The document discusses various topics related to banking in India including:

1) It defines banking and describes the key roles of commercial banks in accepting deposits and providing loans.

2) It outlines the four main types of banks - commercial banks, cooperative banks, specialized banks, and central banks.

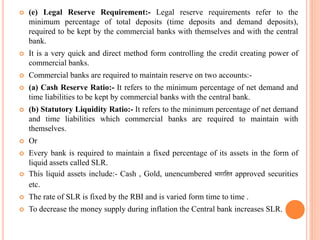

3) It explains some of the key functions of central banks like being the banker to the government and controlling money supply through tools like repo rates and open market operations.