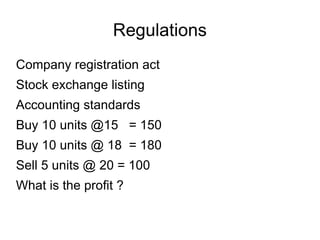

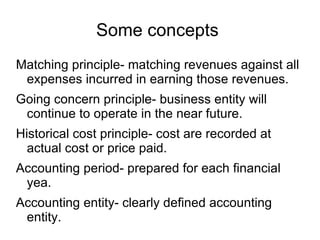

This document provides an introduction to accounting, outlining key learning outcomes around financial accounting concepts and statements. It describes the accounting process, different types of businesses and their structures, the roles of accountants, and important accounting regulations and standards. Students will learn to prepare financial statements and use accounting software to analyze business transactions and communicate financial information.