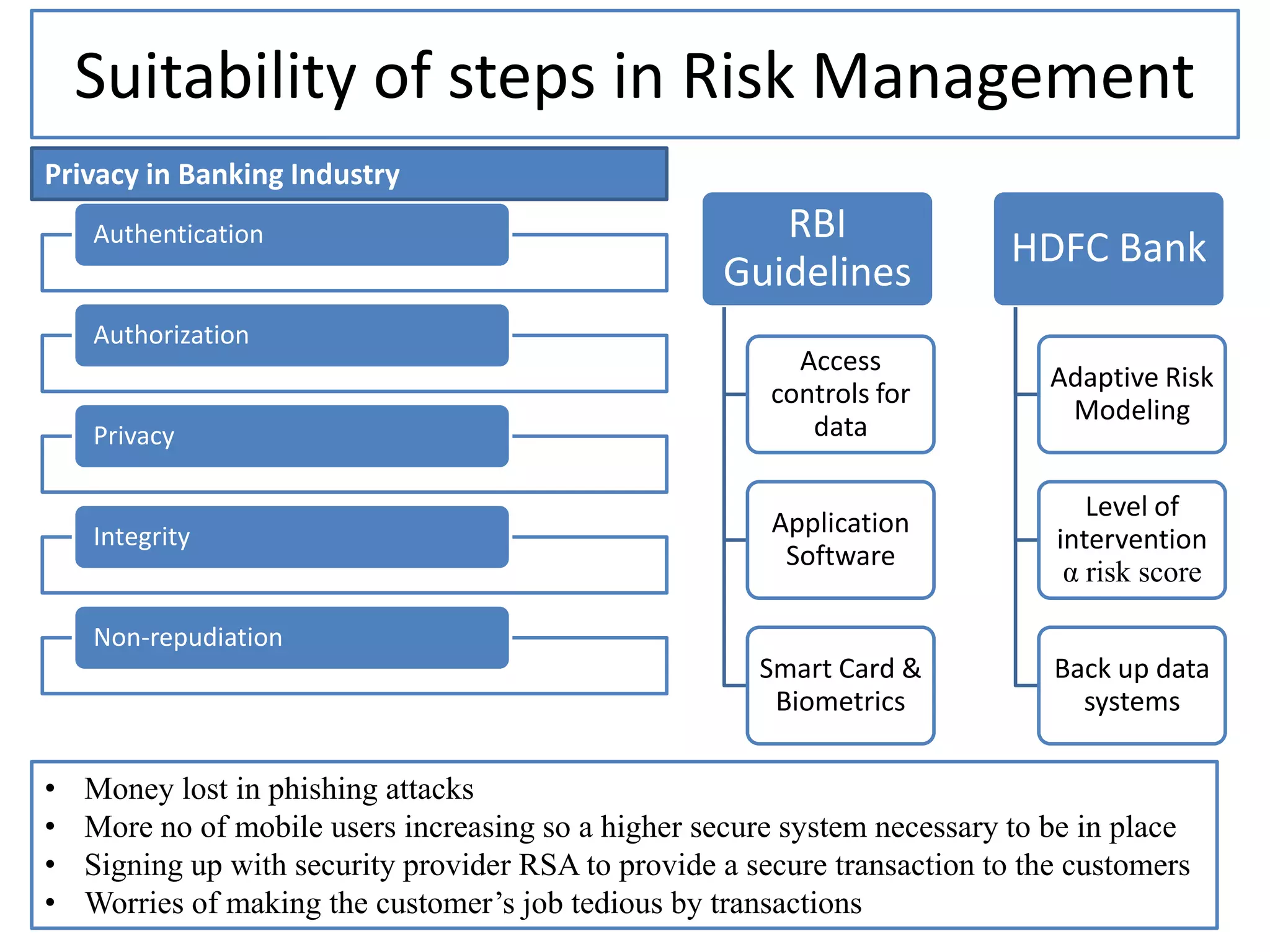

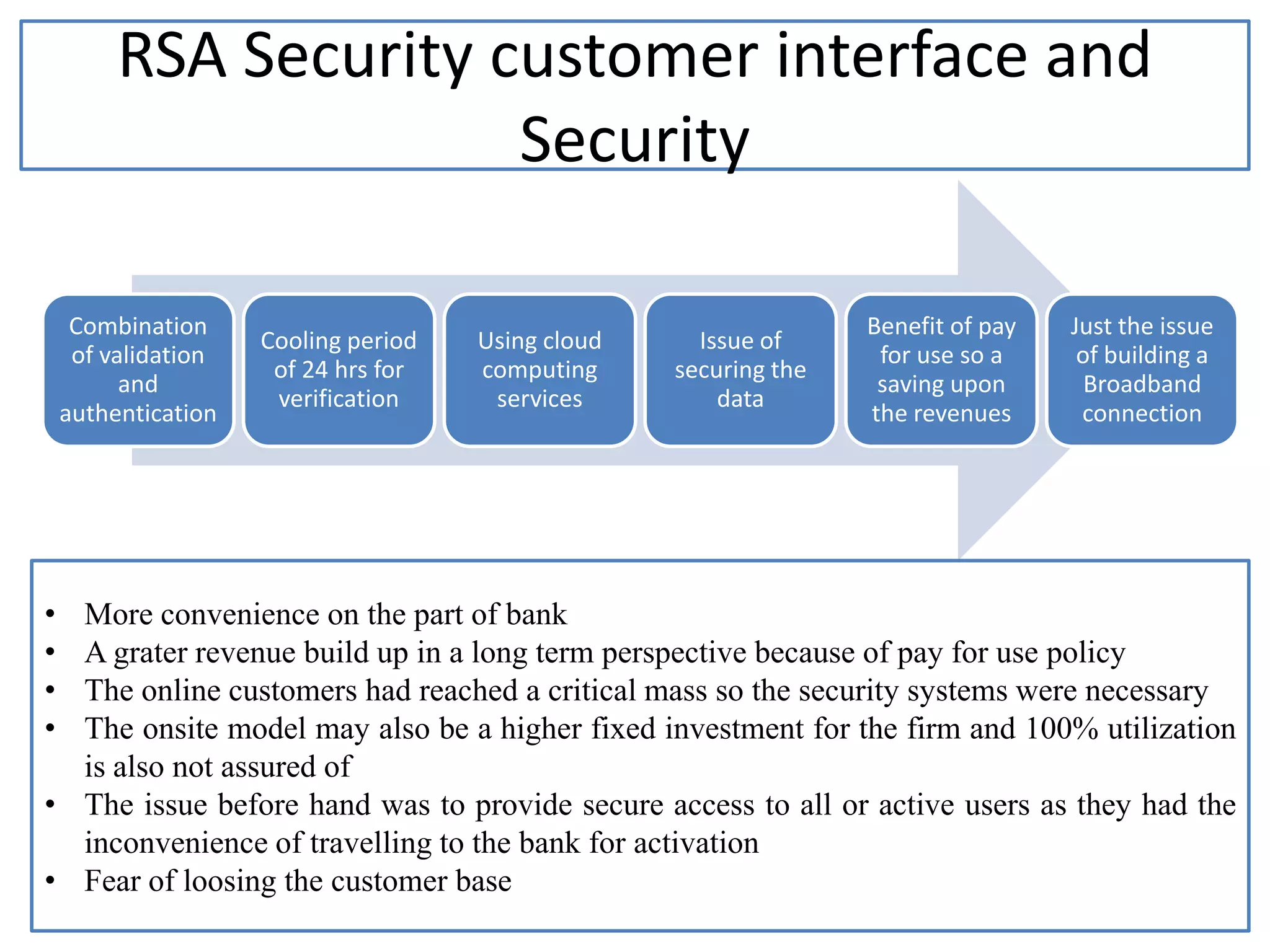

HDFC Bank is taking steps to improve risk management and security in response to increasing threats like phishing attacks and more mobile users. It is partnering with RSA Security to provide more secure transactions for customers. The bank is also implementing adaptive risk modeling, access controls, privacy and data integrity measures to authenticate and authorize users securely. Moving some services to cloud computing aims to provide convenient online access while maintaining security.