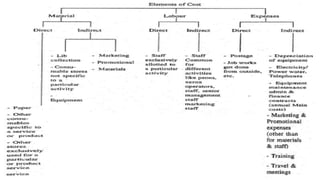

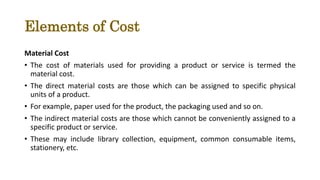

This document discusses costing in libraries. It defines costing as the process of obtaining estimates to produce a product, provide a service, or operate a department. There are two main types of costs - direct costs that can be directly attributed to an activity, and indirect costs that are overhead costs. Costs are also classified as fixed, variable, semi-variable, or step costs. Understanding costs is important for libraries as it helps with budgeting, pricing services, assessing productivity, and making decisions about services. The key elements of cost include materials, labor, expenses, and capital costs.