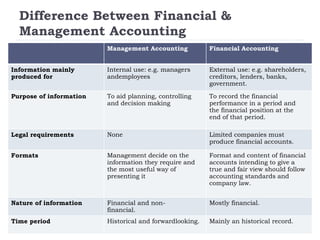

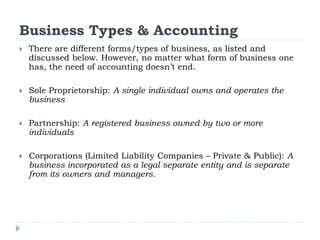

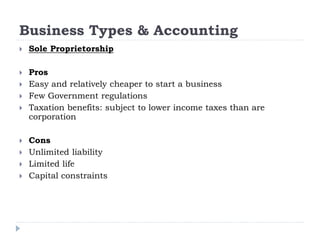

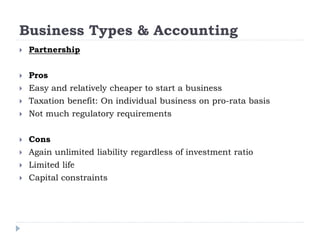

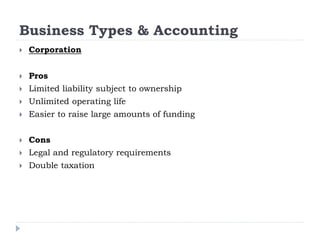

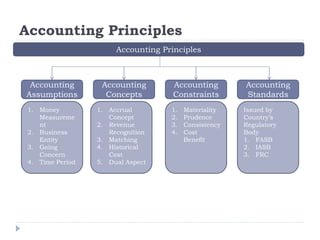

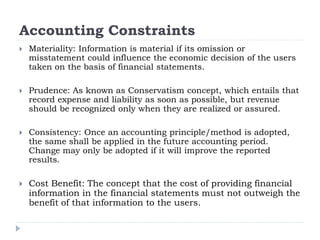

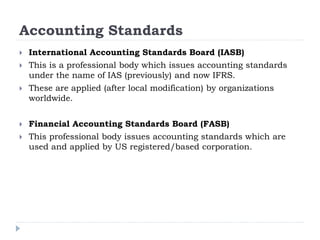

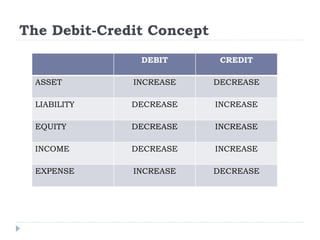

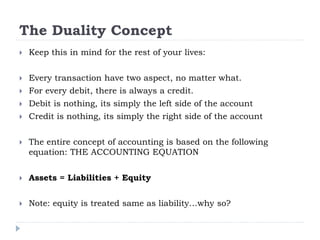

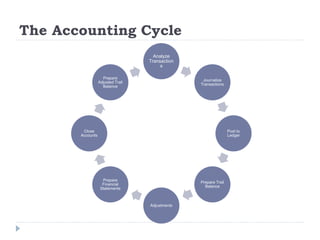

This document provides an introduction to financial accounting. It defines accounting as the process of measuring, processing, and communicating financial and non-financial records of a business. It distinguishes between financial accounting, cost and management accounting, and management accounting. The document also discusses the differences between financial and management accounting, types of businesses and their accounting needs, and key accounting principles such as GAAP, the accounting equation, and the accounting cycle.