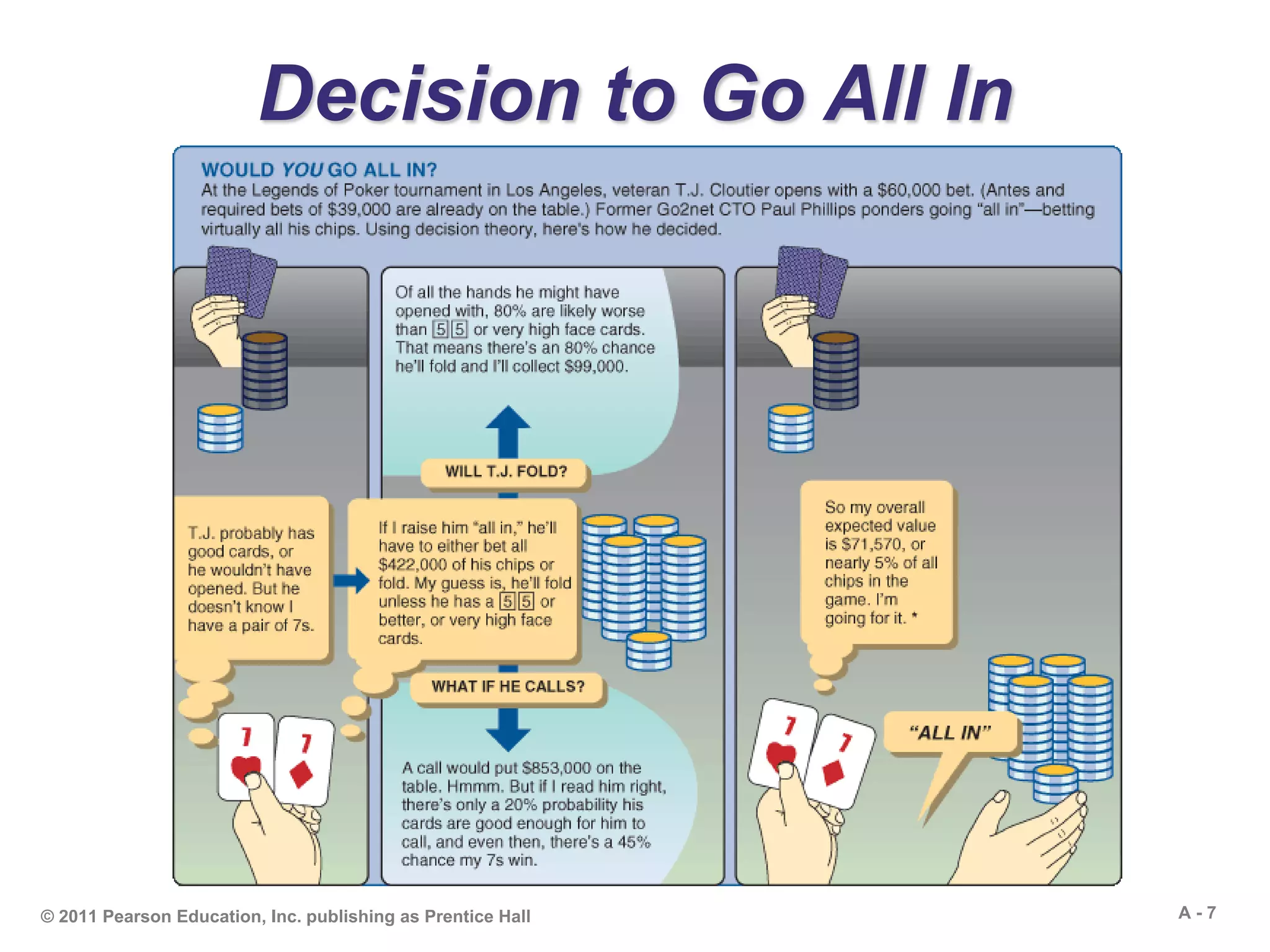

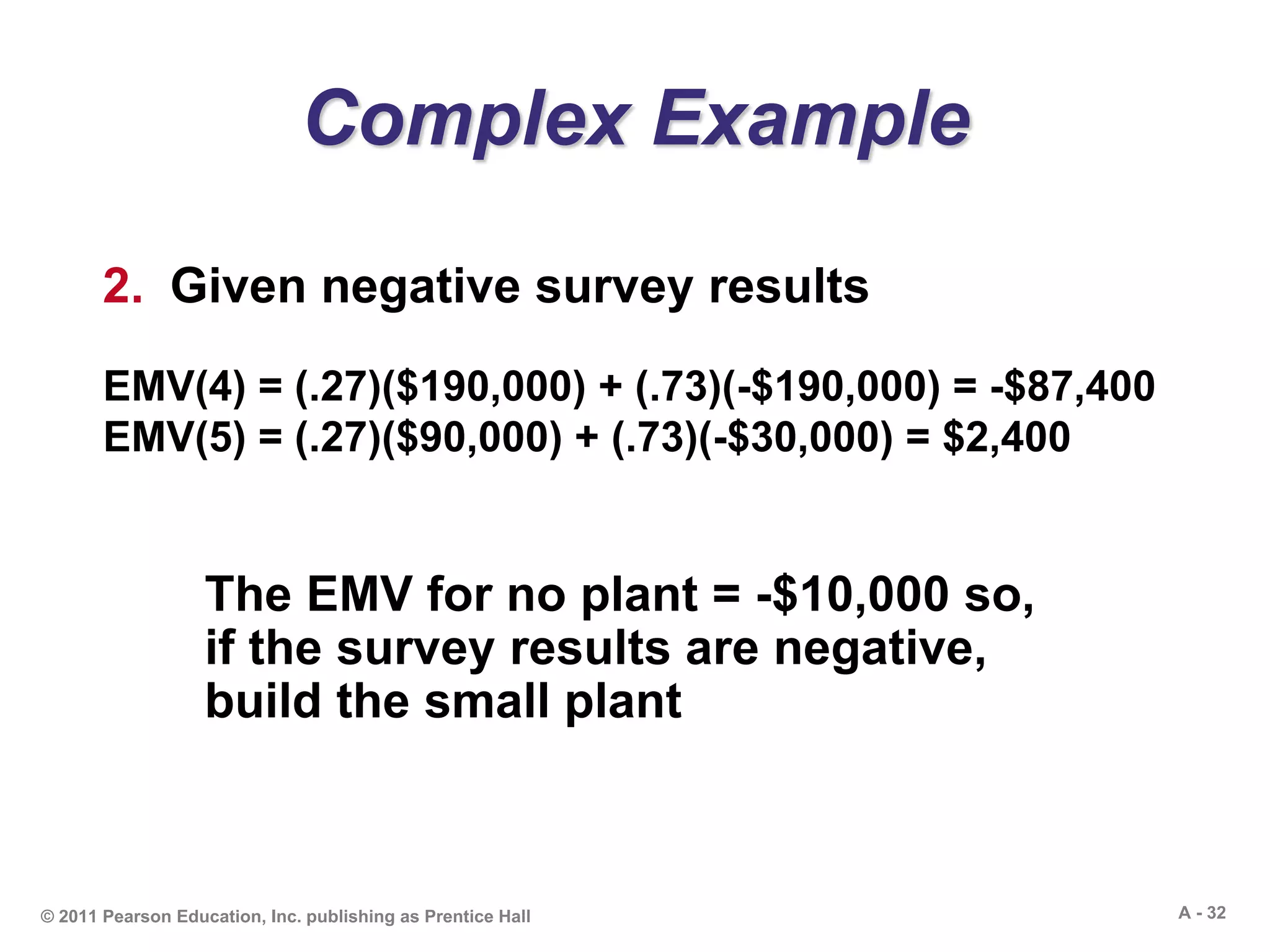

The Poker Design Process

If T. J. folds,

If T. J. calls,

EMV = (.80)($99,000)

= $79,200

EMV = .20[(.45)($853,000) - Phillips’ bet of $422,000]

= .20[$383,850 - $422,000]

= .20[-$38,150] = -$7,630

Overall EMV = $79,200 - $7,630 = $71,750](https://image.slidesharecdn.com/heizerom10moda-130602071658-phpapp01/75/Heizer-om10-mod_a-36-2048.jpg)