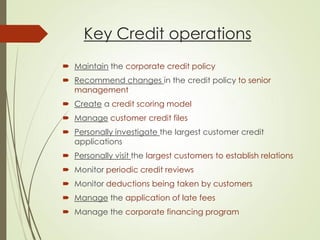

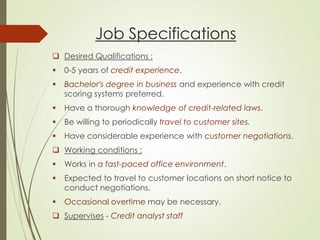

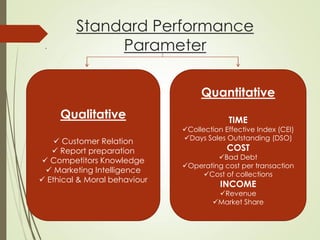

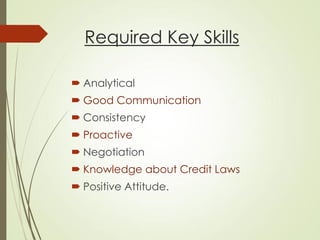

The document outlines the job profile of a Credit Manager, detailing their primary functions related to credit assessment and management, reporting to the treasurer or CFO. It includes key responsibilities such as maintaining credit policies, managing credit operations, and overseeing staff performance, along with required qualifications and working conditions. Essential skills highlighted include analytical ability, communication, negotiation, and a thorough understanding of credit laws.