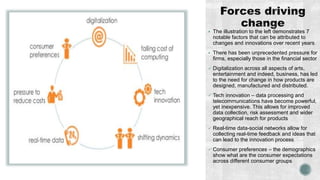

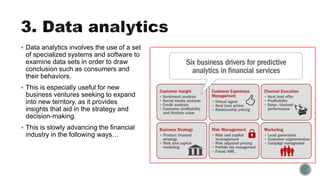

The document summarizes major innovations and challenges in the financial sector due to digitization. Key innovations discussed include increased digitization across payments, data collection/analytics, cloud-based financial management platforms, and alternative capital raising platforms like crowdfunding. This has improved access and efficiency but also creates challenges around data security, maintaining specialized expertise, and external dependency. Overall, the financial sector is being transformed by new digital technologies and platforms, but also faces growing risks from greater digitization and data collection that must be addressed.