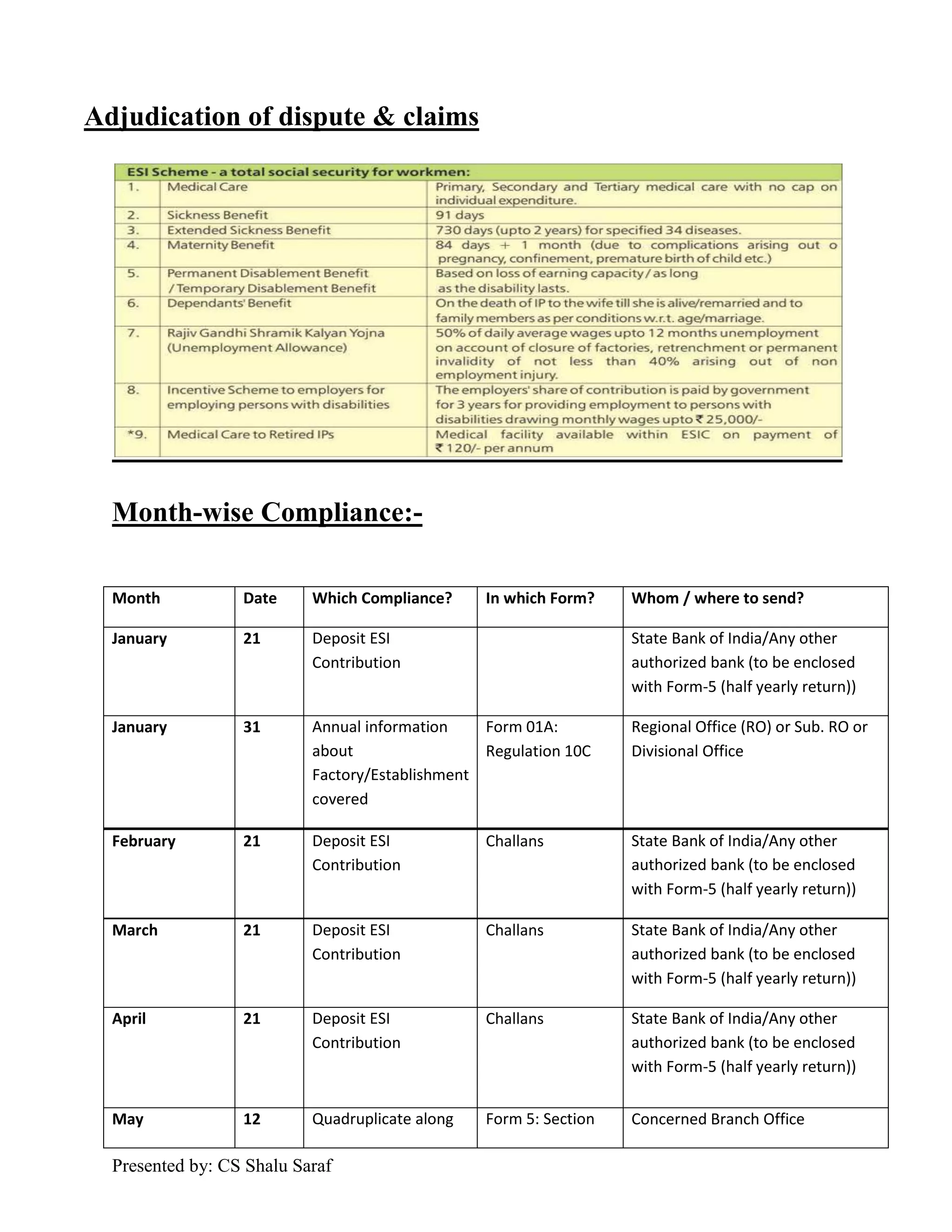

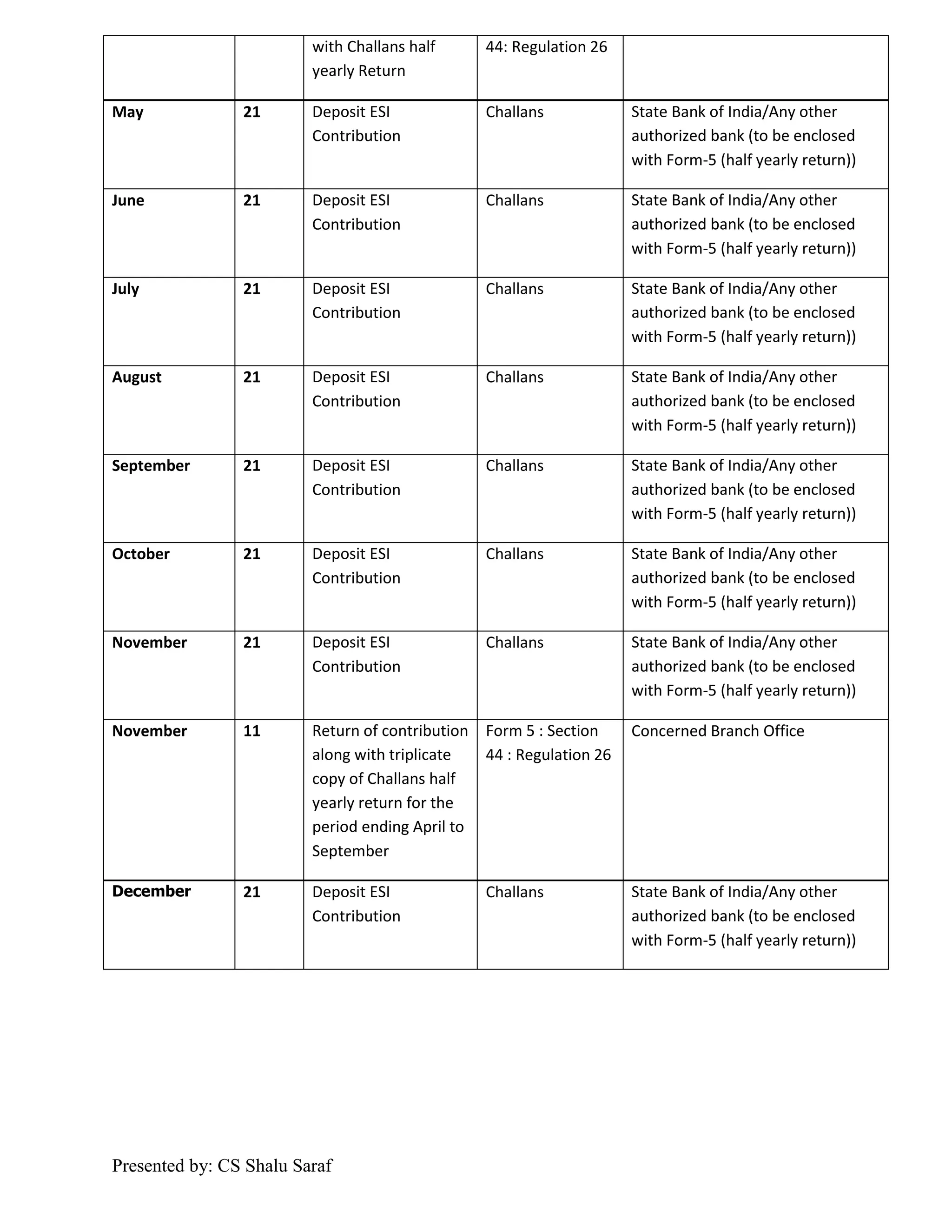

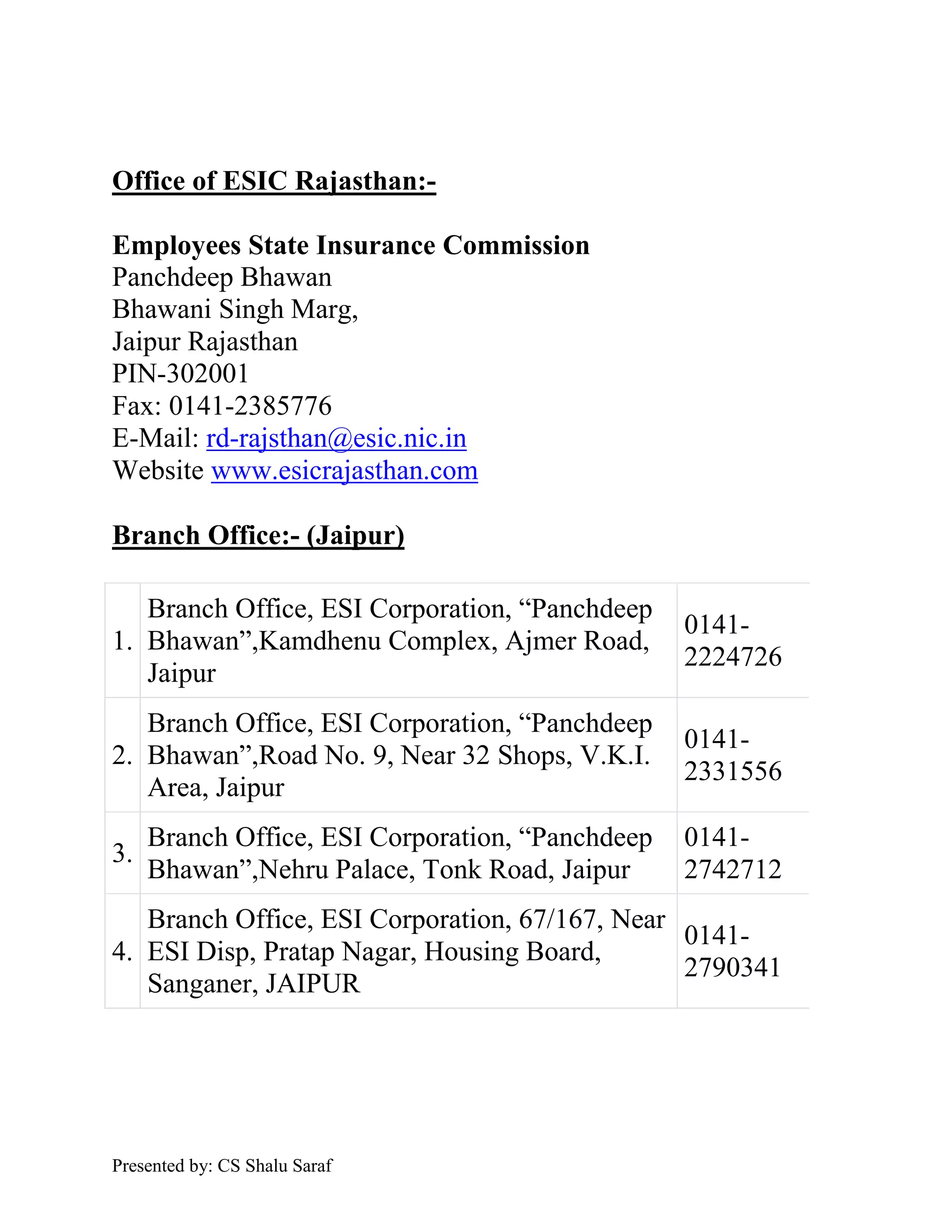

The document outlines the key compliance requirements for the Employees' State Insurance Act, 1948 in India. It details the scope of coverage, contribution rates for employers and employees, contribution periods, manner and timeline for making contributions, required returns and registers to be maintained. It also provides a month-by-month compliance calendar indicating the due dates for depositing contributions through authorized banks and submitting returns to the relevant offices. The document concludes with contact details of the regional office of the Employees State Insurance Commission and its branch offices in Rajasthan.