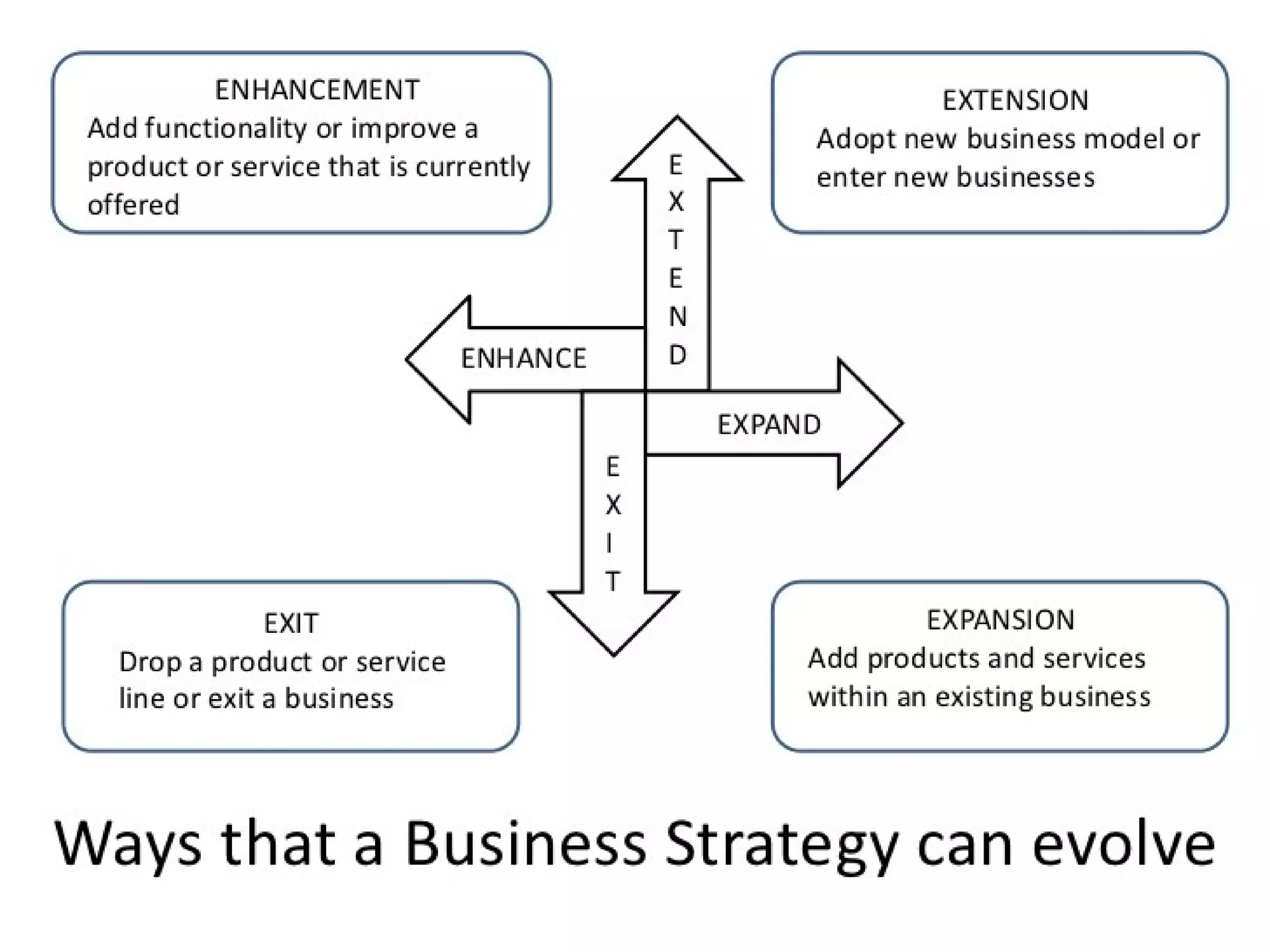

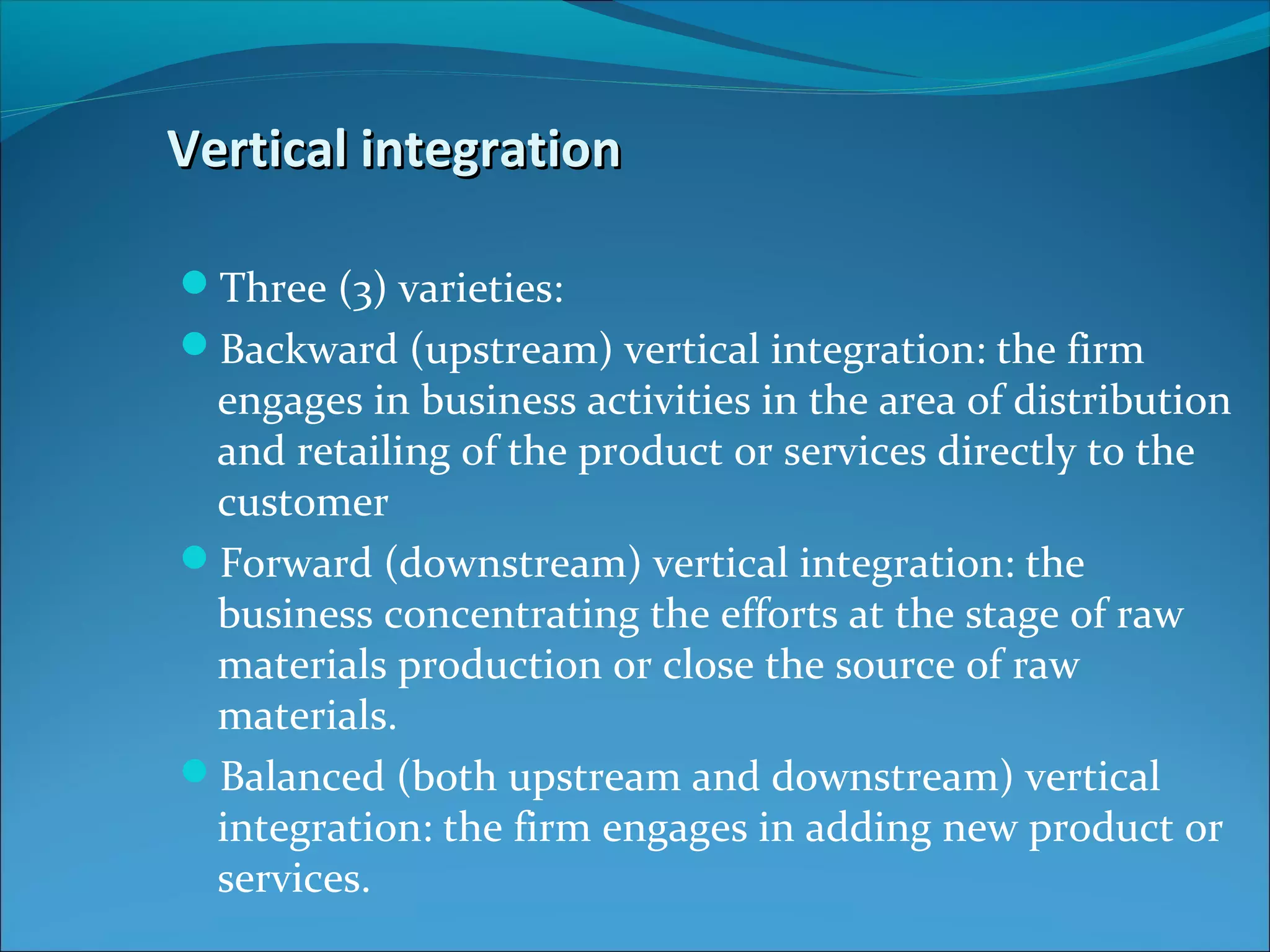

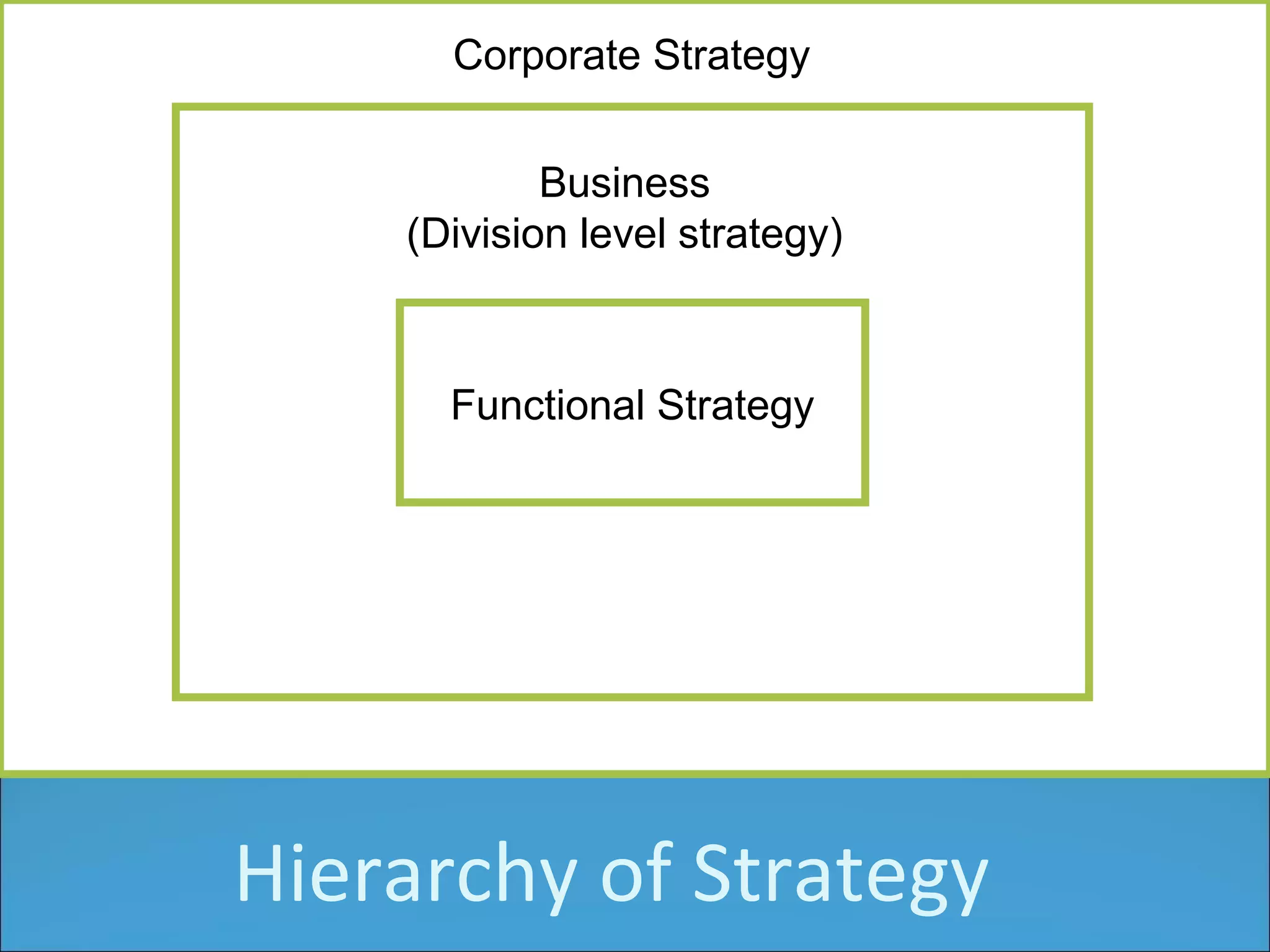

The document discusses various corporate strategies including the 4 E's (extend, expand, exit, enhance). It defines key strategic concepts like vertical integration, horizontal integration, diversification, growth strategies, stability strategies, and retrenchment strategies. Some specific strategic options covered are mergers, acquisitions, strategic alliances, turnarounds, contractions, and divestments. The document also discusses factors like strategic fit, directional strategy, and the hierarchy of strategy from functional to corporate levels.