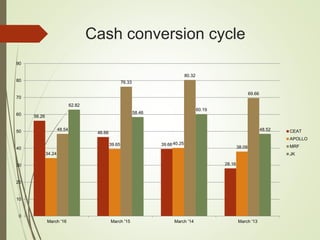

The document presents a financial management project focusing on working capital management within the automotive tyre manufacturing sector, analyzing four companies: MRF, Apollo, Ceat, and JK. It includes various financial ratios and performance metrics over several years, such as inventory conversion period, debtor conversion period, and cash conversion cycle. The analysis aims to compare the financial positions and operational efficiency of these companies based on their working capital management strategies.