Embed presentation

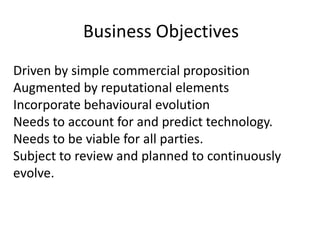

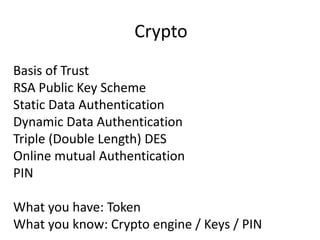

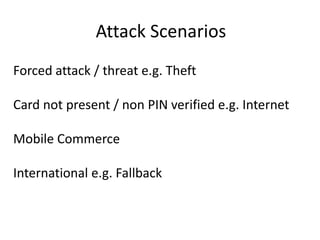

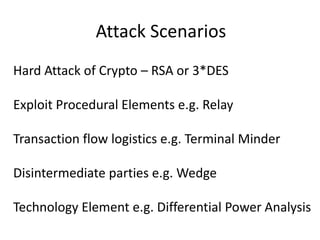

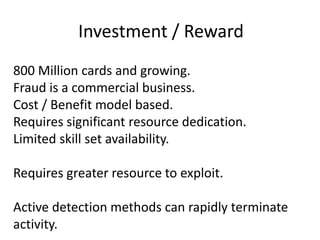

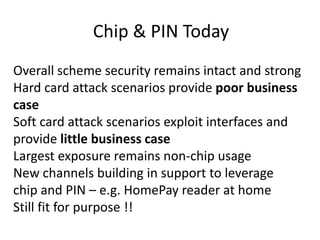

The document discusses the fundamental concept of risk management in banking, emphasizing the relationship between risk and profit. It highlights the importance of a robust security framework in financial transactions, particularly with the adoption of chip and pin technology. Challenges such as fraud and evolving attack scenarios are noted, along with the necessity for continuous adaptation of security measures to maintain efficacy.