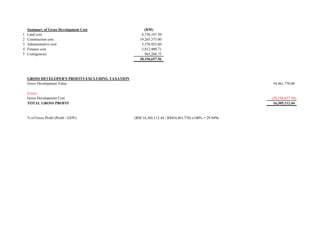

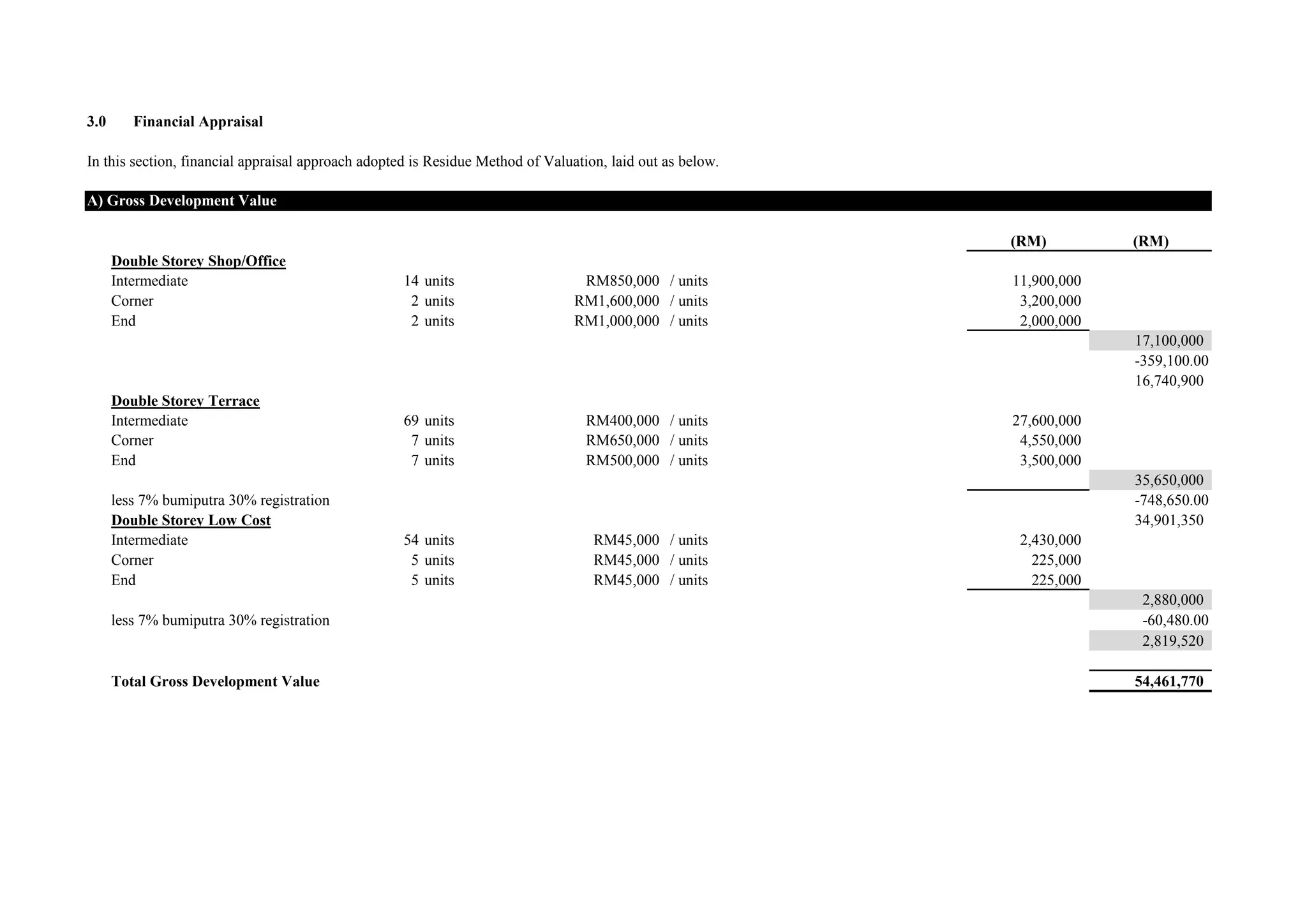

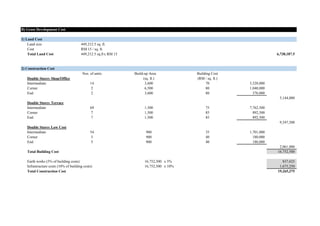

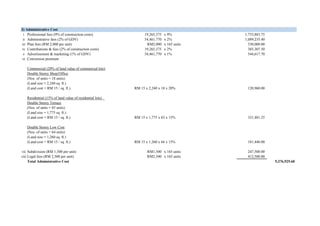

This section provides a financial appraisal of a proposed property development using the residue method of valuation. It details the gross development value, land and construction costs, administrative costs including fees and financing, and contingencies to calculate the total gross development cost. The gross development profit is then determined by taking the difference between the gross development value and cost, which in this case is RM16,305,112.44 or 29.94% of the gross development value.

![i Financing Cost for Land

(Loan = RM 6,500,000)

(Interest = 2.5% p.a. + 6.5% BLR)

(Compound interest = [(1 + i)ⁿ - 1]) [(1+0.09)⁵-1] x RM 6,500,000 3,501,055.71

ii Cost of finance

(Construction cost = RM 19,265,375)

(Interest = 5.5% p.a. + 6.5% BLR)

(Assuming loan of 50%) (RM 19,265,375 x 50%) x 12% x 2 2,311,845.00

Total Finance Cost 5,812,900.71

Contigencies (5% of construction costs) 19,265,375 x 5% 963,268.75

TOTAL GROSS DEVELOPMENT COST 38,156,657.56

5) Contigencies

4) Finance Cost](https://image.slidesharecdn.com/de-assignment-finalized-281120172-171221184902/85/De-assignment-finalized-28112017-2-4-320.jpg)