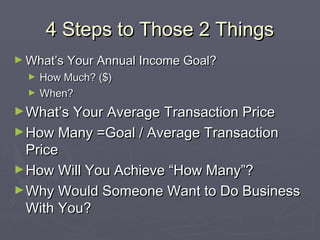

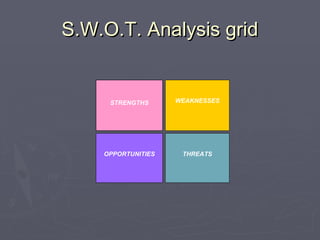

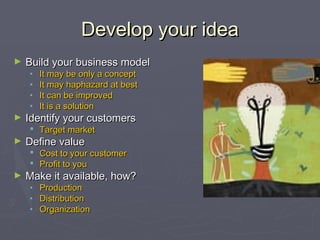

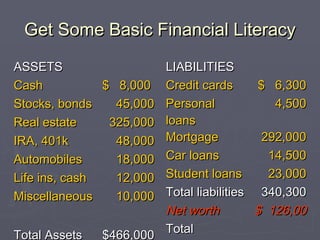

The document discusses starting a business and provides advice from SCORE Chicago. It begins by introducing SCORE and its educational programs and consulting services. It then debunks common myths about entrepreneurship, such as the idea that only a good idea is needed or that business owners don't have to work hard. The document emphasizes that starting a business requires hard work, planning, and overcoming challenges. It provides tips for evaluating business ideas, understanding customers, developing a business model, and creating a financial plan and business plan. The overall message is that entrepreneurship is rewarding but difficult, and learning business skills through resources like SCORE can help aspiring entrepreneurs succeed.