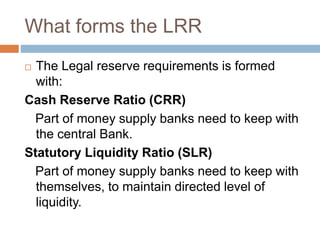

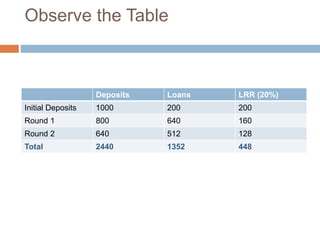

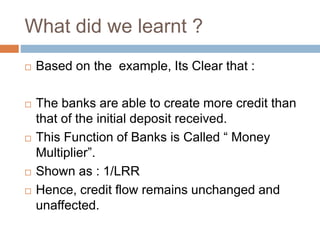

Banks engage in credit creation by lending out more money than they hold in deposits. They are able to do this through the process of credit multiplication. When a bank receives a deposit, it is only required to hold a portion, called the legal reserve requirement, as reserves. It can then lend out the remaining amount. When those loans are deposited in other banks, they become part of the money supply and more loans can be issued based on the new deposits. In this way, the initial deposit is multiplied across the banking system, allowing banks to collectively lend out much more money than the total of all deposits. Central banks control the money supply and flow of credit by setting the legal reserve requirement ratio.