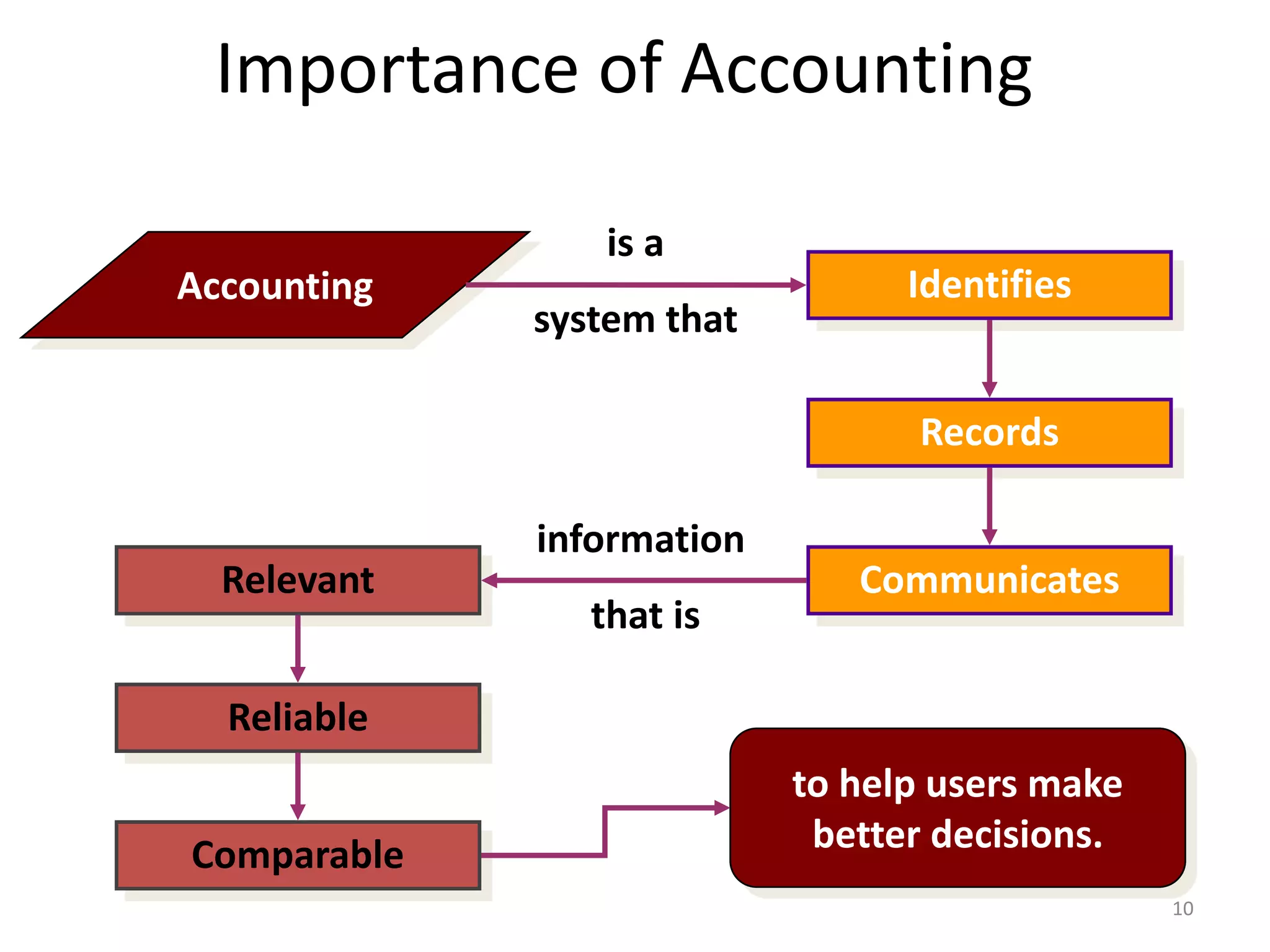

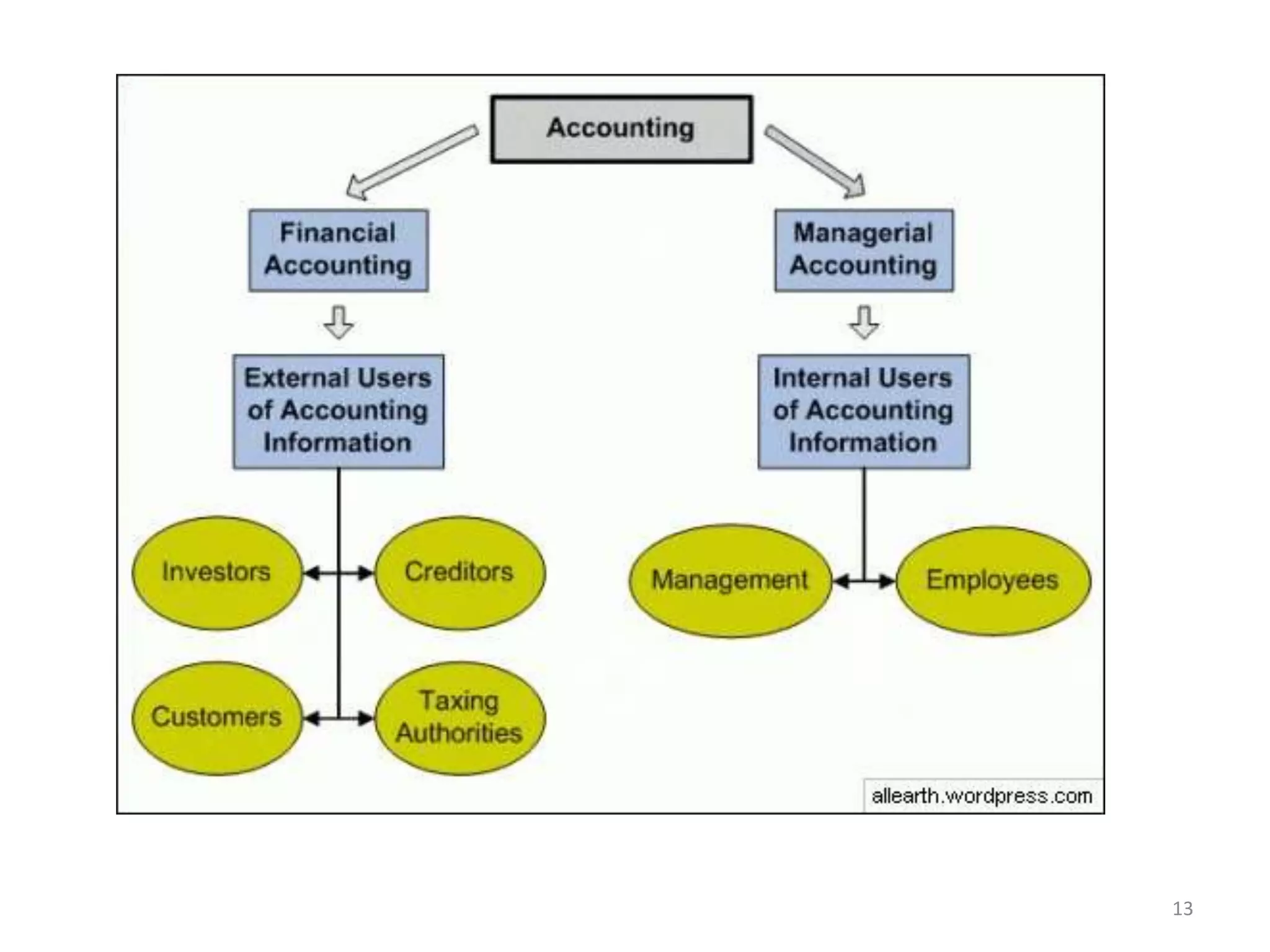

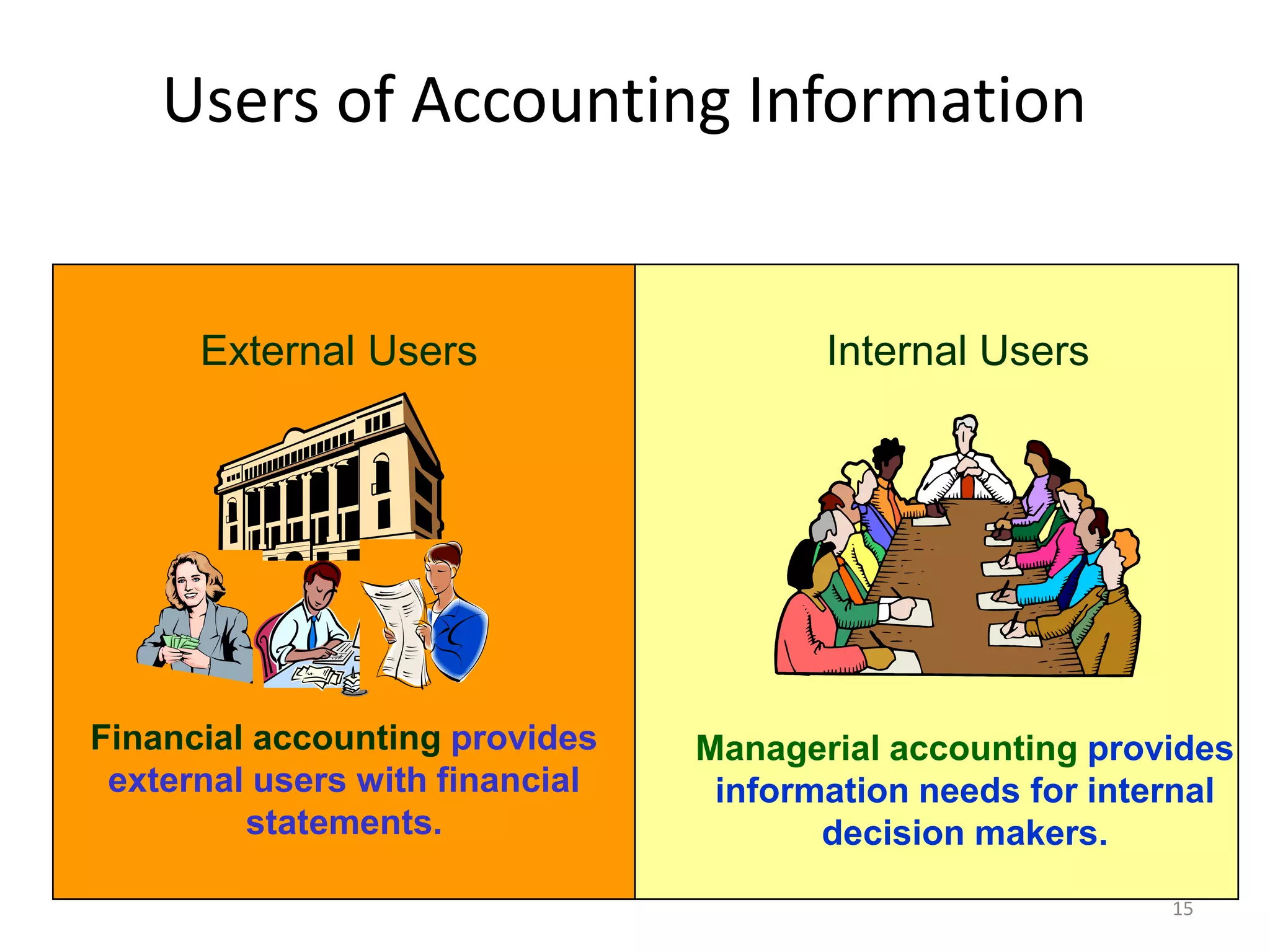

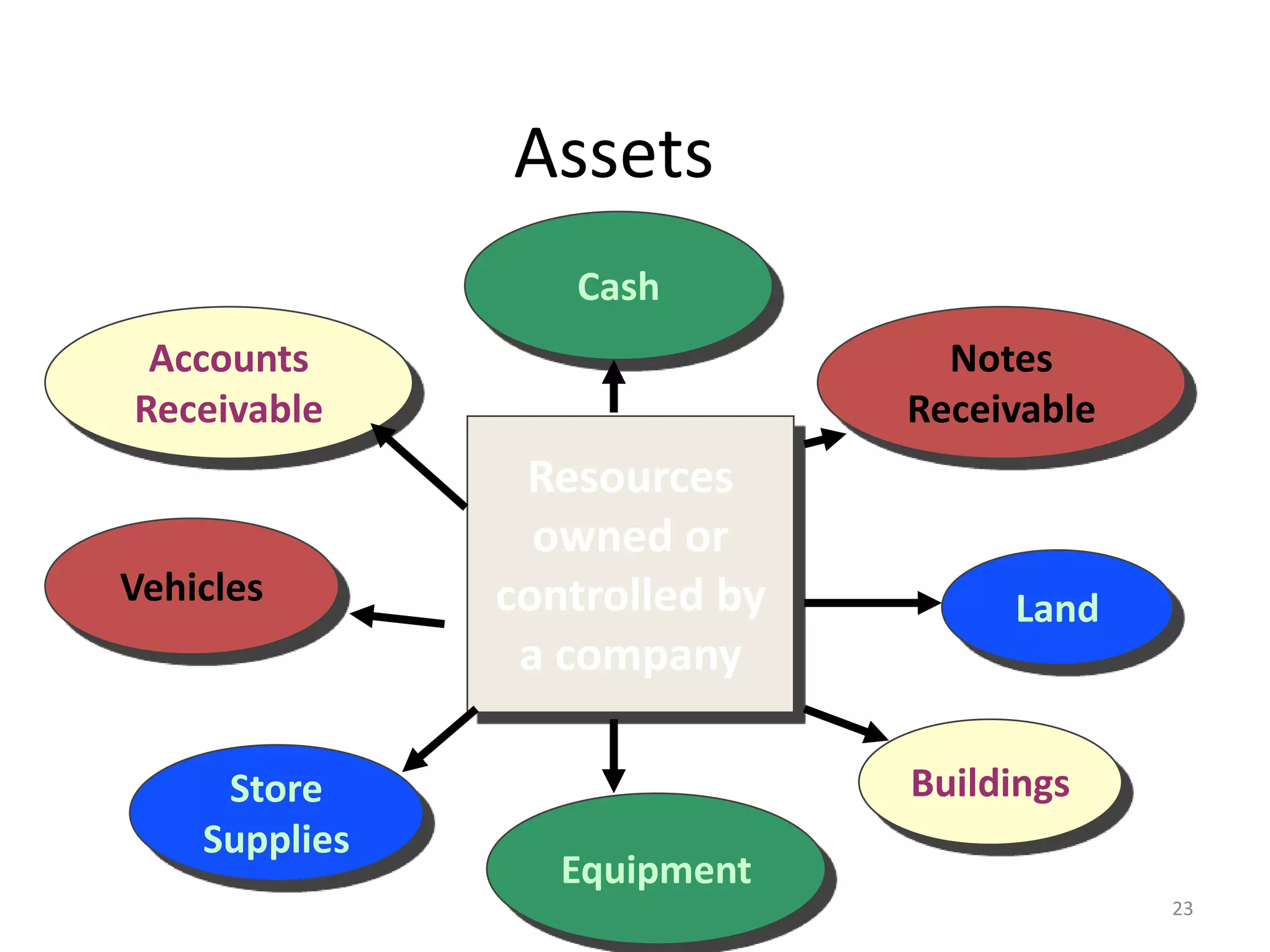

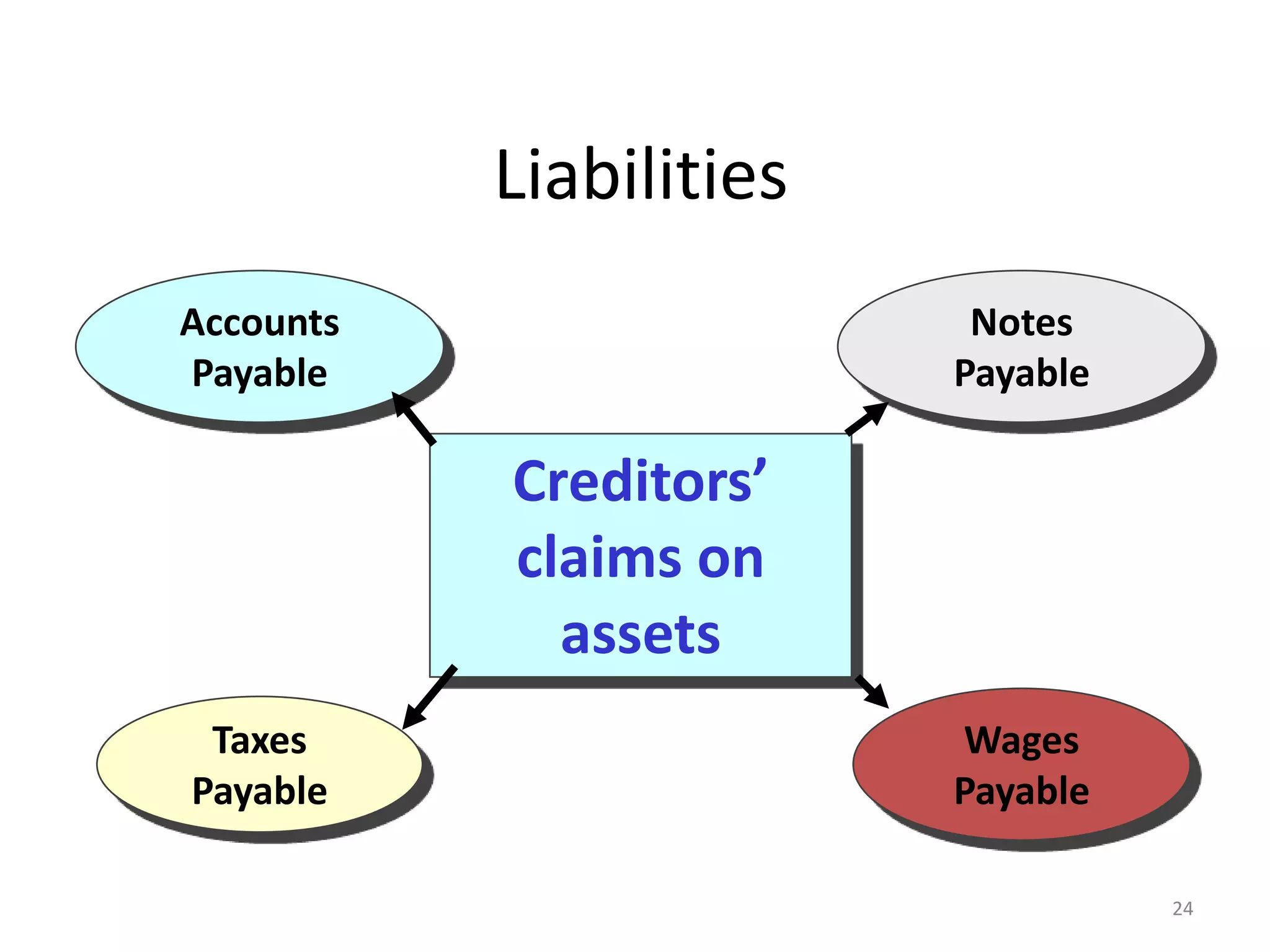

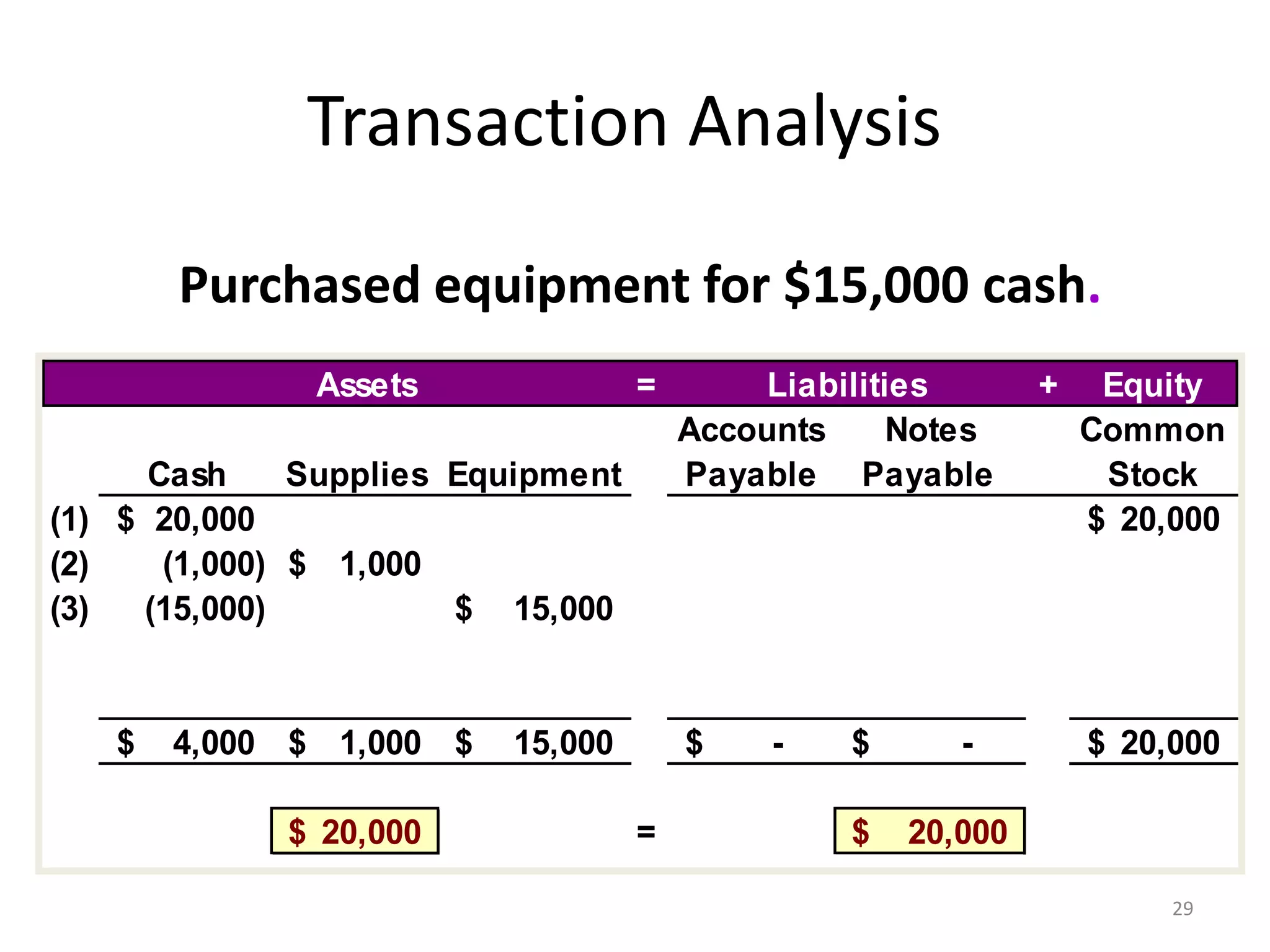

This document provides an overview of accounting and financial management concepts. It discusses how accounting identifies, records, and communicates financial information. Key topics covered include the accounting equation, assets, liabilities, equity, revenues and expenses. Transaction analysis examples are provided to illustrate adjusting accounting entries for purchases and payments. The purpose of accounting is to provide relevant and reliable financial information to both internal and external stakeholders of a business.