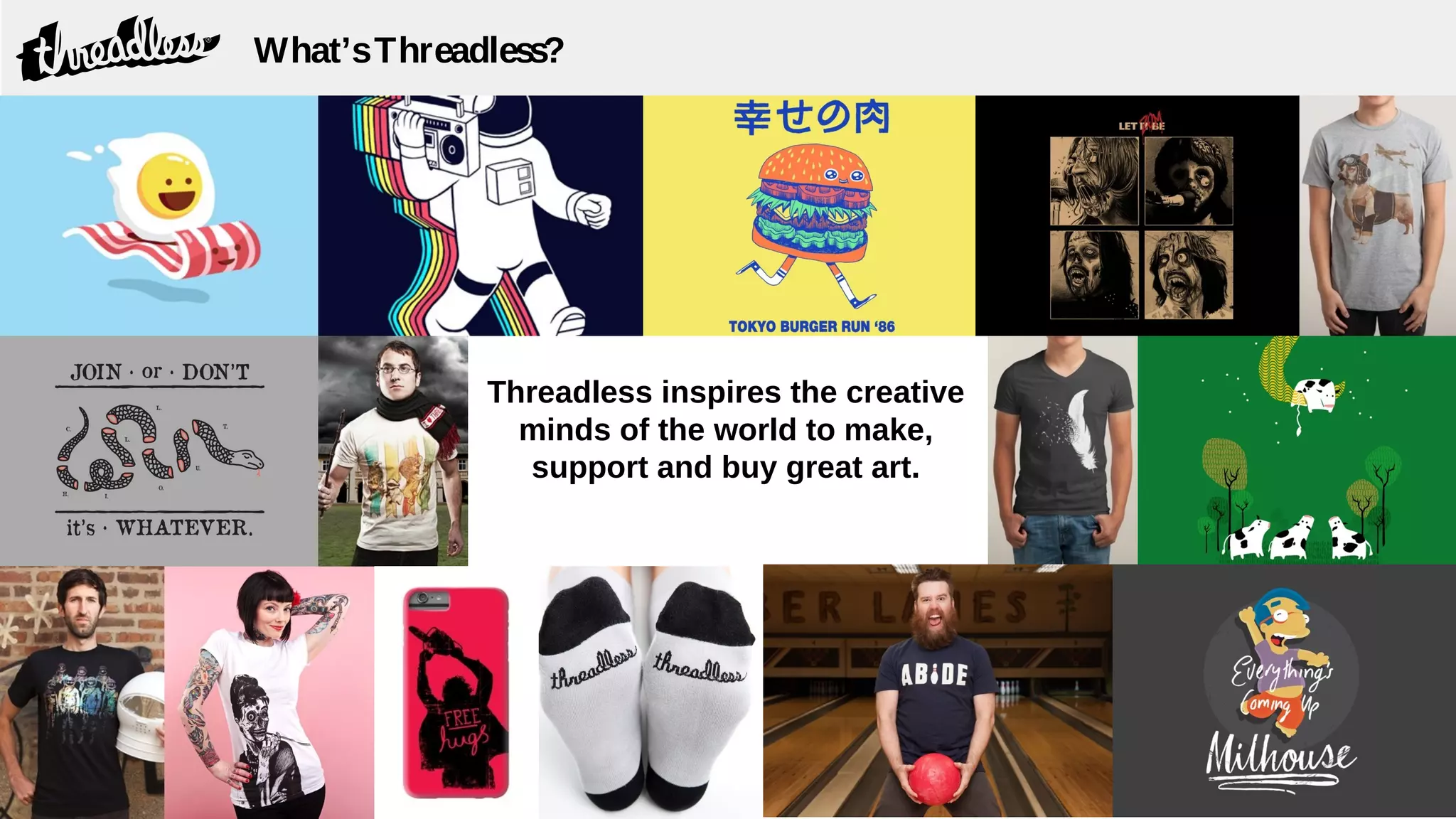

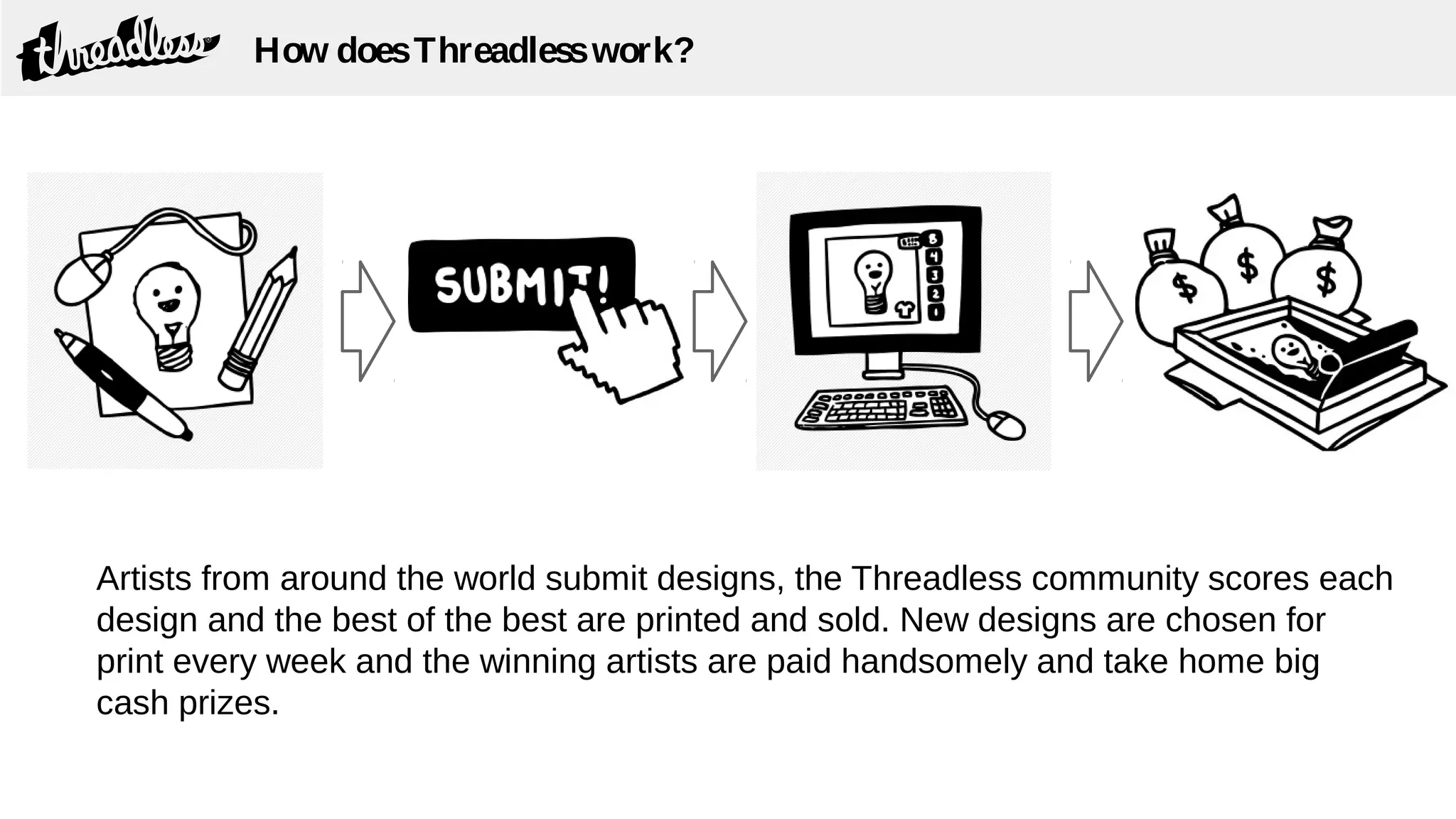

This document discusses creating an effective budgeting process. It addresses some challenges to an effective budget like gamification where participants try to game the system, and the entrepreneurial mindset which values vision and rule-breaking over constraints. It then provides basic steps to create an effective budget including setting goals, assigning accountability, setting measurable targets, estimating costs, and executing. It also discusses balancing the entrepreneurial mindset with the budgeting process, capturing risks in the budget, and using a case study of Threadless to set overall goals while considering constraints.