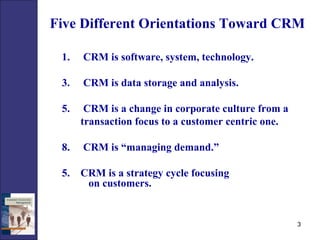

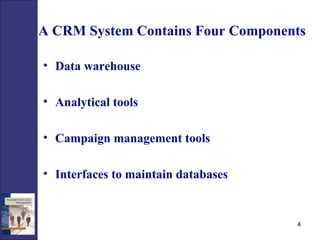

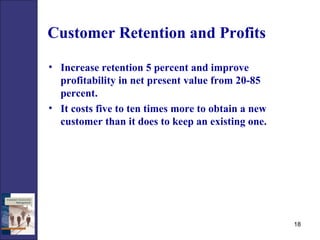

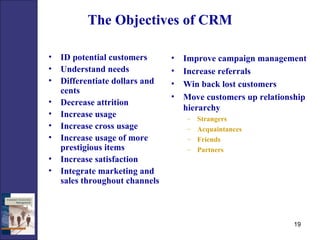

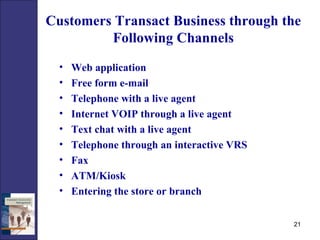

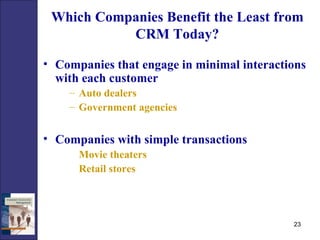

Customer relationship management (CRM) involves managing interactions with customers across different channels to improve customer retention and maximize customer lifetime value. Traditional marketing focused on transactions and acquiring new customers, while CRM prioritizes developing long-term relationships and sharing customer data across departments. Successful CRM systems identify the most profitable customers, differentiate customer needs, and allow customizing offerings through interactions across multiple channels like web, phone, and store.