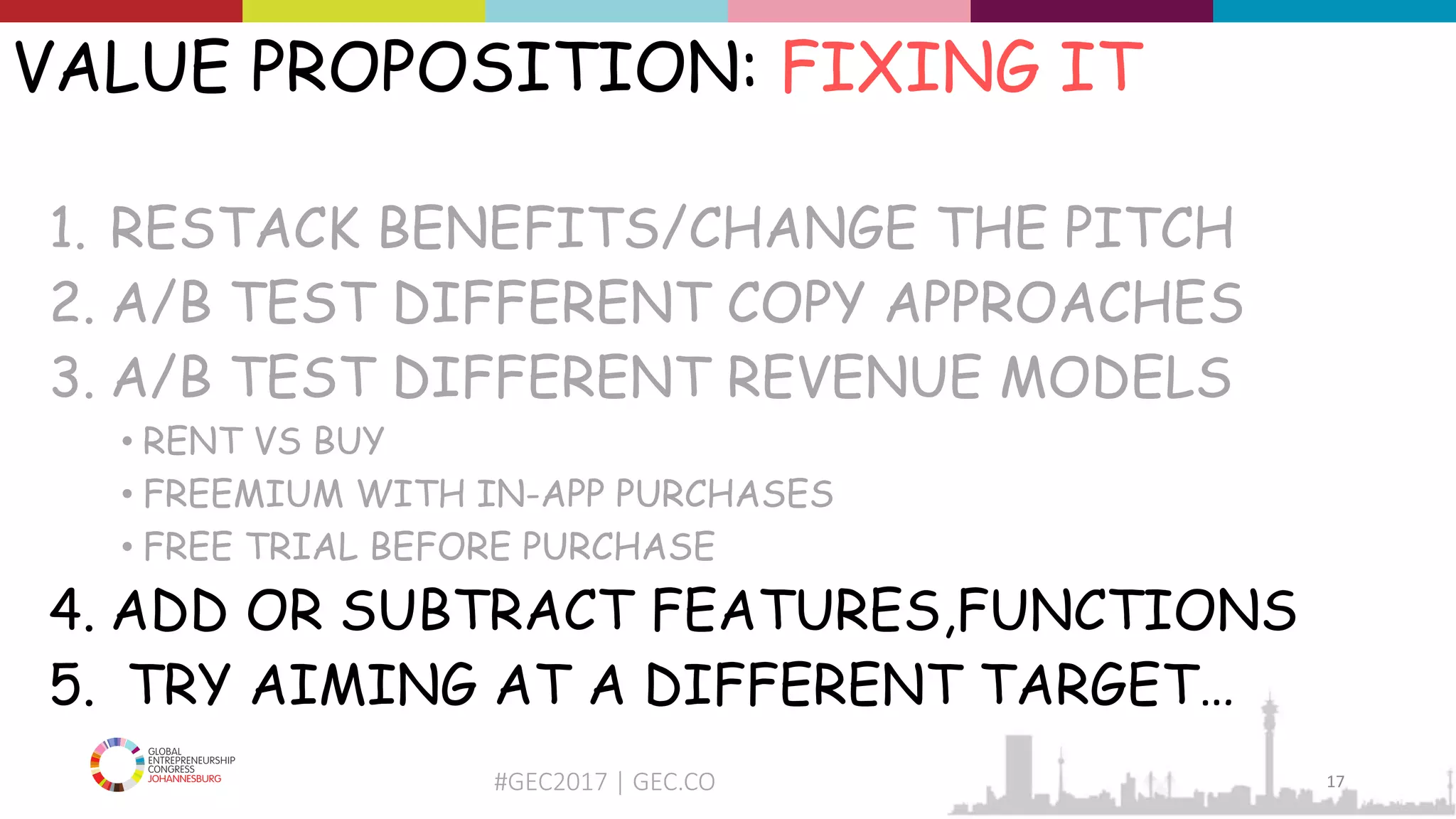

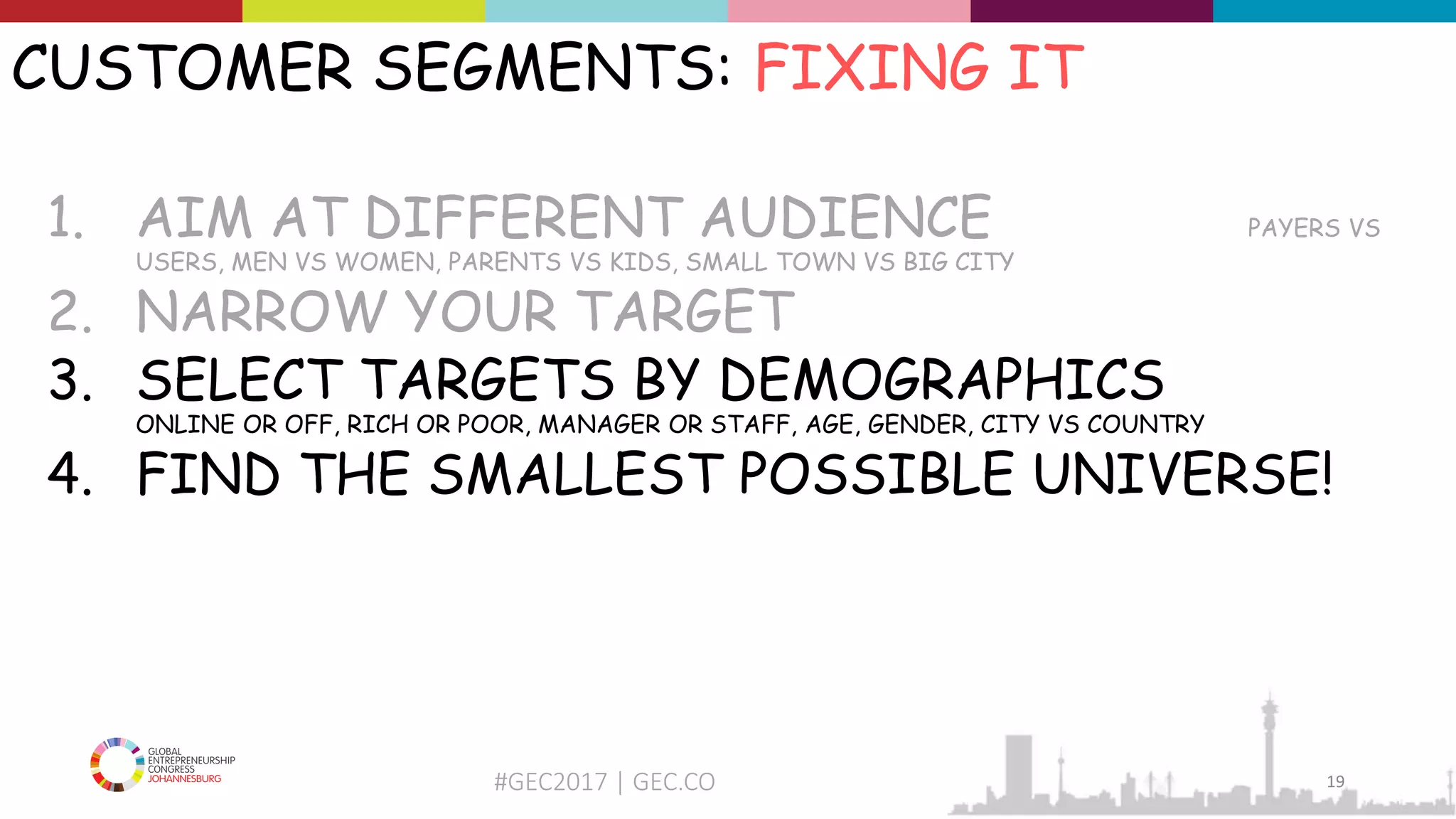

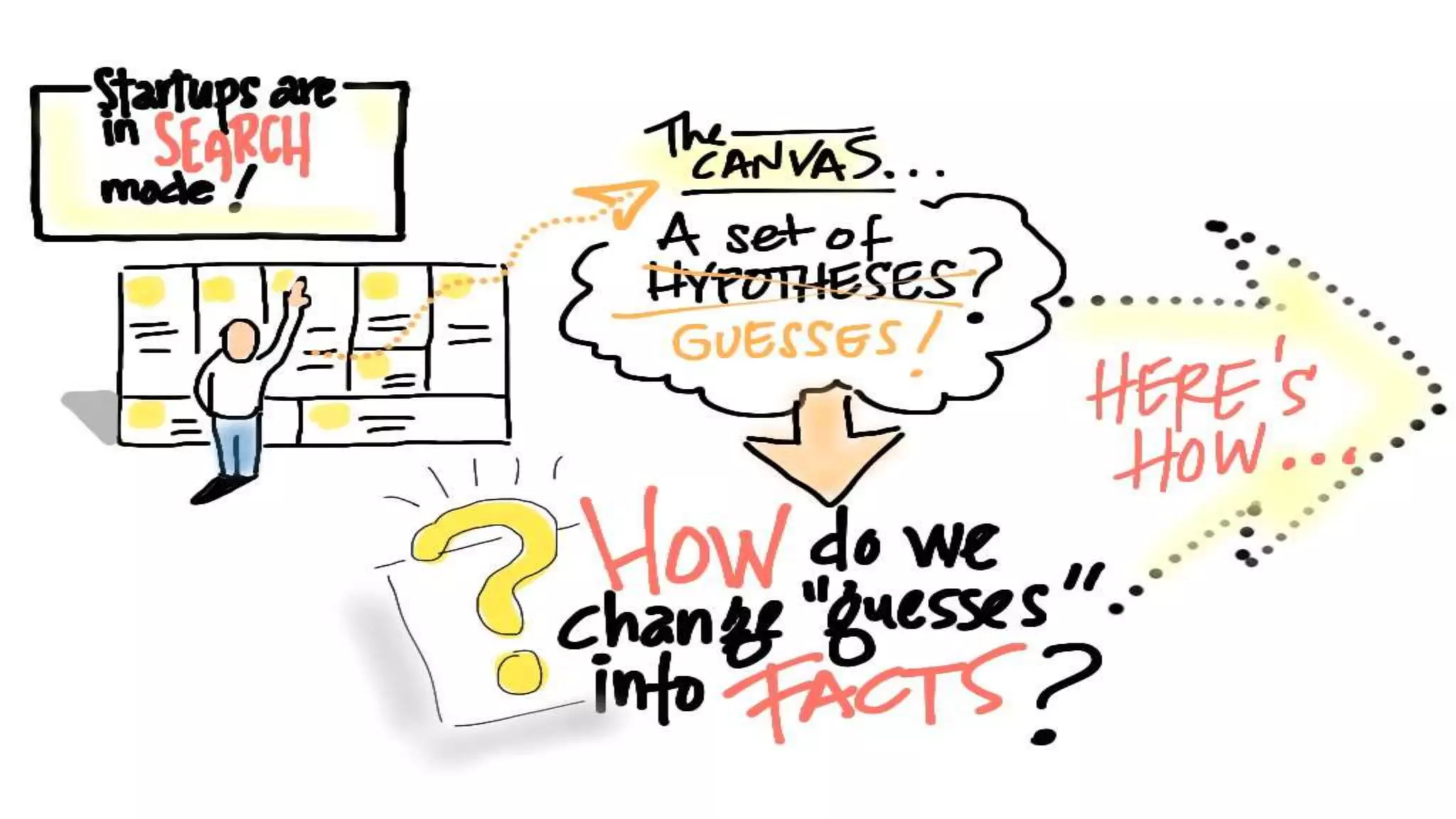

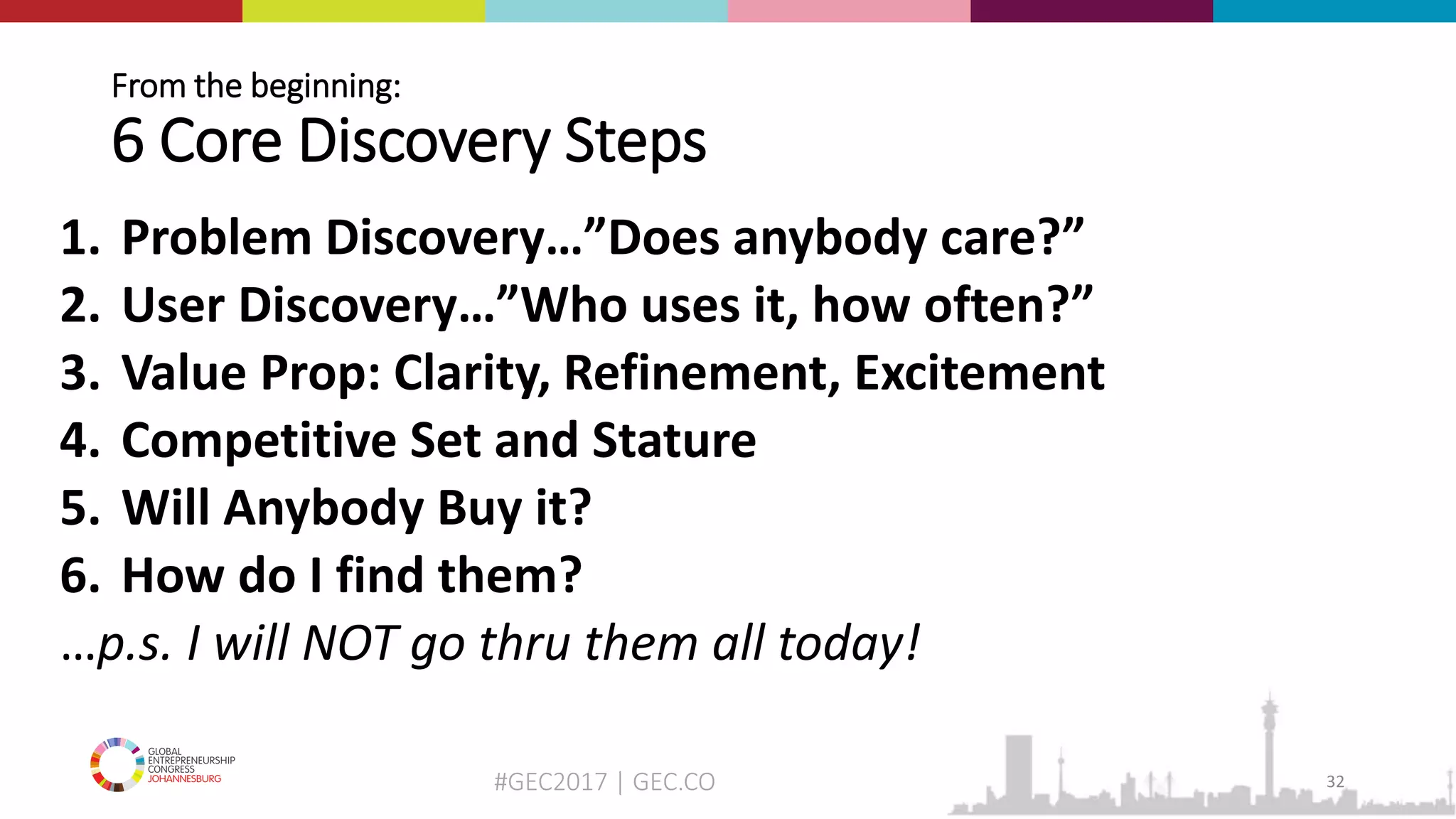

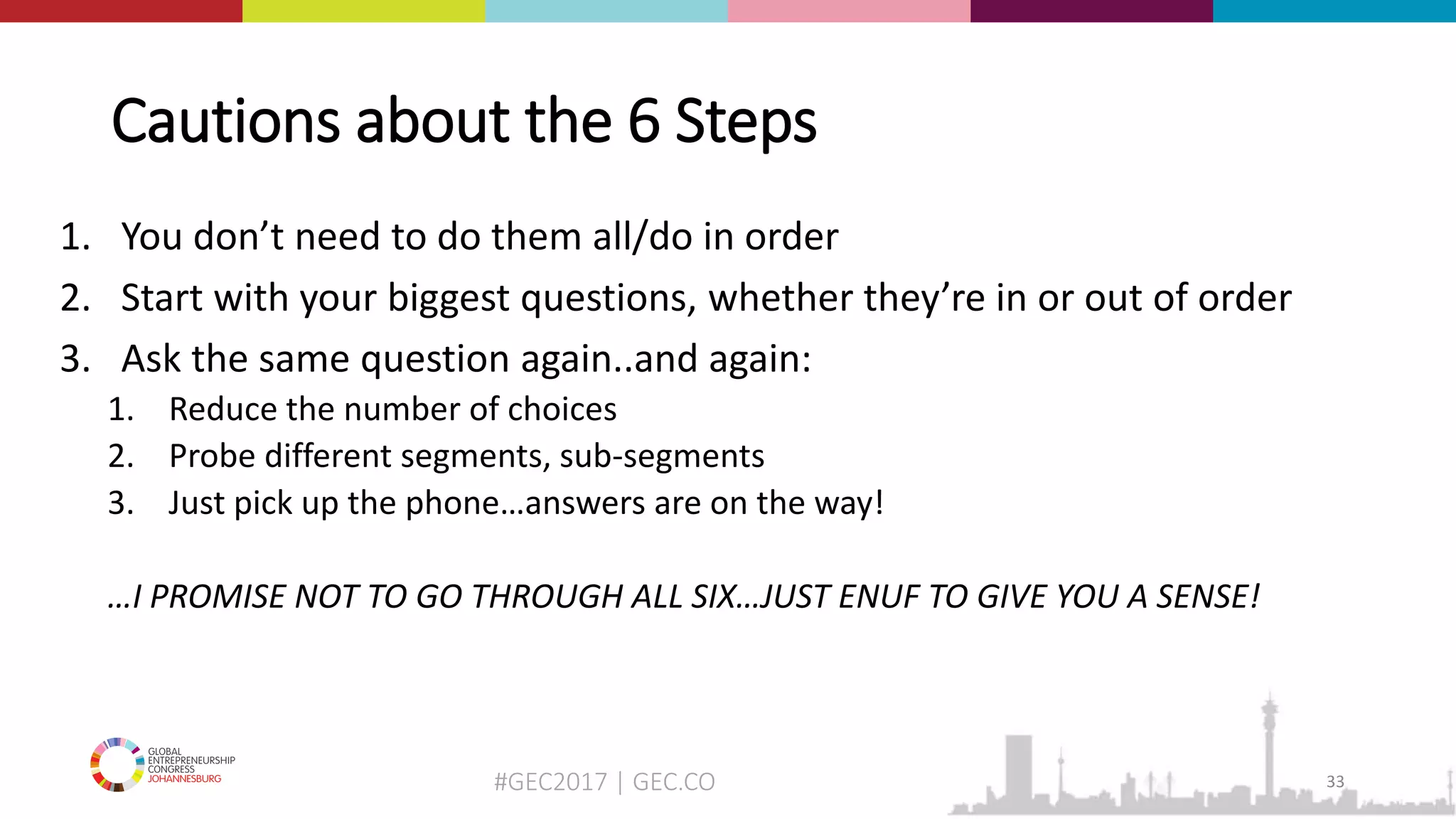

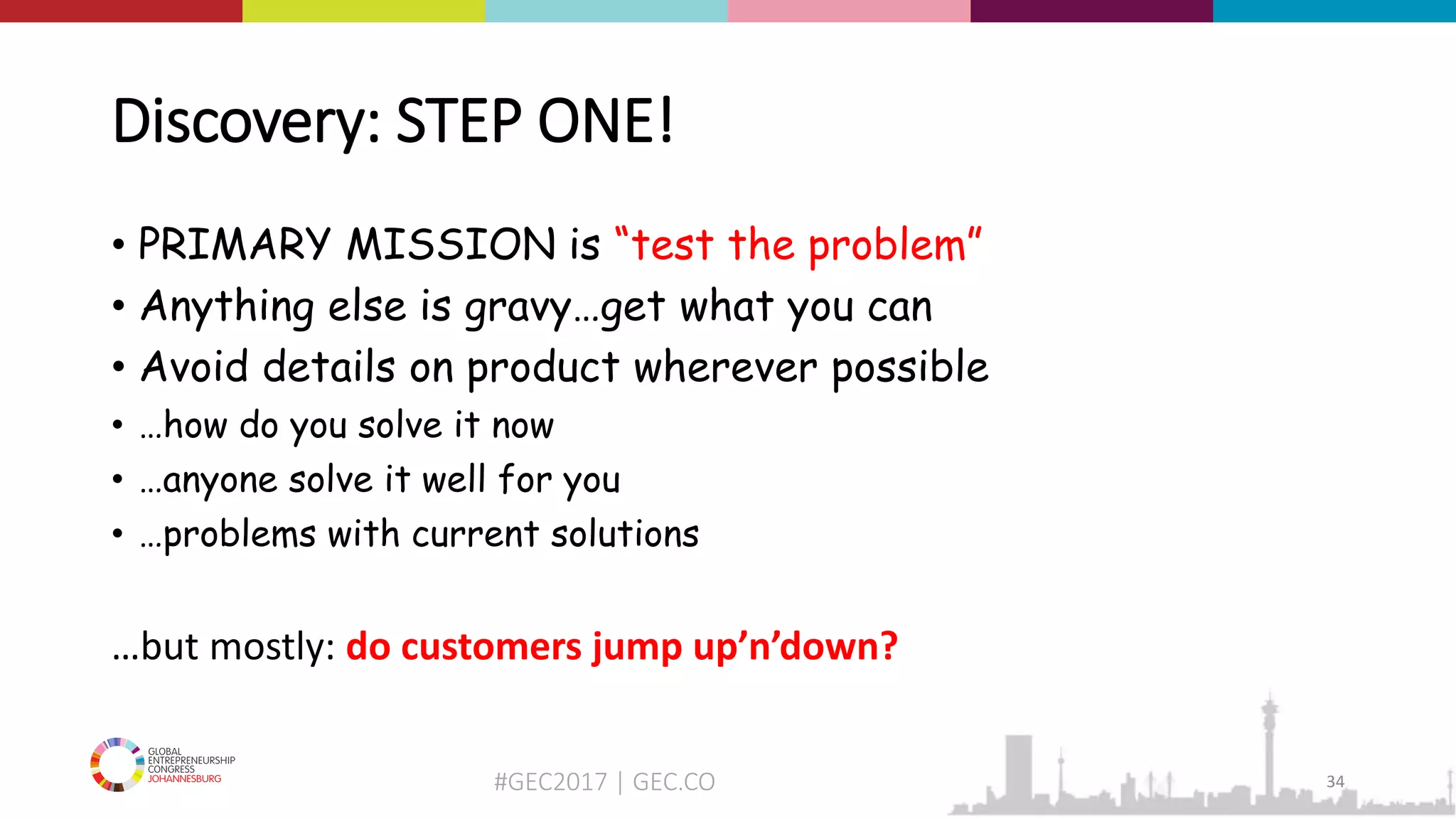

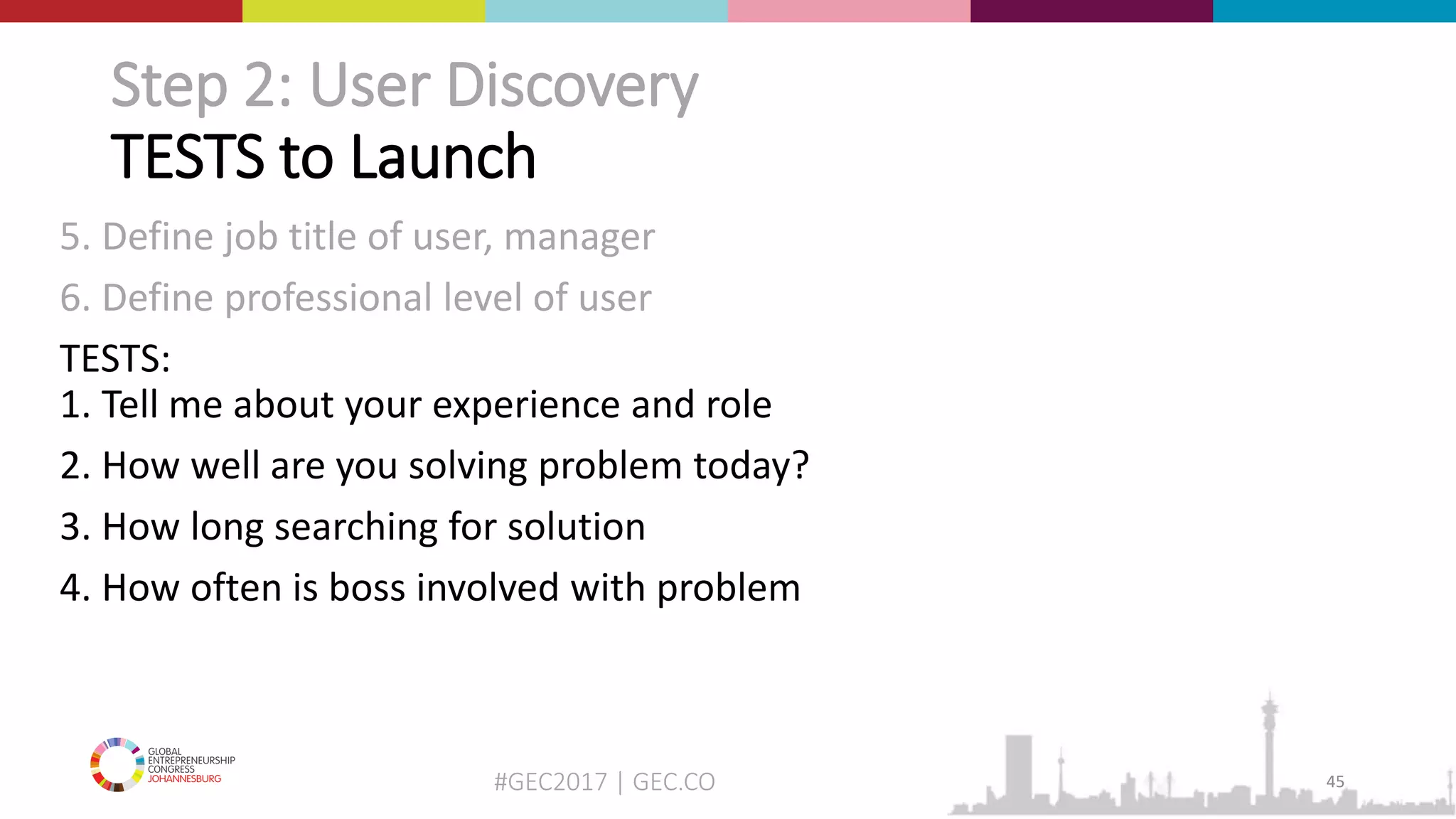

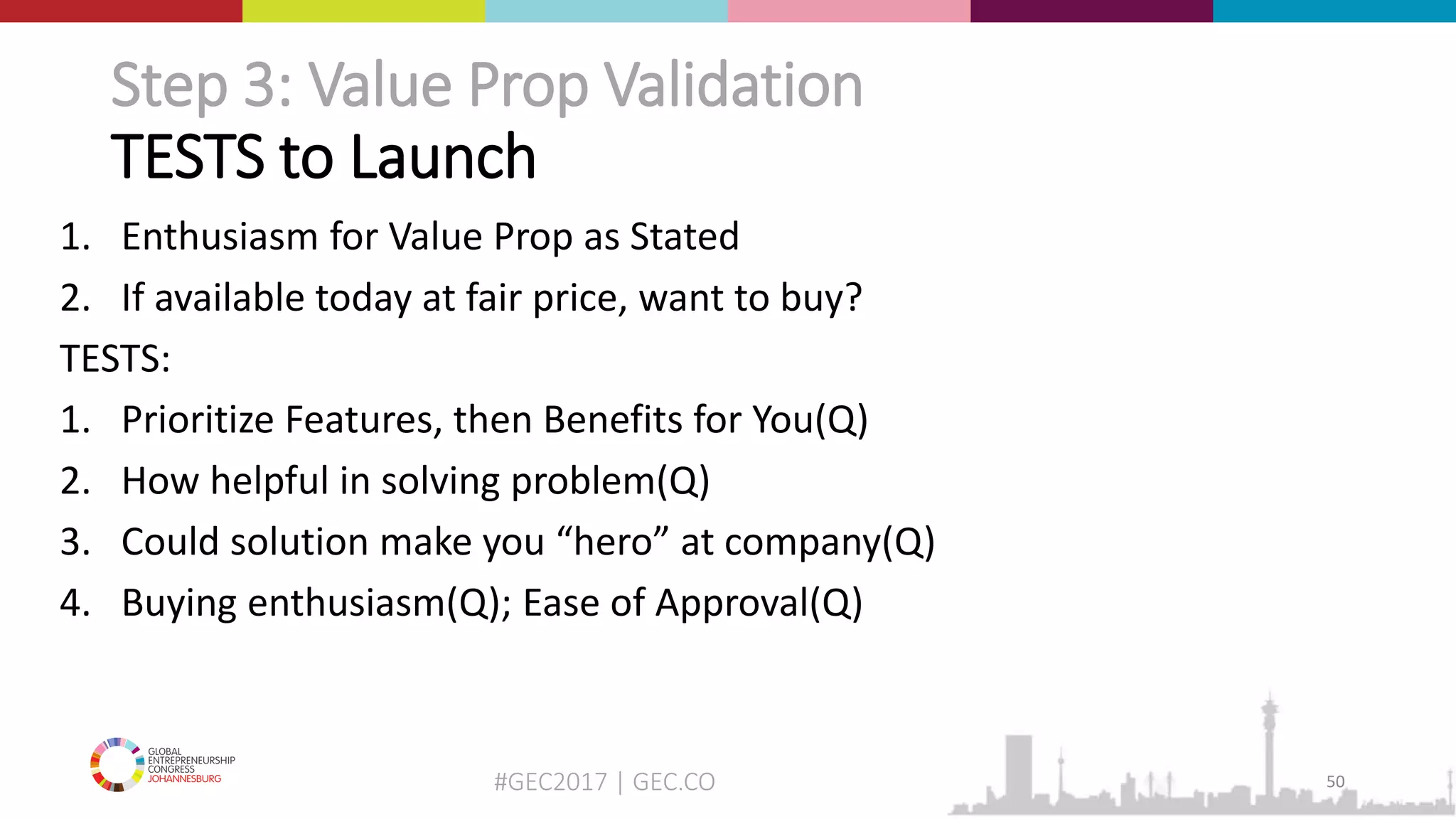

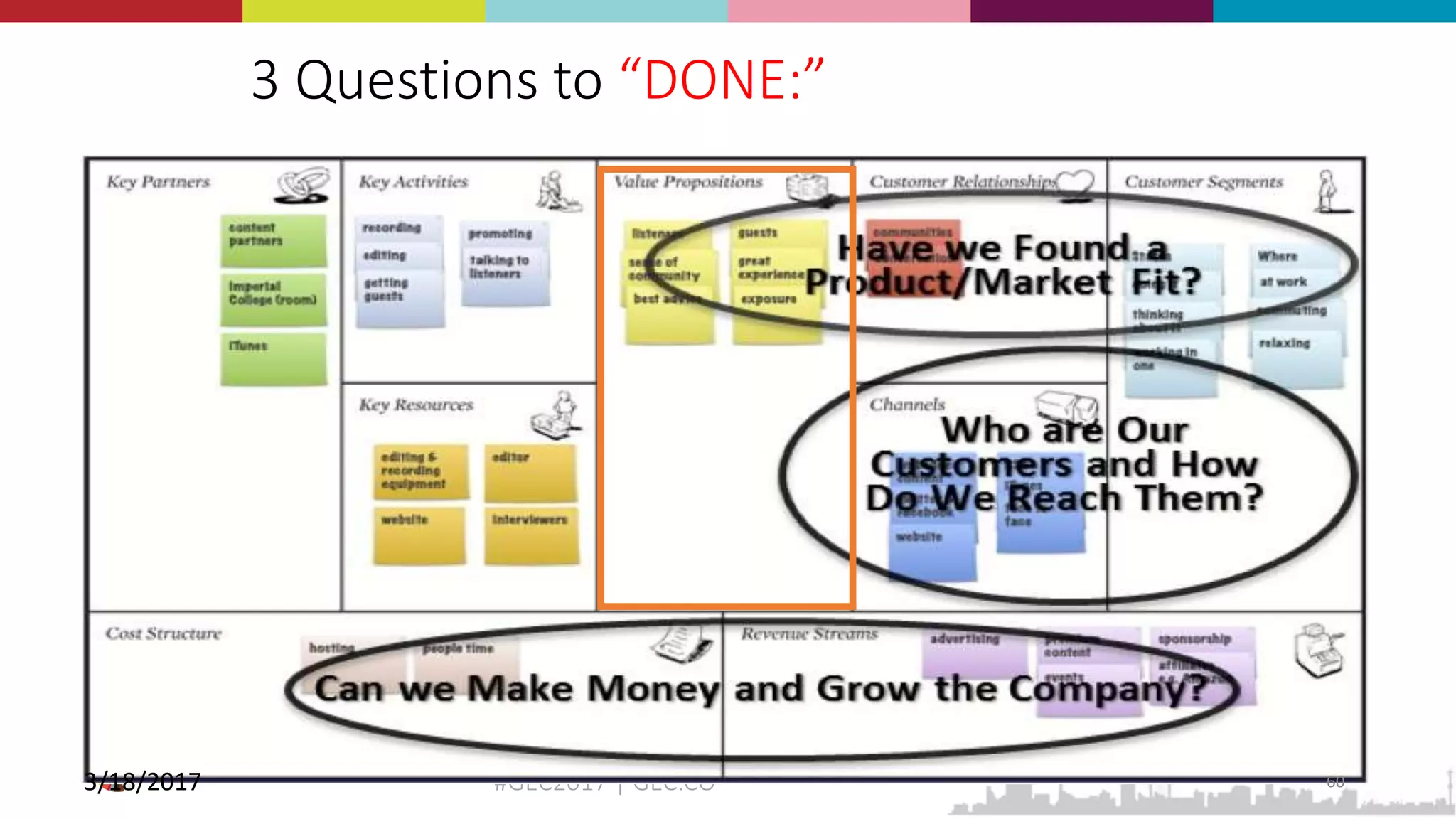

The document is a guide for startups on achieving product/market fit through customer discovery and understanding value propositions. It emphasizes the importance of identifying customer segments, addressing the right problems, and validating business models to avoid common pitfalls that lead to failure. Key steps include problem discovery, user identification, and testing value propositions to meet customer needs effectively.