The Provident Fund Act of 1952 establishes a mandatory provident fund for employees in India. Key points include:

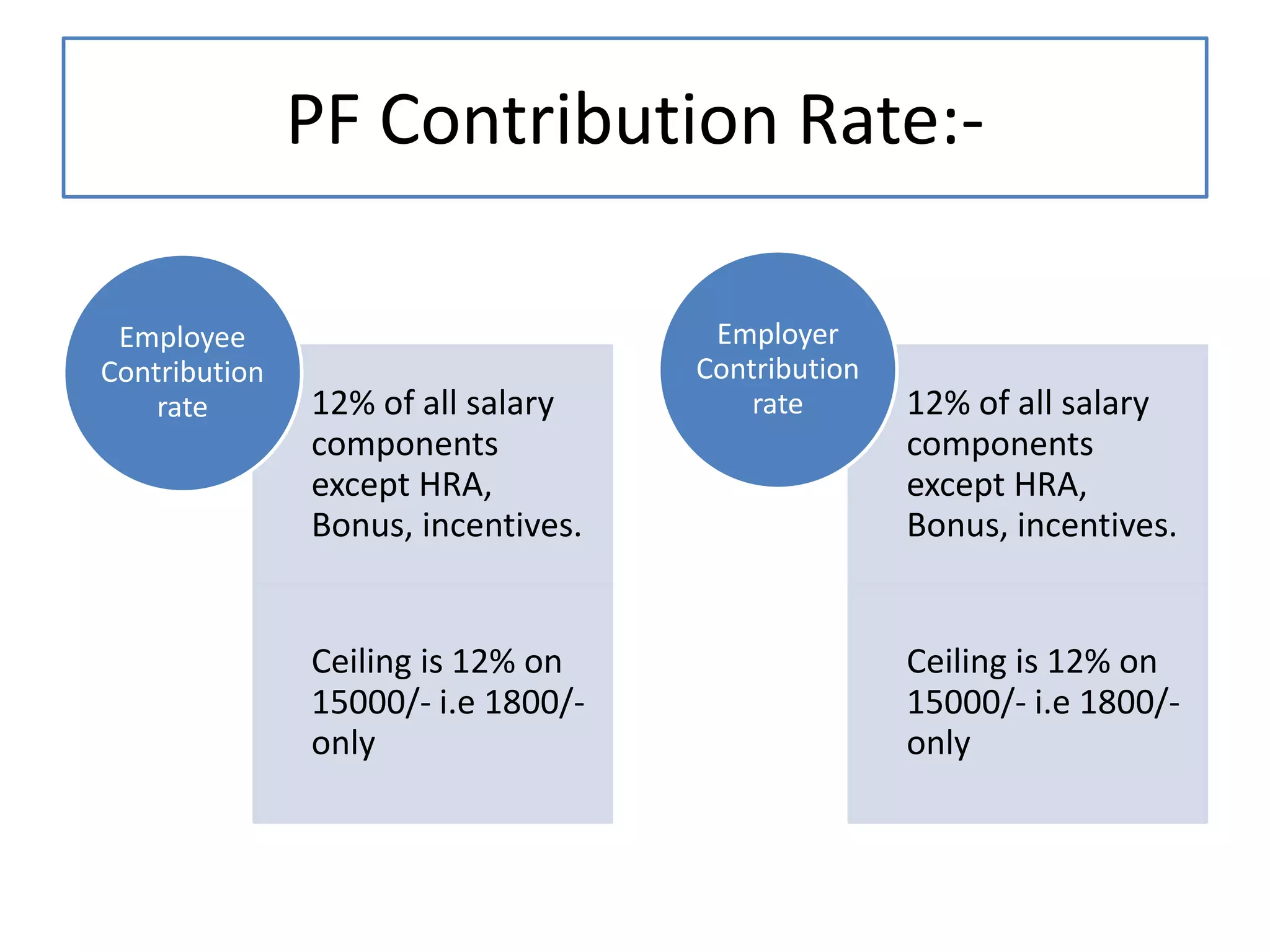

- It applies to all companies with 20+ employees and requires 12% contributions by both employer and employee up to a 15,000 salary cap.

- The employer deposits the full 12% and deducts the employee's share from wages. The contributions are put into employees' provident fund accounts.

- The act provides social security benefits like retirement funds and payments in cases of job loss or leaving employment.

- Employers must comply with documentation and timeline requirements for enrollment, contributions, withdrawals and other processes to remain in accordance with the law.