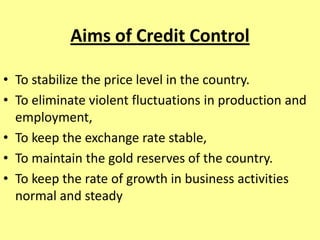

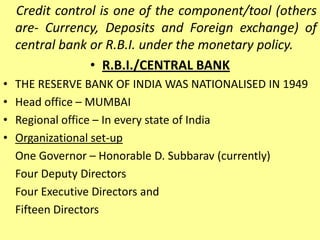

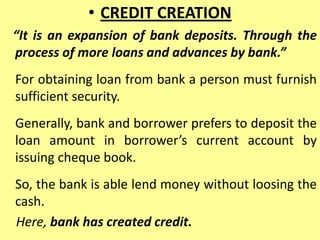

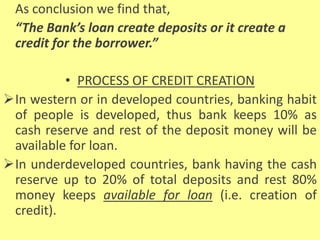

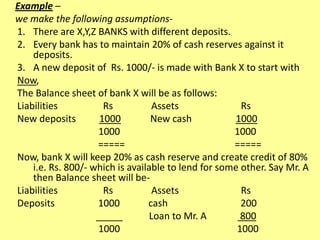

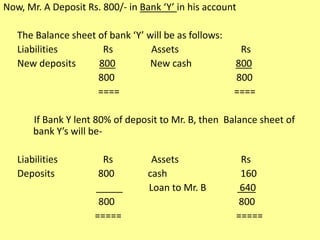

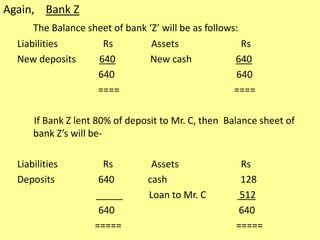

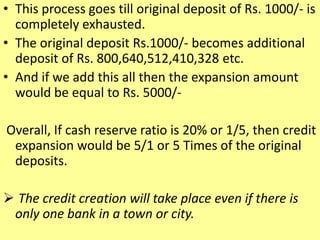

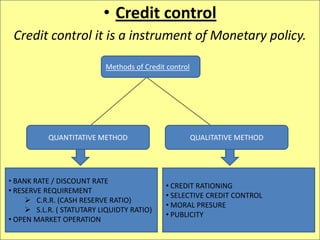

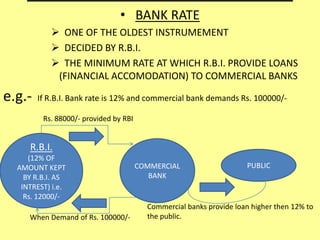

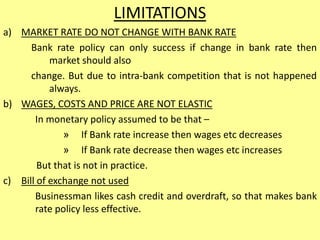

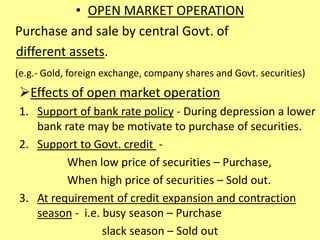

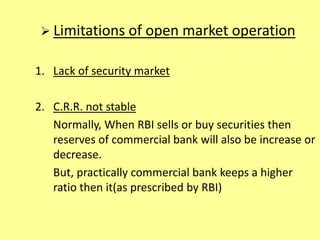

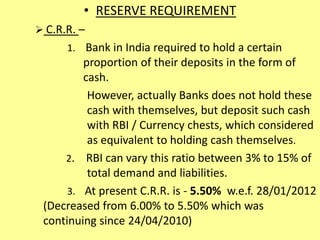

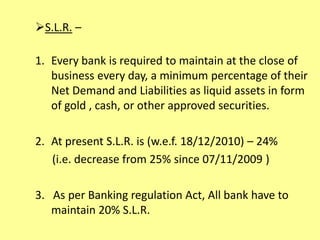

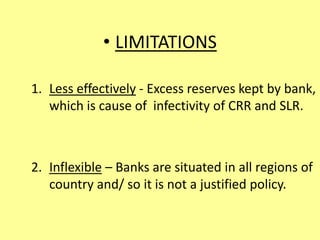

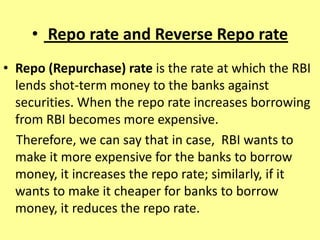

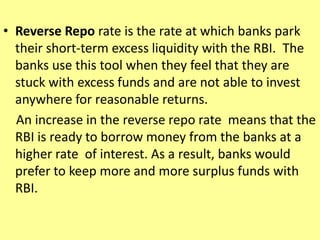

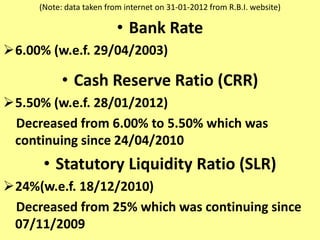

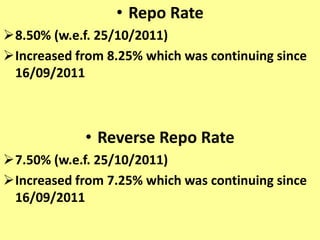

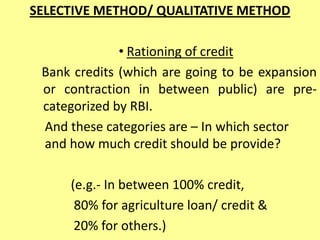

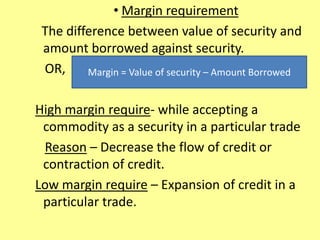

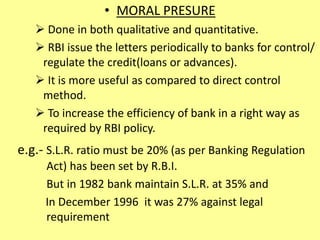

The document provides information on credit creation and credit control methods used by central banks like the Reserve Bank of India (RBI). It discusses that credit control is a tool used by central banks under monetary policy. The goals of credit control include stabilizing prices, production, employment and exchange rates. It then explains the process of credit creation through commercial bank lending and the expansion of the money supply. The document outlines various quantitative and qualitative methods used by RBI for credit control, including bank rate, reserve requirements, open market operations, and moral persuasion.